Freedom of choice lacking for first time buyers

Published: by Adam van Lohuizen

A huge symptom of the broken housing market is a lack of choice. Whether it is the long waiting lists that exist for social housing; the poor conditions and lack of security whilst living in the private rented sector; or the sky high house prices when looking to buy a home of your own, for ordinary people, choices are limited.

We’ve found just how limited the choices are for those looking to buy their first home. Even for those able to save enough for the gigantic deposit now required, there are not many homes available that they can afford to buy with the mortgage offers available to them.

We analysed all of the properties that were advertised for sale on Zoopla on one day in March. By comparing the asking prices to how much a typical first time buyer in the area could borrow, we could determine which homes in the area were affordable for first time buyers, and which ones weren’t.

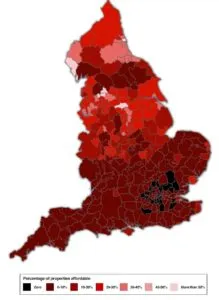

The results were stark, but unfortunately unsurprising. Of all the homes on the market, only 17% were affordable and suitable (had at least two bedrooms) for a family earning the median income in their local area. For bigger families that need a three bedroom home, this falls to only 7%. There were 35 local authority areas where there was not a single affordable home on the market, rising to 93 for those looking for a 3 bedroom.

Map of percentage of homes affordable for a family by local authority

As you might have guessed, the problem was most acute in London, with only 43 affordable properties in the entire Greater London area- that’s just 0.1% of the market. And when we did a little digging we found that only nine of these listings were both a. within the scope of the analysis and b. a genuine option for a family to buy and live in. For example, there were a number of retirement properties and sellers looking for cash only buyers listed. Of the nine, there were eight two bedroom flats (two of which were above shops meaning a buyer would struggle to get a mortgage) and one was a mobile park home (which has since sold). That was it. Not much of a choice is it?

Mobile park home for sale in London

But the problem isn’t just limited to London. Less than 10% of the market is affordable in the whole of the South and East of England, while around one in five homes are affordable for families living in the Midlands.

And this is only for the families that have managed to save up the required deposit to buy. We’ve found it would take the typical family in England 12 years of saving to do this.

Not much of a choice is it really?