Property prices and household debt to only get higher and higher – OBR

Published: by Adam van Lohuizen

The major announcement from the Autumn Statement released two weeks back was the cuts to stamp duty, cuts that will actually push up house prices. But the Office of Budget Responsibility (OBR) also released all of its forecasts that underpin government finances and the economy, including those for the property market. These tell us quite a lot about what it expects to happen in the housing market up until the end of the decade. Unfortunately, the picture it paints isn’t a pretty one – at least not if you aspire to get onto the property ladder.

The OBR expects that residential property prices will increase by over 10% this financial year. This is no surprise, as we’ve all read about the strong growth in house prices this year. But the further into the future you look, the greater your concern should be.

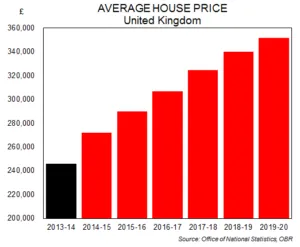

The OBR expect house prices to be 43% higher in 2019-20 than they were last year. This implies that the average house price will increase by over £100,000 across the next five years to exceed £350,000.

Such increases in property prices might be manageable if prices were currently affordable, and/or future rises in incomes matched that of property. But unfortunately they’re not and they won’t.

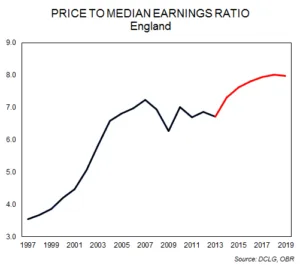

House prices in England were 6.5 times higher than incomes in 2013, almost double the ratio of 3.5 back in 1997 (a price to income ratio of 3 or below is considered to represent a balanced market). While incomes are predicted to grow at half the pace of residential property prices across the forecast period. This will push the price to income ratio for England up to 8 before the end of the decade.

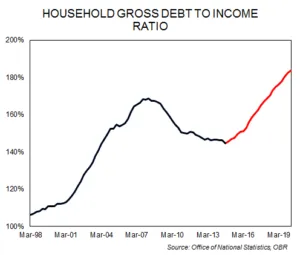

So how will we pay for rising house prices if incomes aren’t going to keep up? More debt – and a lot more. The OBR expect household debt relative to incomes to sharply increase from around 145% of incomes to over 180% of incomes by the end of the decade, easily exceeding the previous peak prior to the financial crisis in 2008.

If this scenario comes to fruition, then we can expect the impact on household balance sheets to be severe. We already know that households are concerned about the size of their mortgage, and will struggle with interest rate rises – rises that will come sooner or later. And the implications for the overall health of the UK financial system are similarly worrying – as the size of private debt levels enters unchartered territory.

These sky high levels of debt – and the burden on households that will accompany them – can only be avoided by building enough homes to stop prices rising, and provide enough genuinely affordable homes to offer people a real alternative to excessive levels of mortgage debt. It’s quite clear from its latest forecasts that the OBR doesn’t expect this to happen, but rather that the housing crisis will continue to get even gimmer. But the future isn’t decided yet, and we can avoid this bleak outlook if we start to build the amount of homes that we need now.