Homes for who? A blow for low income home ownership

Published: by Steve Akehurst

The last Parliament saw housing rise rapidly up the political agenda. As a result, there is now a firm political consensus on the need to address the shortage of homes in England. This includes a genuine desire across government to get more homes built, which is very welcome.

The next big question, which will define housing in this Parliament, is homes for who? Who are we building for?

On this question, the government has made a much less auspicious start. The Prime Minister’s ‘Starter Homes’ announcement today is just the latest example.

Starter Homes are homes that will be for sale at 80% of market price. They will probably help some middle and high earning people in some parts of the country get over the line in to home ownership. The trouble is that these homes will be paid for by cutting funding for low rent homes for people on typical incomes. Where developers could previously be obliged to build affordable low-rent homes (through what are called ‘Section 106 obligations’) they will now be forced to build Starter Homes instead.

This is problematic on several fronts:

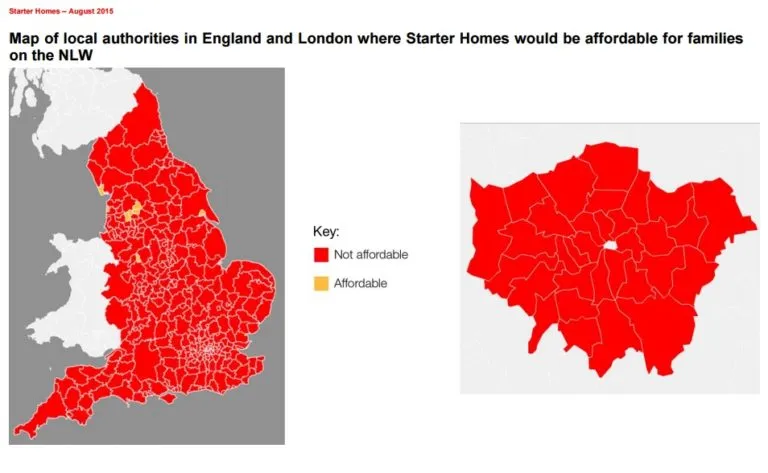

- As our research has shown, Starter Homes are only affordable to the already well off. They are out of reach for people on low and middle incomes in a majority of the country. Middle earners are priced out of Starter Homes in 58% of the country, while families on George Osborne’s new ‘National Living Wage’ are priced out of Starter Homes in 98% of the country.

- It will lead to fewer low income people becoming home owners – entrenching home ownership as the preserve of the well off. It may seem counter-intuitive, but low rent housing has historically been the best route into home ownership for people on lower incomes. This was MacMillan’s original vision: council housing as a stepping stone to ownership. Lower rents allow families to save more for a deposit, while the Right to Buy offers them the chance to buy their home at a discount. Fewer low-rent homes means fewer low income homeowners, with ownership the preserve of the types of people who can afford Starter Homes. A one off Right to Buy extension will not mask this trend if more low-rent homes are not being built.

- This particular policy doesn’t actually get more homes built. Instead, it just takes homes that would have got built anyway and switches the tenure to a more unaffordable one.

To be clear, there’s nothing wrong with building homes for people to buy at lower than full cost. At Shelter we’ve long called for more and better ‘intermediate tenures’. We urgently need more homes for people on all sorts of incomes, in all corners of the country – which means a broad based programme of increased investment and reform.

But supporting low cost homeownership must not come at the expense of more genuinely affordable homes – which unfortunately is what the government is now proposing. Across the board – on Right to Buy without proper replacement, the forced sale of council homes and in their spending choices – the government is phasing out homes affordable to people on typical incomes in favour of homes for higher earners.

The result will be a bit more home ownership for the already wealthy, with working people typical incomes consigned to expensive, unstable private renting for life.

To say the least, the politics of this are challenging for a party that is increasingly laying claim to be the party of low income workers. If George Osborne wants to make his ‘blue collar Conservatism’ a reality, he is going to have to build some homes for the kinds of people he’s talking about.

There is an alternative course here: it’s ensuring Starter Homes are additional to, not instead of, genuinely affordable homes to rent; it’s maintaining funding for homes to rent rather than cutting it and it’s ensuring homes sold through Right to Buy are replaced like-for-like.

Unfortunately, things seem to be going in the opposite direction. Announcements like today’s may get the government through the day’s news cycle, but unless they are careful it will catch up with them politically. We’ve already seen the Chancellor’s tax credits policy unravelling as people (including his own MPs) look through the detail of who it helps and who it doesn’t – there is a real risk his flagship housing changes will end up the same way.