One (rare) thing that everyone agrees on after Brexit is that it shone a spotlight on millions of people in England who feel left behind. As the new Prime Minister put it:

“I know you’re working around the clock, I know you’re doing your best, and I know that sometimes life can be a struggle. The government I lead will be driven not by the interests of the privileged few, but by yours.”

While not the full story, housing is central to this. In particular, the 15 years of falling homeownership in England which has struck low and middle earners (and the children of low earning homeowners) much, much harder than higher earning families. It’s been a reversal of fortunes from one generation to the next.

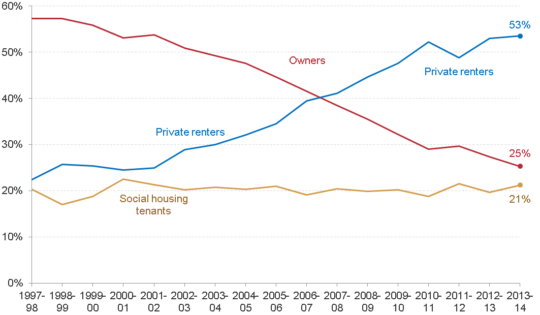

Just look at the striking chart below from the Resolution Foundation, showing home ownership among low and middle earning under-35s. This precipitous fall is in spite of three successive governments recognising the problem and throwing billions of pounds at ever more generous mortgage products for first time buyers. But as the chart below shows, it hasn’t worked for working England.

Under 35s, low and middle earners, housing tenure

That’s what makes a new report out today from the Conservative pressure group Renewal so exciting, which we’ve supported. The paper, written by Renewal’s director David Skelton, argues for a fresh approach to getting low and middle earners into secure homes and ultimately having a proper chance of homeownership.

The full report is here, or you can read The Sun and Observer’s write up – or David’s blog here.

David argues persuasively that Conservatives have a proud history of building homes for low earners and finding ways to help them get into ownership. But, he notes, this has always required an approach that begins with affordable renting. In essence – if families can’t afford to pay the rent then they can’t afford to save. If they can’t afford to save, then they won’t ever be able to get a mortgage.

Renewal rightly notes that the totemic Right to Buy policy in the 1980s was built on having financially secure families who after years of low council rents had savings in the bank. Without that foundation of savings, it doesn’t matter how big a discount or how cheap a mortgage you offer – low earners won’t be able to access it. In research with London renters I’ve heard again and again that saving £10,000 to access (the cheapest possible) shared ownership homes sounds impossible. We’ve got to help people to help themselves by providing the breathing space to save.

This isn’t just a London problem either. Recent research by YouGov for Shelter, which I’ve summarised below, shows that the majority of private renters who want to buy a house in each part of England can’t afford to save more than £100 per month towards a deposit. Most can’t save anything. It doesn’t really matter if there’s a generous Help to Buy ISA if you can’t afford to put more than £10 a month into it.

YouGov/ Shelter research[1]

| England | North East | North West | Yorkshire and the Humber | East Midlands | West Midlands | East of England | London | South East | South West | |

| I/ we don’t save anything towards a home deposit | 48% | 45% | 49% | 42% | 49% | 55% | 46% | 45% | 50% | 51% |

| Less than £50 | 16% | 18% | 20% | 16% | 17% | 18% | 15% | 10% | 13% | 17% |

| £50 to £100 per month | 9% | 13% | 8% | 8% | 8% | 8% | 10% | 10% | 10% | 11% |

| All under £100 per month | 73% | 76% | 78% | 66% | 74% | 81% | 71% | 65% | 73% | 79% |

The Renewal paper is also right in its pragmatism in saying that the market alone can’t be expected to drive down rents to affordable levels, it takes government intervention. Other pressures on local house building mean that we’ve got to be judicious about the homes that we do build: making sure they work for local people.

The solution Renewal outlines is clear. The government must invest to build a generation of Rent to Buy homes, targeted specifically at low-middle income, working families. These homes would have rents at a third of local low pay and councils would have flexibility to prioritise local working people. They would come with contracts of up to 10 years, which gives a much stronger degree of security than the private rented sector ever offers. Renewal also suggest that they would have a built in Right to Buy option.[2]

It may be that some of the detail in David’s proposal needs smoothing out – such as what exactly the level of rents should be to balance opportunities to save with the ability to fund as many homes as possible, and what should happen to households who still aren’t in a position to buy when their tenancy term ends. However the principle is sound. Help people with a secure foundation and it is up to them to build their lives.

One of Theresa May’s top advisors Nick Timothy recently asked the question: what can Conservatives offer working class kids from Brixton, Birmingham, Bradford or Bolton?

Here’s one answer: a secure home, a proper chance to save and a shot at homeownership.

[1] Question: Thinking about saving money towards a deposit to buy a home…Approximately how much, if anything, do you personally save during an average month? Source: YouGov survey of 3792 private renters in England, July 2015, weighted, online. Base: 3043 who know that they want to buy a home.

[2] Instead of the hugely expensive discounts in the council housing version of Right to Buy – which is one reason why the homes were never properly replaced – the scheme would link in with an equity loan, as per Help to Buy.

A more direct solution would be build more social housing. If anything the focus of the last two decades has been that home ownership is almost a compulsory requirement and that if a person does not wish to own their own home they are somehow deficient of purpose and drive.

All of the housing schemes of the last government were about getting people into ownership, which adds to the pressure on the sale market and thus continues the upward pressure on prices.

I think you’re right Colin and it’s also been added to by the encouragement of private landlords.

Nothing wrong with ordinary folk renting out properties but it’s risen at such a fast rate that it’s put extra pressure on housing supply.

At the end of the day we need more houses built, both social housing and private housing. Local builders would love to have more scope to build on small plots around the country, but the big companies have grabbed most of the land allocated for building and they’re not going to give it up any time soon. And unless they’re forced, they’re not going to allocate much of it to social housing