Let councils build – and borrow

Published: by Toby Lloyd

Many voices – including Shelter’s – have been plugging the economic benefits of getting housebuilding, but two things are new about the current burst of pre-budget clamour.

Firstly, the breadth, and seniority, of the voices demanding investment has reached a new level. When the CBI, the Chambers of Commerce, a former Thatcher Government Cabinet member and even the Secretary of State for Business are all saying the same thing, all it needs now to complete the set is for the new Pope to emerge from the Sistine Chapel and call on the Chancellor to increase housing spend in the budget.

More interestingly, the calls for more homes are now focusing explicitly on public investment and public delivery.

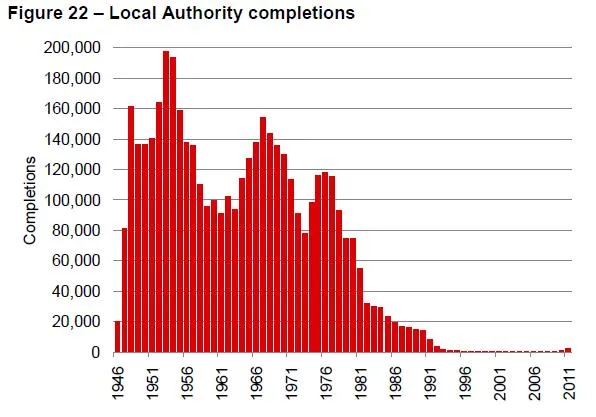

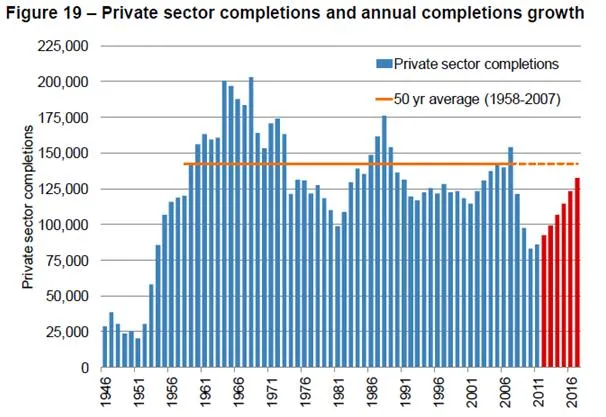

Not so long ago the talk was all about ‘cutting red tape’ or channelling finance to the private sector to deliver. Now, after years of falling or flatlining housing production, attention is finally turning to the sleeping giant of house building: local councils. A glance at the figures shows just how big a giant it is, and how profoundly asleep it’s been:

(Graphs from this Savills report [PDF])

There’s a huge amount of opportunity lying idle there. Councils have plan-making powers, own large land assets that could be developed, and have both a duty and an incentive to build the homes their voters need.

After years of paying down historic debts and investment in repairs via the Decent Homes programme, the remaining council stock is in good physical financial shape, with half the average debt gearing of housing associations. And with over 1.7m council-owned homes in England, that’s a serious asset base on which to raise finance.

Recent changes have allowed councils to start building again, but the numbers are piddling, because the Treasury tightly caps the amount councils can borrow. The problem is that even prudent council borrowing is counted as national debt, and so runs into the same fiscal straightjacket that George Osborne finds himself in.

But, as others have highlighted, it seems this is more a function of accounting rules than real economics. Council borrowing to build homes for rent is not the same as government borrowing to fund wages, benefits or tax cuts – or even other types of investment. What other government spending generates immediate jobs and growth, provides a secure, long term income stream, AND gives you a capital asset that grows in value?

Nothing else I can think of passes the test: new hospital buildings create construction jobs, but incur an ongoing wage cost for all those doctors and nurses; new toll roads generate an income stream, but their value declines over time.

The campaign to lift the borrowing cap from councils is growing in momentum – and in Tuesday’s Lords debate Lord Jenkin joined the chorus. It’s a modest proposal – allowing borrowing up to the normal prudential limits to fund 60,000 new homes over five years – and there is surely scope for more in the same vein, but it’s a good first step.

Letting local authorities borrow sensibly to build affordable homes won’t solve the crisis over night, but it’s probably the single best thing Osborne could do to get Britain building again.