Genie let out of the bottle in London

Published: by John Bibby

At the beginning of the week the Mayor of London announced new funding and finance for low-cost home ownership homes in the capital. As well £180 million of ‘recoverable funding’ for 4000 new shared ownership homes, the announcement included up to £40 million of cheap loans to bring housing association Gentoo’s Genie product to London.

Genie is a home purchase plan that has been operating in the North East of England since 2011 and it has a lot going for it. It allows people to buy shares[1] in a home without a deposit or a mortgage by making a single monthly payment, which feels a bit like rent. The payments rise predictably over five year periods so there are no surprise increases. At the end of every five years the next five year payment plan is reviewed to allow for changes in the provider’s costs (inflation and interest rates). And after thirty years the occupier acquires all of the shares and the home is theirs – owned fully outright.

It’s a simple offer and appears to combine the best of renting (low up-front costs and no mortgage liability) with the best of buying (greater security in your home and investment in a property). It also closely resembles the rent-to-buy model that topped the new housing ideas we polled last year for popularity, “where every rent payment goes towards owning the house”. And it’s one that we have called to be developed to improve the intermediate options that are currently available to people who can’t afford to buy but don’t qualify for social housing.

So it’s a simple and popular housing product that will help people who’ve been priced out or home ownership get on the ladder. Positives all round, no?

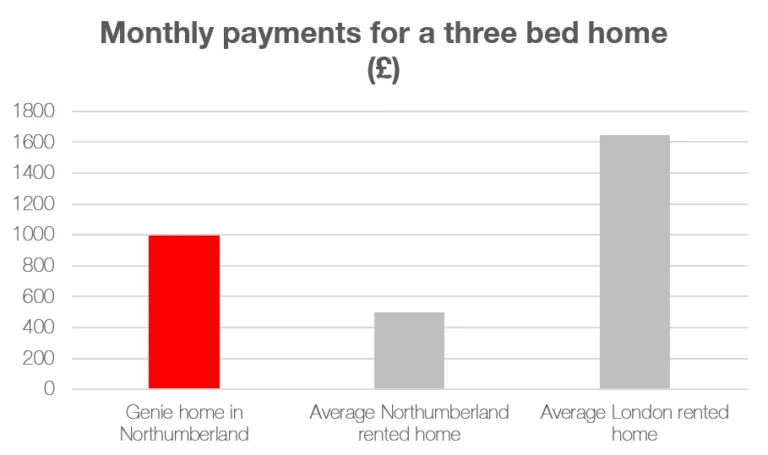

Well, that depends in-part on exactly how the scheme will be implemented in London in practice. Because although the monthly payments for existing Genie homes will appear low to Londoners this is mainly due to their location, in the relatively cheap North East. At the time of writing a new three bedroom home was advertised by Genie for just over £997 a month, compared to an average rent of £1647 per month across London for three beds. But the average rent for a three bedroom rented property in the same local authority as the advertised Genie home (Northumberland UA) is £500 each month, making the Genie almost twice as expensive as the average rented home there. (An upper quartile rented 3-bed home in the same authority is £595 per month, suggesting the Genie payment is equivalent to the very top end of the rental market).

Building Genie homes in London, where the cost of building new homes is much higher than in the North East, largely because of the much higher cost of land, will be much more expensive. As such, without intervention, we could expect the payments on Genie homes in London to be much higher. Were the correlation between rents and the cost of a Genie home fully replicated in London it would push their cost well beyond the reach of most of the capital’s priced out renters and could even bump into the income limit for intermediate homes. This would make them a genuine option only realistically for those who are already able to buy, although they could still be an attractive option to people who find it difficult to get a mortgage, like older people and the self-employed.

Which is where the role of the Mayor of London’s cheap finance comes in. The question is whether cheap borrowing alone will be able to markedly reduce costs for Gentoo and bring down the monthly costs of a Genie to a level that renters would be able to afford.

If it is then the arrival of Genie in London could represent a great new way to buy a home with no mortgage and no deposit. If not, then London’s growing legion of priced-out renters may have to wait to see if the model, which looks great on paper, can be made fundamentally more affordable.

[1] The share accumulation profile means that over time the proportional amount of equity that you build up in your home increases each year, a bit like the way capital is paid off in a traditional mortgage