Details still needed on social housing benefit limits

Published: by Kate Webb

Last week the government announced a pause in plans to force supported housing providers to reduce their rents. Supported housing will not now be subject to the 1% rent cut due to come in across the social sector from this April, in order that the government can review the likely impact on providers.

The pause is welcome but risks being overshadowed by plans to further restrict rents by introducing the Local Housing Allowance caps across the social rented sector. This was the move announced with little fanfare – or indeed an impact assessment – in the Autumn Statement. The nature of the jargon-heavy cut means it fails to evoke the tangible punch of the bedroom tax, but its impact could still be devastating for some vulnerable residents.

Since 2008, the maximum housing benefit entitlement for most private renters has been worked out via a system called Local Housing Allowance (LHA). This calculates awards based on the household’s size and a snapshot of rents in their local area. In essence it gives a private renter an “allowance” which should allow them to rent a home locally that broadly meets their needs.

Local Housing Allowance was a key target for cuts in 2010 and has been pared back ever since. Many private renters now find that their allowance is out of step with rents in their area, and the problem is set to get worse with rates frozen until 2020.

In the Autumn Statement the Chancellor announced that the LHA limits will be applied to social renters from 2018, covering all tenancies signed from April 2016. The move means that no social tenant will be able to claim more than they would be entitled to if renting from a private landlord locally.

Because private rents are on average twice as expensive as social rents, the majority of social tenants will be unaffected by this move. But there are exceptions, and those social tenants that live in supported housing are set to be hit badly.

This is because LHA rates are pegged to the bottom – often grotty – end of the private rental market. Rents for supported housing, such as domestic violence refuges or some homeless hostels, will often be more expensive than this because of the higher quality accommodation and intensive support they provide. Such schemes would become unviable if they are forced to lower rents to be on a par with a damp bedsit.

The government’s solution to date has been to point to the tired old standby of Discretionary Housing Payments, the flexible pot of money provided to local authorities to help tenants through the welfare changes. The fear across the sector is that this will simply be unworkable and that vital supported housing schemes will close.

But if the impact on supported housing providers has gone under the radar, there’s been even less said about the other households who will be affected. Key groups will be:

-

People living in low demand areas where the private rented sector is relatively cheap. Remember that LHA rates are set in line with the bottom of the rented sector, and are set to drift further downwards due to the four year LHA freeze. Add the introduction of Affordable Rents set at 80% of market rents and it’s easy to see how a good quality, modern social home could actually be more expensive than the bottom end of a declining local private rented market.

-

Under-occupiers. Each household’s Local Housing Allowance is based on the size of the home the household needs, not the one it actually occupies. So those private renters with homes larger than the minimum size for them normally already get less LHA than their rent – in much the same way as social tenants hit by the bedroom tax. The bedroom tax specifically exempts pensioners who happen to be under occupying their social rented home – but the new regime will not, meaning that many social renting pensioners living in larger homes will now potentially be expected to make up a housing benefit shortfall.

-

The third and most worrying group are under 35s living alone. Under Local Housing Allowance rules, single under 35s without dependent children are generally only allowed to claim housing benefit to cover the costs of a room in a shared house – known as the shared accommodation rate (SAR). Currently social renters face no such restriction, but come 2018 the SAR will kick in to the social sector.

Impact on young people

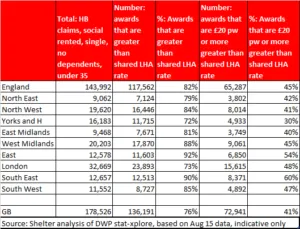

It’s this group who we expect to be most affected by the policy. We’re still waiting for an official DWP impact assessment but our initial assessment is that the losses for some under 35s will be deep and hard to bridge. Shelter looked at existing housing benefit award data and found that the vast majority (82%) of existing awards for single, childless under 35s in England are over the relevant SAR limit, meaning their housing benefit could be cut. And for a significant proportion of these households (45%) the difference between the existing award and SAR cap is more than £20 a week, a sum that someone on a very low income would struggle to make up.

This is based on average awards and it may be that some claims are distorted by under-occupation or the higher cost of supported housing. In some areas one bed social rents may indeed be in line with the cost of a room in a private flat share. But in others the SAR cap will mean that LHA will fall far short of people’s existing rents. For example, Savills estimates that the average one bed social rent in Birmingham is £76 per week – compared to the SAR for the city of just £57.

It’s unclear how DWP expect landlords and tenants to adapt to this new regime. As a first step landlords will have to compare their one bed rents with the local SAR to assess just how steep the shortfall is. In areas with a large gap the options look stark:

- Perhaps the government expects social landlords to adapt and move their tenants into shared housing. This is uncharted territory for many landlords and would undoubtedly create management challenges – not least around allocations. It would also risk cannibalising larger homes that could have been let to families.

- Landlords may reconsider whether they let to single under 35s without children at all. This would be an extreme outcome from a cut billed as a tidying up exercise.

But with all tenancies signed from this April in scope for the new regime, landlords don’t have long to decide how to manage the risk.