Is it better to invest in bricks or benefits?

Published: by Kate Webb

The Housing Minister recently tweeted that the housing benefit debate is “misinformed” by claims the budget is being cut, when spending is in fact forecast to resume its upward trend after next year’s cuts have bitten.

This may be a deeply disingenuous argument – the Minister knows full well that the amounts paid out to individual households are falling – but it does highlight an important point: despite a £2 billion package of cuts the overall housing benefit budget will likely rise – meaning that housing benefit will remain firmly in the Treasury’s bullseye for the next round of spending cuts. Last week’s confirmation that the claimant count has crashed through the five million barrier further underscores this.

The reason why housing benefit is so expensive will be obvious to anyone who rents privately. Rather than a cheap option, private renting has become increasingly unaffordable. At the same time more low income households have come to rely on the private rented sector because of a shortage of genuinely affordable social housing. Combined with rising unemployment and stagnant wages you have a perfect storm: more people need help with housing costs and their housing costs are more expensive than ever before due to a shift towards the private rented sector and rising rents.

Ministers have reacted to this by heaping criticism on “unsustainable” housing benefit spending and reforming welfare to move people into work. But really this is the fault of successive governments going back to the 1970s. Taking the long view may be unfashionable in a world of 24-hour news and five year election cycles but it is necessary if we want to break out of a dysfunctional system.

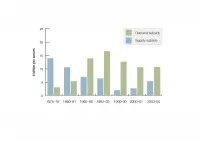

Past governments deliberately shifted spending from bricks and mortar to income top-ups for tenants in the belief that this would be more efficient. It has been a costly experiment. Costly to taxpayers who now support a £20 billion plus annual bill; but also costly to households claiming the benefit who have suffered from poor administration, discrimination and a benefits trap that meant working would leave many little better off. Supply of genuinely affordable housing has collapsed, leaving too many families at the mercy of rogue landlords at the sharp end of the market.

How spending on housing has shifted over time

We have just published a report setting out the problem and calling for a switch back. We know this is a big ask – investment in supply was cut by over 60% in the last spending review.

But if the government is serious about bringing down the benefit bill then it cannot be a matter for welfare reform only. Getting people into low paid work will not bring down costs sufficiently if high rents mean working families need additional support. It’s time the Treasury took some of the heat off the Department for Work and Pensions and started asking the Housing Minister what he is doing to reduce the housing benefit bill.