The danger of hanging your hat on experimental statistics

Published: by John Bibby

The Office for National Statistics (ONS) have updated the methodology for their index of private rents.

That might sound boring, but believe me: it’s not. Because the update shows that over the last ten years private rents have been going up twice as quickly as they previously thought.

So, where the ONS index (with the unwieldy official title of Index of Private Housing Rental Prices or IPHRP) under its old methodology suggested that rents increased by 4.5% between January 2011 and September 2014, the new index suggests that they increased by 8.3%. For someone who paid £500 a month in rent in 2009 that would mean the difference between a £22.50 increase and a £41.50 increase.

It’s important to be clear that the ONS’s index measures the amount that the cost of renting has changed for all private renters, including new and existing renters. In this way it differs from other measures of rent inflation, which tend to focus on market rents for new renters (we’ve previously written a fully explanation of this difference).

So that means that on average, over that period rents increased 8.3% for all renters. And for some people – particularly those in London or for new entrants and people moving home – costs will have increased even more.

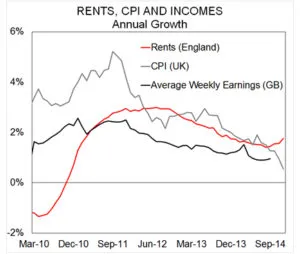

It also means that since 2011 rent increases have consistently outstripped wage increases and – until half way through last year – were broadly in line with inflation. Since September 2014 a gap has begun to grow between CPI and rents, which could – if maintained over time – be significant for private renters who receive Local Housing Allowance (which now increases at CPI).

Obviously, a change in the methodology of a retrospective statistical series doesn’t change the amount that actual rents have been going up. No one has suddenly been made any worse or better off. So apart from a bit of catharsis for private renters who experienced high rent increases, why does it matter?

Quite simply, the answer is that the government hung its hat on the index under the old methodology and made policy based on the principle that rents are rising slowly. Again and again, when asked what the government is doing to improve the affordability of private renting, ministers have pointed to the ONS index as evidence of low rent inflation. It also made the Department for Work and Pensions confident in pressing ahead with further cuts to Local Housing Allowance. Having broken the link between support and market rents in 2013, LHA was (in most areas) up-rated by just one percent in April 2014 and April 2015.

This is in spite of the fact that the index has – and continues to be – experimental. Changes and improvements in the methodology were to be expected.

The implications of this should be clear. Imagine, for example, if we suddenly realised that CPI is and had been double what we’d previously thought. The monetary policy choices faced by the bank of England would suddenly change considerably. In just the same way, this update by the ONS should have a marked impact on the government’s understanding of the increasing unaffordability of private renting and how they see their role in tackling it over the long and short term.

The ONS’s index remains experimental, so we should treat even this new index with caution. But this update should help to shift any complacency that the previous methodology might have (quite understandably) prompted and make the challenges facing renters more clear.