George Osborne’s housing gamble

Published: by Pete Jefferys

George Osborne is a housing radical. He may not emphasise it, or even acknowledge it, but he’s taking some big gambles on housing policy which may or may not pay off.

One major gamble he’s considering at the moment is what to do with the Affordable Homes Programme: the main house building budget of the government. In 2010 this budget was cut, as part of the broader deficit reduction programme. To reduce the impact of the cut, Osborne changed what could count as “affordable”, allowing rents as high as 80% of the local private market to continue to fund some new development. Renters had to pay more, but so did taxpayers through the housing benefit bill, and crucially some homes for rent still got built.

Osborne is now considering going even further in his reforms. In his 2015 conference speech he said: “this autumn we’ll direct our housing budget towards new homes for sale.” This indicates another big change in affordable housing policy. It could mean a wholesale switch in the Affordable Homes Programme away from funding low rent homes and only funding homes for sale. Putting all his eggs in this basket would be a dangerous gamble.

The most likely types of housing to be funded instead of low rent homes are shared ownership (part buy, part rent) and Starter Homes, which are sold at 80% of the local market price. We’ve looked at Starter Homes in detail and shown that they will be out of reach for most low and average earners.

What about shared ownership?

On the face of it buying just 25% of a home as a shared owner will be much more affordable than buying 80% of one, as with Starter Homes. However there are some caveats. First, shared owners have to pay rent (and usually service charges) for the bit they don’t own. While the rent is subsidised, the whole package together can work out to be quite expensive in high house price areas. This will only become more common as house prices rise.

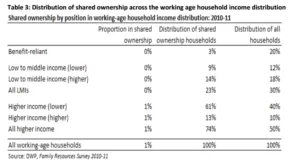

Back in 2010/11 the DWP found that three quarters of shared ownership properties were occupied by higher earners, with just a quarter occupied by low and middle earners (23%) or benefit reliant households (3%). Five years ago, the product was already skewed away from low and middle earners – what makes Osborne think that will improve over the coming five years?

A more recent study by Viridian housing association found that the average income of a single shared ownership buyer in London has risen £10,000 in the last decade to £35,500, far faster than wage inflation and now above average full-time earnings in the capital. They argue:

“the role of shared ownership products in the housing market may be changing. Where once they may have been conceived as a route to home ownership for those on lower incomes, they are now perhaps a product for those on higher income trajectories who are nonetheless struggling to keep up with the rising price of home ownership, and have found a new point of entry in to the housing market.”

Shelter has previously made the case for reform of shared ownership, to make it more affordable to lower earners and more flexible to changing lifestyles. Those reforms would still be very welcome if we are going to build more shared ownership homes. However, extra homes for higher earners to buy should be additional to more homes that lower and middle earners can afford to rent.

The crux of the problem is quite simple. For many families their incomes are too low – or too variable – to be able to safely take out a mortgage. Self-employment has risen exceptionally fast. Taking out mortgages is going to get harder for this group in the medium term, even if the mortgages are only to cover a share of a home. The answer cannot be the reinvention of sub-prime lending, especially with interest rates likely to start rising soon.

What we need is investment and reform to deliver a generation of new high quality homes, with living rents that are low enough to help families on low incomes save. Shelter research last week found that half of private renters who want to own a home can’t afford to save a penny towards a deposit each month. Helping families with low rent, secure homes can provide a platform to accessing low cost home ownership in the long term by building up savings.

The reality is that the pivot towards shared ownership and Starter Homes will benefit some people, but it will be at the expense of others – not in addition to them. The likely winners will be two higher earner couples, who will be able to own more quickly than they expected. The likely losers will be households with a single income, a variable income or a low income. It’s not too late to change course and to keep funding low rent housing. That would provide a far more positive platform – and mitigate some of the risks of George Osborne’s housing gamble.