Five big housing trends that should worry you

Published: by Pete Jefferys

Today, the government has published its annual headline report on the state of housing in England. This gives us a chance to spot the big trends and how they might link to one another. Here’s five trends that have big implications for us all:

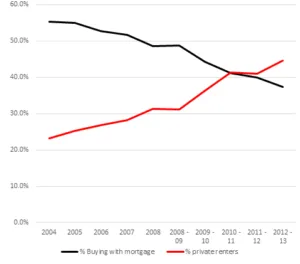

1. If you’re under 35, then you’re now more likely to rent privately than be buying with a mortgage…

The proportion of 25 – 34 year olds who rent privately has overtaken those buying with a mortgage in England. The same trend of falling ownership and rising renting exists for 35 – 44 year olds and without any intervention those lines will cross too.

Proportion renting privately vs. buying with a mortgage: age 25-34

2. …meanwhile, a growing group of older home-owners has no housing costs at all

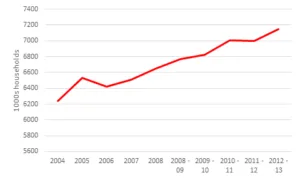

While more young adults rent than own, there’s a growing group of around 7m households in England who have paid off their mortgage and have no housing costs. Unsurprisingly, more than half of these households are aged over 65 with very few under the age of 45.

This isn’t a simple intergeneration issue though. Many of these households will have children and grandchildren who can’t afford a home of their own. While some will be able to help their children, the majority won’t have enough spare cash to make up the gap with rising house prices.

Equally, within this older generation more than a million households are renting privately. The wealth and income gap within the generation between renters and outright owners will grow if rents and house prices continue to rise. This will have further consequences for the next generation’s chances of becoming a home-owner or renting for life, as housing assets are passed on within families.

Number of households who own outright

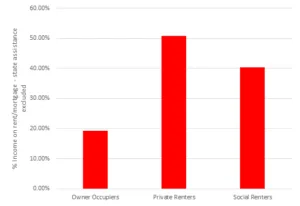

3. For those stuck renting, there’s a premium. Renting costs more than owning…

Despite not owning their home, private renters pay more each month to keep a roof over their head than owners do. This is both in proportional and absolute terms. In other words there’s a ‘renters’ premium’ – if you’re stuck renting then not only do you not have a financial asset but you also have to pay more for the privilege. Again, this has major consequences for pensions policy, financial security and the wider economy, which will suffer from lower consumer demand if more people have to pay higher housing costs.

Proportion of income spent on rent/mortgage by tenure

4 …so fewer renters can afford the rent…

An important medium term trend for government is that along with a growing private rented sector, fewer of those renting from a private landlord can afford to pay the rent. This is despite the fact that a bigger proportion of private renters are in full or part time work than in any other tenure. According to today’s EHS, a quarter of private renters in England receive support because they cannot afford to pay their rent up from 19% in 2008/09. More detailed claimant data from DWP shows that this rise has peaked and fallen slightly over recent months. With rents not getting any cheaper and wages still stagnant, this is one to watch.

This medium term trend presents a stark choice for policy-makers: (1) allow the bill for social security to keep growing, (2) cut the safety net and see pressure on renters increase, (3) intervene to take action to reduce housing costs by building more affordable homes.

Number of private renters receiving housing benefit (DWP data)

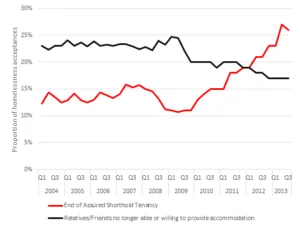

5. … and now the loss of a private rented home is the leading cause of homelessness

The leading cause of homelessness in England is now the loss of a private rented contract (AST).

Today, Shelter and Crisis published a major report on private renting and homelessness based on two years of in depth interviews with homeless families placed into the private rented sector. You can read more about it here. Given the trends shown by the annual report out today this research couldn’t be more timely or important.