Budget 2016 – the housing and homelessness bits

Published: by Toby Lloyd

This was the third budget in 12 months – or even the fourth, if you include November’s Comprehensive Spending Review – and a lot of the announcements had a familiar ring to them. So you’d be forgiven for feeling a bit confused, or even jaded, as George Osborne pledged once again to boost housing supply and extend homeownership via a bewildering array of small measures.

So here’s a quick summary of the most important bits for housing and homelessness that we’ve spotted so far:

Homelessness

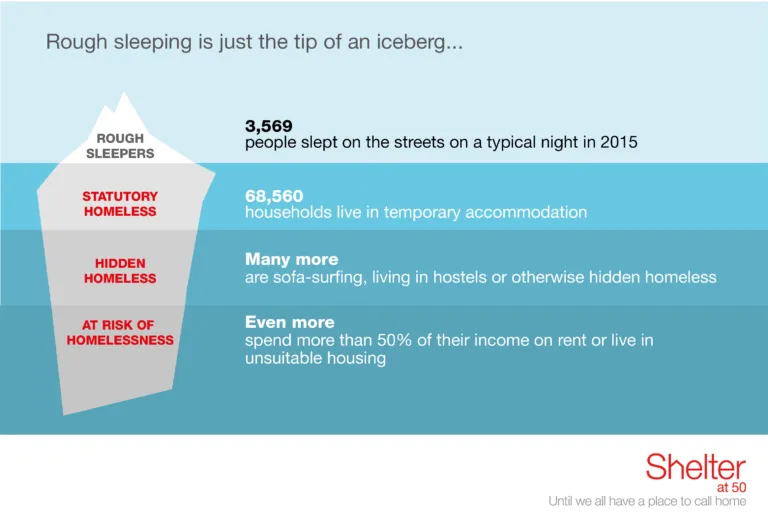

The big story was a new £115m fund to combat rough sleeping. This is a welcome first step towards tackling a growing problem – although it doesn’t address the real drivers of homelessness in our failing housing system. We welcome this funding – and have set out our response in a blog for Inside Housing – but it’s vital to remember that rough sleeping is only the smallest, if sharpest end of a much bigger spectrum of homelessness.

Building more homes

House building didn’t get much profile today – partly because it was most of the measures had been announced before, some of them multiple times. The government’s flagship Starter Homes plan was first announced in September 2014, although not a single Starter Home has begun construction yet. Lenders also very concerned about lending on Starter Homes – unless the length of discount is changed, some will have to opt out of supporting the scheme.

The Budget also repeated the favourite idea of ‘freeing up brownfield land’ – which has been proposed in various forms several times, by both the government and Mayoral candidates, but at its heart is a false premise, that there’s lots of mythical Brownfield land held by public sites just waiting to be built on. The report we carried out with Quod examined this and found that there is very little Brownfield land left in the capital. But the Budget did at least include some real money – £1.2bn in fact – to ‘remediate brownfield land’, and promised to speed up the delivery of some of the Starter Homes promised for later years.

More interestingly, the government will introduce new legislation, ‘technical and financial support’ to help local authorities who want to build new garden towns, garden villages and market towns. Some cynicism here is almost inevitable, given the number of times garden city-type initiatives have been announced in recent years (including a new healthy towns initiative only a few weeks ago) – none of which have materialised so far. But there was at least an indication that this time they might be serious, as the government will now consult on a second wave of Compulsory Purchase Order reforms with the objective of making the CPO process clearer, fairer and quicker. Techy though this may sound, we’ve said for years that improving CPO is one of the critical steps needed to make new garden cities actually possible.

Homeownership

The Budget revamped the existing Help to Buy ISA with a new Lifetime ISA for young people under 40. This will pay a 25% bonus to younger people saving towards their first home, and unlike the existing ISA it will also pay the government top-up if the saver holds on to the ISA until retirement. We’d expect this to be popular with first time buyers, as it’s free money: in return for the maximum £4,000 annual savings, people will receive a £1,000 government bonus. But as is becoming all too typical with housing-related policies, it will only help those who were on course to buy anyway and offers little for those priced out of homeownership. Although, in a nod towards restraint, eligible properties will be capped at £450,000, yet another demand-side boost can only inflate house prices (as the OBR notes), pushing them further out of reach of the very people such policies are meant to help.

In fact, the OBR expects house prices to rise by over 26% by 2021 – so an extra £4,000 isn’t going to help many people over the line into homeownership. It also appears that the new ISA will only be available to first time buyers, excluding those growing families who now find themselves stuck in overcrowded flats and unable to afford a family sized home.

Having said all that, given that the lifetime ISA is so strongly weighted in favour of the better off, it was welcome to also see confirmation of a Help to Save ISA, which will also pay a government bonus to those on lower incomes – no unattainable house purchase required.

And finally, three other interesting things….

As ever, some of the more interesting bits are buried in the extensive documentation accompanying the Budget speech.

Housing Associations: The cost of the ‘voluntary’ Right to Buy pilot being delivered by five housing associations looks surprisingly high, estimated at £35m per year for two years. On the other hand, by deciding NOT to force housing associations to implement Pay to Stay (ie market rents), the national accounts will now save over £300m per year because housing associations won’t borrow as much based on their rental income as was expected when the policy was modelled in last year’s budget. Clear? No, me neither… but at the least it shows just how complicated things get when you change so many different bits of a complex system at once.

Taxes: The changes to Stamp Duty announced last year, which will levy an additional tax on Buy to Let landlords buying properties, will not include an exemption for large scale, corporate investors. This will hit the emerging institutional investment in Build to Let that the government had previously been very keen to promote. Similarly, the reduction in Capital Gains Tax will not apply to residential property, so landlords will still pay the higher rate.

There was also an new tax allowance of £1,000 for homeowners who let out their spare rooms temporarily – dubbed an ‘Airbnb tax break’ – which sounds fine, but which contrasts sharply with the government’s attitude to spare rooms in the social sector, where tenants are hit by the bedroom tax.

Transparency: Finally, the Budget also announced a consultation on options for increasing transparency in the property market, including by increasing the visibility of information relating to options to purchase or lease land. This may sound as obscure and boring as it gets – but might just be a major step forwards. We’ve been banging on about the need for greater transparency for years. If George Osborne finally acts to improve the quality and availability of data in this most murky of markets, it could have a genuinely transformative effect over the long term. Here’s hoping.