Green belts, green nooses, green fields

Published: by Toby Lloyd

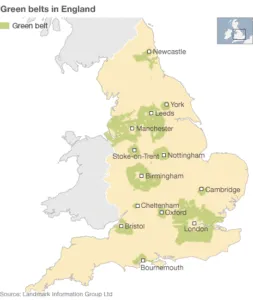

Scarcely a day goes by at the moment without someone having a go at the sacred cow of British planning, the Green Belt. This morning it was Tom Papworth at the Adam Smith Institute, calling for the complete abolition of the Green Belt in order to let market ‘price discovery’ determine where best to build homes – although he does also suggest less extreme measures, like releasing all Green Belt land within ten minutes’ walk of a station.

From http://www.bbc.co.uk/news/magazine-14916238

For the record, we have also drawn attention to the problem of Green Belts preventing much needed housing growth, and called for sensible reviews: releasing 1% of Green Belt land over 15 years would provide enough land for 33,000 homes a year – and that’s at low, village densities.

But the Green Belt is also a broadly sound principle that has served England’s towns and cities rather well over the decades. It’s always easiest for builders to site new development in green fields at the edge of towns – that way you can free-ride on existing infrastructure and build cheaply without having to deal with complex brownfield sites. This means that, in a world with cheap access to cars, cities that are left entirely to the market tend to sprawl outwards in vast, low density suburbs that cannot be efficiently served by public transport or social infrastructure.

Fans of total planning deregulation tend to eulogise the 1930s – when we did build a lot of homes around cities. But would anyone really argue that our cities should double their footprint every ten years, as they did then? That only around 10% of England is urbanised is indeed a sign that a bit of greenfield loss would not be the end of the world. But it’s also a sign of the success of Green Belt policy in preventing infinite sprawl.

So despite our call for sensible release of greenfield land for more homes, I do part company with those that blame Green Belt policies for all the world’s ills. Papworth sets out very clearly the problems of undersupply, and does a good job knocking down some of the simplistic arguments for treating Green Belts as sacrosanct. But he commits the classic mistake of theoretical economists – setting up the problem in detail, and assuming that the solution is just to do the opposite. This sounds simple in theory, but the sadly reality is rather more complicated than that.

Just consider what would happen if national government abolished all Green Belts tomorrow: there would be an immediate land speculation boom, as developers, investors, dealers and brokers piled in to buy up potentially developable sites, hoping to cash in on easy profits. Land values, long supressed by Green Belt restrictions, would sky-rocket – and almost certainly crash again as the bubble burst. As I’ve argued repeatedly, high and volatile land prices are the real root cause of our failure to build more homes. Economists like to say that ‘in the long run’ the land market would stabilise at a new equilibrium, and argue that this would be at lower prices than in today’s constrained market. Yet the lesson of history is that land markets are rarely, if ever, stable: the speculative pressures caused by long lead times and very high potential gains naturally drive boom and bust cycles. Property bubbles were common in the nineteenth century – when there were no Green Belts and millions of us lived in overcrowded slums. I’d go as far as to say that we don’t have scarce land and a volatile land market because of planning, we have planning because land is inherently scarce and land markets are inherently volatile.

To continue the thought experiment, once the initial speculative frenzy was over, there would then be a protracted period of bickering over where infrastructure should go and who should pay for it. All the new speculative landowners would jockey for their sites to benefit from public investment, using whatever means available to them – a recipe for divisive, even corrupt, decision making. In the end, some of this land would get built on, but the chances of it being the best bits to deliver public benefit as opposed to the bits owned by the most influential people are slim. And the costs incurred in getting to this point would mean that, just as now, low quality, high cost development was the most likely outcome. The successful developers would still have the same incentive as now to eke out supply and keep prices up.

We can’t rely on the abolition of Green Belts to solve our housing shortage – we need a smarter approach that recognises the role of agency, understands the land market, and has the courage to tackle vested interests and ideological shibboleths.

Simply put, planning is not the only constraint on house building: where the train line and waste dump go are just as important, as is the financial model driving development. In this context, planning is actually a way of crystalising all of the constraints into a clear framework so they can be rationally addressed together. Belief in the perfection of markets is not an argument – it is just an article of faith. And we need more than that to crack this complex problem.