What can 1.4 million private renters expect in the next round of welfare reforms?

Published: by Zorana Halpin

The government plan to cut a further £12 billion from the welfare bill across the next two years. There’s not much detail on how they’ll do this, but a two year freeze on working age benefits is planned, and this will include a freeze on housing benefit for low income private renters, known as Local Housing Allowance (LHA).

LHA acts as a crucial – but increasingly ineffective – bridge between the cost of renting and the ability of low income households to pay the rent.

Successive cuts and changes to LHA mean that it is already a challenge for low income renters who qualify for this help to find a home within Local Housing Allowance limits – especially those living in areas with high rents.

Renters, like Bob from the Wirral, recently got in touch with Shelter to tell us he already faces a rent shortfall of £45 a month, despite being in receipt of LHA.

In the past, Bob’s best option could have been to move in search of cheaper rents – but the effects of the planned freeze will be felt across the country.

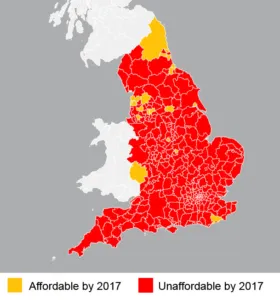

By 2017 there will only be a handful of areas where the cheapest 30th percentile of properties for rent are within LHA rates. By this measure only 6% of England will be ‘affordable’ to renters in receipt of LHA. All will be in areas with low employment and far from employment growth in London and the South East.

| Places in England where LHA will cover the cheapest 30th percentile of properties for rent in 2017 |

| Blackpool |

| Bury |

| Chorley |

| Derby |

| Fylde |

| Gateshead |

| Hartlepool |

| Herefordshire |

| Kingston upon Hull |

| Leicester UA |

| North Tyneside |

| Northumberland |

| Ribble Valley |

| Rochdale |

| Rother |

| St. Helens |

| Stockton-on-Tees |

| Sunderland |

| Wakefield |

| Wyre |

By 2017 in more than twenty areas LHA will cover the rent of less than 1 in 10 properties for rent. These include areas in London, Manchester, and the East of England.

Competition for properties which fall within LHA rates will be intense and some renters will be forced to rent properties they can’t afford. Topping up the rent by turning to other sources of income – in Bob’s cases, his pension credit – threatens to become a way of life for those affected.

Landlords seeking the best rental income may be further encouraged to stop letting to housing benefit tenants altogether. Indeed, our research shows that 67% of private landlords would prefer not to let to households on housing benefit at all.

We’re concerned that more low income families, like Sylvia and her children, will be forced to rent properties they can’t afford and have to resort to incentivising landlords and agents to take them on, risking getting into debt in the process:

“Because we’re a family and we’re on housing benefit, about 99% of agents don’t want to entertain us. In 2013, it took us almost a year to actually find a flat for our little family. In April 2014, we had to offer 6 months in advance to make the agent bite – offering a higher advance was a suggestion that we’ve found from somewhere in google.” (Sylvia, London)

Even more renters may be forced to compromise on conditions to keep a roof over their head.

The private rented sector is already unstable. The end of a private tenancy is now the single leading cause of homelessness. Freezing benefits for 1.4 million will make a precarious situation even worse.

The government should instead prioritise a review of LHA rates to ensure households can afford to rent privately. This should include the need to relink LHA increases to actual rent inflation to ensure families can continue to access basic accommodation and don’t get frozen out.