The government can cut less than £12 billion from benefits – and still meet its welfare target

Published: by Adam van Lohuizen

The impact of the cuts already made by the Coalition Government has been severe. And the government has pledged to make a further £12 billion reduction in welfare spending by 2017-18. But the task of making these cuts has got a whole lot harder since it was announced, because some savings have already been realised, even before any cuts are made.

Because inflation is lower than expected, welfare spending will also be lower than previously expected. This means the £12 billion target for cuts set by the Government is no longer relevant, as it implies a larger cut to spending in real terms – meaning the target can safely be reduced.

Sound confusing? Let me start from the beginning.

The £12 billion target was first announced by the Chancellor in January 2014. Inflation in had been 2.6% the previous year, and the 1% cap on uprating benefit payments had made significant savings for the Coalition Government. It’s fair to say that, at the time, they would have expected to make some of the targeted savings by again reducing the uprating of benefit payments into the future.

Now it is over a year later, and we only know some of the measures to meet the target. In the Queen’s Speech yesterday, the Government committed to:

- Remove housing benefit for job seekers up to 21 years old. We are concerned this will increase homelessness among young people.

- Reduce the benefit cap from £26,000 to £23,000, which will make it even harder for more and more families to meet their housing costs.

- Freeze working-age benefits (excluding disability benefits) for two years. If Local Housing Allowance (LHA) is included in the freeze, then 1.4 million private renters will find it even harder to pay the rent, as LHA rates fail to keep up with the rising cost of rent.

Despite the negative impact the first two changes will have on thousands of families across Britain, they each only save around £100 million each – only a fraction of the £12 billion target.

The largest savings announced come from the freeze in working-aged benefits, a stronger measure than the 1% cap that had been previously used. When announced by the Chancellor in September last year, the freeze was expected to save over £3 billion. However, today, this measure will only save £1 billion. Low inflation has reduced the cuts available from this measure by two-thirds, or over £2 billion.

Change in estimated savings from freezing working age benefits for year 2017-18:

Date of estimate | September 2014 | February 2015 | May 2015 |

Estimated saving | £3.2 billion | £2.4 billion | £1.0 billion |

Source: Institute of Fiscal Studies, Shelter Analysis

How has an inflation forecast had such an impact? Well, the government increases benefit payments each year in line with inflation. By freezing benefit payments instead of increasing them, the government makes savings. Just like it did by limiting increases to 1%.

But we’re currently in a period of deflation, and the outlook for price growth has dropped to 0.2% growth this year, down from 2% when the Chancellor announced the freeze back in September. It doesn’t sound like much, but that’s a 90% decline in price growth.

This has had a huge impact, shrinking the savings that will be generated from not uprating payments with inflation. But the total cash spend on welfare would be the same under a freeze, whether inflation had dropped or not.

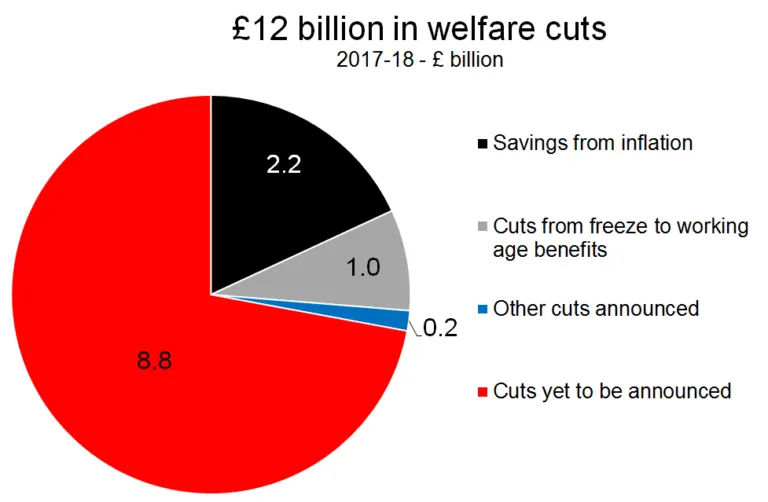

If the government is insistent on fulfilling its pledge to lower the benefit bill by £12bn, then it needs to acknowledge the savings that are being generated from lower inflation. Either the £12 billion target should be reduced to reflect lower inflation, or savings made by inflation should count towards the £12 billion. As demonstrated in the chart below, these savings would make a significant contribution to the overall target.

If the inflation savings are not counted, the government will be forced to make even deeper benefit cuts than it actually needs to in order to meet its own target – which seems perverse.

Just like households who have enjoyed cheaper food and fuel costs due to low inflation, the government is now better off as well. It needs to take this turn of good fortune and count the savings that low inflation has delivered, rather than make cuts even worse than it originally intended.

We still don’t know where the rest of the cuts will come from. But what we do know is that the deeper they are, a greater number of people will find it even harder to stay in their home.