Will house building survive the next crash?

Published: by Pete Jefferys

House prices are now above the peak they hit before the last recession. That crisis, caused in part by dodgy lending, was a disaster for many parts of our society and economy. House building was high among them with so many jobs lost and so many much-needed homes never built. Next time house prices fall though it will be even worse. House-building will be devastated.

From 2007 to 2009 the number of new homes started by private builders plunged 59%. Even now, a full six years since that low point, private house builders are still not starting as many homes as they did back in 2007. We are certainly not close to building the minimum number we need to deal with our long-term shortage.

But why are the risks from the market higher than ever before?

In short, it is because both the last government and the current one are pursuing policies which are making the market more likely to suffer shocks. At the same time they are stripping away the resilience of the house building system to cope with those shocks – especially by linking affordable housing ever more closely to the wider market.

We are not only failing to ‘fix the roof while the sun is shining’, but ensuring the walls will be gone when the next storm hits.

A more volatile housing market

It is a fool’s errand to try and predict when the next major fall in house prices might happen. There are simply too many factors that could trigger it: macro-issues like rising interest rates, a global financial crisis or a UK recession. To housing market specific ones – sub-prime loans, interest-only mortgages and mortgage terms being extended to 30 years plus.

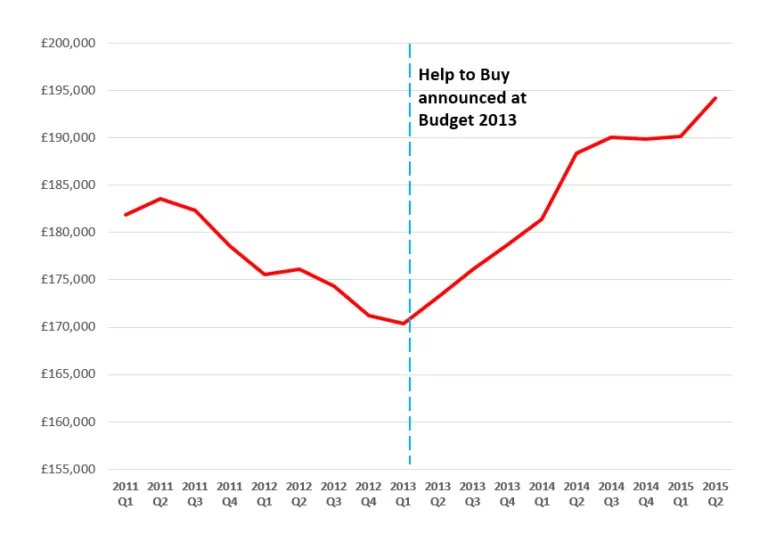

Whatever the proximate cause of the next crash though, the government is increasing the chances of it happening by fuelling house price inflation. While the changes brought in by the Mortgage Market Review to regulate the way banks extend credit were sensible, the thrust of all other Treasury and Bank of England policy since has been to put rocket boosters under house prices. Help to Buy, cutting stamp duty, quantitative easing, pension freedoms, and now inheritance tax cuts – all have the net effect of encouraging more cash to chase the same number of homes.

The fuel for more house price inflation doesn’t just come from ploughing taxpayers’ cash into the market though. When the Help to Buy scheme was launched we warned that the main risk was actually psychological: people would respond to the combination of the safety of government saying that home loans were now backed by them and by gradually rising prices, and jump in for fear of missing the boat. While Help to Buy may only a fund a small proportion of transactions in the market, it’s impact stretches much deeper, influencing the behaviour of potential home buyers and so pushing up house prices.

Real House Prices, UK (Nationwide)

A less resilient house building system

At the same time as stoking house prices, the government has made the house building system far less resilient to the next market downturn.

In previous housing market busts the building of subsidised affordable rented housing could pick up the slack when private house building fell, sustaining overall supply numbers and preserving industry capacity. But the next time around that ability for counter-cyclical government intervention will have been largely removed, making the entire system vulnerable to market corrections.

Here are the main policy changes that will really hurt next time house prices head south:

-

Starter Homes. The big one will be the shift from affordable rented housing to so-called “Starter Homes” which are sold for up to £450,000. The government is looking at directly replacing affordable rented housing with Starter Homes on every significant site and redirecting subsidy to them. Like any market housing, these Starter Homes will rapidly become unprofitable to build if house prices fall and so will not get built the market softens.

-

Housing associations forced to become commercial developers. The major builders of non-market homes are independent housing associations. These charities have been hit hard by a range of government policies in an attempt to make them more efficient and commercial. The upshot of this change is that housing associations are forced into a business model much closer to those of private developers, speculating on land purchase and financing themselves through building and selling market homes. They are becoming far more exposed than ever to the whims of the property market and will stop building if it weakens, just like commercial developers.

-

Weakened planning obligations on private developments. The planning system allows councils to negotiate a proportion of the profit from a scheme to be spent building affordable homes. However in recent years these rules have been systematically weakened and as a consequence obligations are lower. Much like the “zero lower bound” problem with interest rates, there simply won’t be anything left to negotiate on when the next crash comes, meaning large private schemes will become unprofitable much more quickly.

There are some major changes being made the housing system in England at the moment. None of these changes (save the Mortgage Market Review) seem to learn any lessons from 2007/08. In fact, the approach has been to amplify the weaknesses and vulnerabilities of the system.

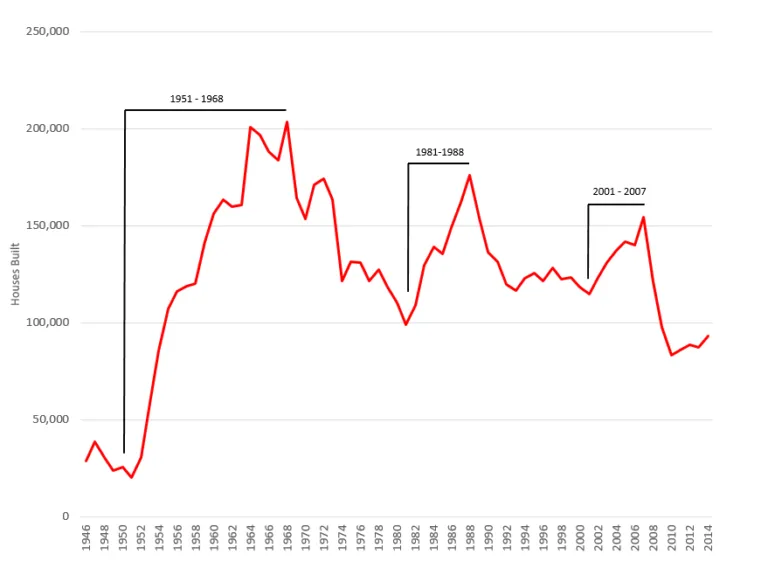

Simply looking at the history of private house building should tell us all we need to know about how vulnerable it is to market cycles and how dangerous it will be to lose the mixed economy of housing supply. Every peak has been lower, and shorter, than the previous one.

Private house building cycles, 1945 – 2014 (DCLG)

While in the short term some policies may make political sense there should be a nagging worry for the occupant of Number 11 Downing Street. There’s going to be an even bigger social and economic mess to clean up for whichever unfortunate soul is in charge next time the music stops.