Who can afford a Starter Home?

Published: by Pete Jefferys

At Shelter we’ve been critical of the government’s new “Starter Homes” policy, re-announced by David Cameron in his conference speech yesterday. As a reminder, this is the policy to swap low rent housing out of all new developments and in its place build homes sold at 80% of market prices. There’s a cap at £250,000 for homes sold in England and £450,000 for London.

We do want to see better options for people on low and typical incomes, who want to eventually own a home but are totally priced out and stuck in unaffordable, insecure renting. However our analysis suggests the Starter Homes policy won’t cut it for ordinary families. What’s worse is that the policy takes away homes that people on typical wages could afford, to build homes that we think only higher earners will be able to afford in most of the country.

So how much will Starter Homes cost, and who will be able to afford them?

By 2020, we can expect the median house price in England to be almost £268,000 and in London £493,000 [1]. A Starter Home will be sold at a 20% discount from its market price. We know that Starter Homes will be sold at a discount of all price points in the market under the caps, but we don’t know what the distribution will be within that range – what will be the average price? Partly this depends on their form, which the official design guide suggests should be classic and lower density, rather than modern high-rises. It’s also worth noting that, according to industry analysts, new builds now tend to be sold in the top 25% of local house prices.

We’ve therefore taken the median local house price as the price to discount, recognising that actual Starter Homes will sell at a higher and lower points in a range around that level. Discounting this median price by 20% means that an average Starter Homes in 2020 may sell for £214,000 in England or £395,000 in London – both comfortably under the maximum price set by the government.

To afford those prices at current average lending ratios:

- In England, you’d need an income of £50,000 and a deposit of £40,000.

- In London, you’d need an income of £77,000 and a deposit of £98,000.

This assumes that the buyer has to raise a deposit of 19% in England and 25% in London, which is the average size of deposit for first time buyers in these areas. The government might argue that you’ll be able to buy a Starter Home with a smaller deposit than this. That could be because you’ll be able to use the Help to Buy scheme to get a 95% mortgage. In practice, I think that some lenders may get nervous about stacking too many of these schemes on top of each other, which increases their risk.

But assuming you can secure a 95% mortgage, that would indeed lower the amount of deposit needed to 5% of the sale price. The snag is that you’ll need an even bigger income to afford the same priced property.

If you secured a 95% mortgage on a Starter Home:

- In England, you’d need an income of £59,000 and a deposit of almost £11,000.

- In London, you’d need an income of £97,000 and a deposit of almost £20,000.

This is out of reach for low and middle earners, especially families. Only higher earners, in the top 30% have much of a chance, and in London only then if you’re a couple with two high incomes. Even then, that assumes that you’ve already got a hefty deposit saved up. For families without deposits, only the top 10% of earners will stand a chance.

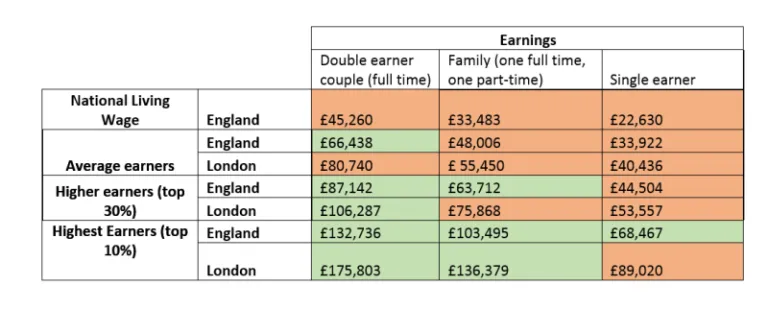

The table below shows the different types of household who can (green) and those who can’t (orange) afford an average Starter Home. This just looks at whether their income is enough to secure a mortgage, not whether they have the deposit saved up.

Clearly those on the proposed National Living Wage and single earners don’t stand a chance. What’s striking is that even most average earners would struggle to afford an average priced Starter Home. Families who are working hard on normal wages and saving will see Starter Homes move further and further away from them if house prices keep rising. Indeed, if the OBR’s house price forecasts are correct, Starter Homes will be 15% more expensive by 2020 than the same house sold today at full market price.

Table 1: Earnings of couples, families and single people in England and London by 2020 (Earnings except national living wage from the Annual Survey of Hours and Earnings)

To repeat, there’s nothing wrong with government seeking to build homes that families can buy. Our concern is that Starter Homes will be a non-starter for low and typical earners. If the government is subsidise this type of housing, it must be additional to support for genuinely affordable homes, rather than re-directing public support to help the better off.

[1] Using the house price inflation forecasts from the government’s Office for Budget Responsibility (OBR) and median house prices in 2014 (Land Registry).