House prices to rise by a third – why planning reforms must deliver more affordable housing

Published: by Adam van Lohuizen

Today the Chancellor announced some pretty major planning reforms. The acknowledgement that we’re simply not building enough homes, and the stated aim of getting Britain building again, are both welcome – and things we’ve long been calling for.

The package of reforms offers a genuine opportunity to really start to address the housing crisis. But it remains to be seen how affordable these homes will be. Worryingly, some of the reforms could actually reduce the number of affordable homes we build, depending on how they’re implemented:

- The introduction of a dispute resolution mechanism for section 106 agreements could get housing starts happening more quickly. But depending on its design and implementation, it could also erode the requirements for house builders to provide affordable housing as a part of their developments – as other recent reforms have done.

- The signal that the spending review will ‘re-focus investment in homes to support low cost home ownership for first time buyers’. Supporting low cost home ownership is great, but not if it means reducing the support for genuinely affordable housing across all tenures – which is what this seems to imply.

We think it’s vital that the government takes effective action to address housing affordability, and this is made abundantly clear when looking at the government’s forecasts in last week’s Budget.

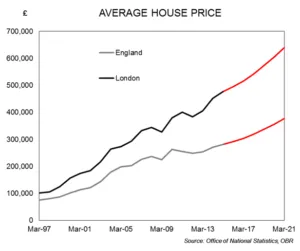

The Office of Budget Responsibility (OBR) forecasts that our already unaffordable house prices will rise by another 34% over the next six years. Sounds like a lot? That’s because it is. It would add another £96,000 to the price of the average house in England, to reach a staggering £377,000 by March 2021.

If London grows at the same pace, the average house will cost an extra £163,000 or £640,000. Almost two-thirds of a million pounds.

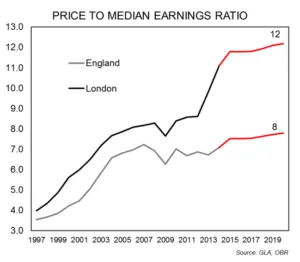

Perhaps this wouldn’t be so bad if incomes caught up. But the OBR doesn’t expect that to happen. The ratio of the average house price to median earnings is set to increase from seven times income to eight times across England, and from 11 to 12 in London. Not huge increases on the face of it, but these ratios are already extraordinarily high. In the 1990s the average house cost just four times the typical income, so they are now twice as expensive to buy as they used to be in England – and three times as much in London.

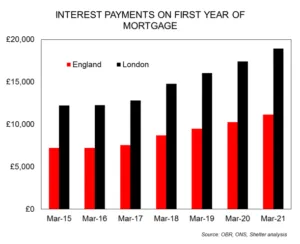

If mortgages became cheaper, then perhaps it might be a little easier for the select few households that are somehow able to raise a deposit to buy their own home. But that’s not likely to happen either. The OBR expects the average mortgage rate to rise from 3.2% at the moment to 3.7% by March 2021.

This means that a home buyer purchasing an average house in England with an 80% loan, will pay around an extra £4,000 in interest in their first year of home ownership than they would currently, or an extra £330 every month. In London it’s closer to £7,000 (£6,700), or £560 more every month. And those are only the interest payments – before any of the hundreds of thousands of pounds borrowed is even paid back.

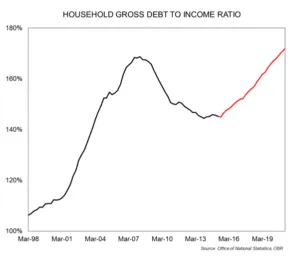

But despite higher rates, households are still expected to take on more debt – a lot more. Household debt relative to income is expected to reach dangerously high levels and exceed 170% by 2021, higher than the peak prior to the crash.

So… Higher prices relative to income. Higher interest rates. Higher debt levels. All of these projections together tell a story. A story of current trends in the housing market continuing, and the housing crisis only getting worse. In this world we could expect almost 70% of young people to be privately renting by the end of the decade, putting home ownership beyond reach for most and creating a nation of renters.

Unless the planning reforms announced today deliver homes that ordinary people can afford, then the OBR is probably right, and this is the world we’ll be living in. Let’s hope that the planning reforms deliver on their potential and don’t just start building more homes, but the affordable homes that we really need.