Can the new Right to Buy reverse falling home ownership?

Published: by Pete Jefferys

There are lots of practical problems with the new Right to Buy for housing associations, which is rapidly becoming the billy no-mates of housing policy.

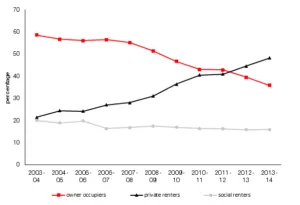

However the policy is aiming to address a very real problem: the decline in home-ownership which has now been falling for over a decade. If that trend isn’t reversed, David Cameron will be the first Conservative PM since Neville Chamberlain to preside over a fall in the proportion who own their home.

Households aged 25-34, by tenure (2003 – 2013)

The original Right to Buy scheme was a route to home ownership for millions, so why not just re-heat it if that’s your goal?

Here’s three reasons why we should throw a bucket of cold water onto claims that the new Right to Buy is the saviour of home ownership:

- Many of the homes sold will be snapped up by investors.

More than 1 in 3 of the homes sold under the original Right to Buy are now private rented homes.

However this time around it’s likely to be even higher. Unlike the original Right to Buy, the new plan is putting half the homes sold straight onto the open market (the council homes sold to fund discounts to housing association tenants). We know that the market is increasingly dominated by cash buyers and investors, not by first time buyers with mortgages – so council homes sold-off will increase private renting, not home ownership.

If the housing association home also ends up being rented out, as happened with a third of the original right to buy homes, then there could be little impact on home ownership at all, as both sold homes end up being private rented.

- Selling council homes (and failing to replace them) restricts buying opportunities

But there’s more. Each sale of a council home to fund six-figure discounts is in fact restricting the ability of a future council renter to access home ownership themselves through the original Right to Buy. It will become harder for many low income council renters to become home owners as the stock of council housing declines.

The government would reply that the homes sold will be replaced. As we know though, the record on this is just awful. Just one new council home has been started for every ten sold since the scheme was extended in 2012. In Greater Manchester more than 800 have been sold and just 2 built.

If that trend continues, and sales to investors outnumber those to first time buyers, the council home sales could easily be restricting home ownership rather than increasing it.

- Housing associations will build fewer homes to buy

Finally, other routes to home ownership will be shut off. Housing associations have pointed out that if the money spent on giving secure tenants massive discounts was instead spent on building, they could manage an additional 100,000 part buy, part rent homes. That’s a clear opportunity cost from paying huge discounts, rather than building to help buyers.

More directly though, the financial uncertainty created will make it harder for housing associations to finance their debts, with the inevitable result that they scale back or freeze construction projects. The original Right to Buy contributed to the near total exit of councils as house builders. If a similar trend emerges for housing associations, then there would be thousands fewer homes built for shared ownership, making it harder for the next generation to get on the ladder.

……

There’s lots of reasons to be sceptical about the ability of the new Right to Buy to boost home ownership. Most worrying from that perspective is whether or not the replacement homes will really be built in a reasonable time. If they’re not, then thousands of potential owners will be restricted from the opportunity to buy as the council stock declines. Given the abysmal record of the previous scheme, it would surely be better to start a major building programme first, so that there’s less ground to catch up.

The Prime Minister is clearly passionate about extending home ownership. However he will be judged not on the schemes he launches, but the result for millions of families. Will home ownership rise or fall this parliament? With that in mind, maybe he should also be sceptical about the new Right to Buy as the saviour of home ownership and instead focus on the real answer: getting on with building.