The Housing and Planning Bill is making its way through the House of Lords and yesterday, attention turned to the thorny question of Starter Homes. During the debate, our hot-off-the-press finding that up to 80% of young private renting households will not be able to afford a Starter Home in London was contrasted with government claims that up to 47% will. So what’s behind these very different pictures? The government is yet to publish the methods and assumptions behind its estimate, so answering this takes a little detective work.

How much do you need to buy a Starter Home?

To estimate who could access a Starter Home, the first step is to figure out what annual income is needed to get a mortgage on one.

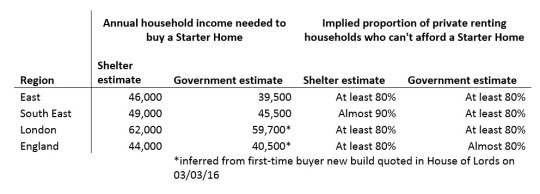

As Starter Homes haven’t been built yet, their cost can only be an assumption. To get their 47% figure, the government assumes the undiscounted price will be the same as the lower quartile of prices of new-build homes sold to first-time buyers. Unfortunately, these particular house prices are not publicly available, so we’re not able to double check this.

Moreover, Starter Homes may not all be valued at lower quartile prices. As pointed out by the CML, if homes built under the policy are all smaller properties in cheaper areas this may not match with local first-time buyer demand. An over-supply of these types of properties may mean that developers struggle to sell them and lenders are not happy to provide mortgages secured against them.

For the policy to be at all workable it is therefore likely that Starter Homes will have to be built in a range of sizes and locations and not clustered at the cheapest end of the market. For this reason, we use the median price of new builds in a region as an estimate of what a typical Starter Home will cost, before applying the 20% discount.

But to try to test what would happen if Starter Homes were all priced at the very low end of the market, we also tried the lower quartile price of new build homes. The number of excluded households dropped from 80% to 70%, still far more than half.

Intriguingly, in the debate on Tuesday, government claimed that in London ‘up to 55% of households currently renting privately will be able to secure a mortgage on a starter home’. This different figure seems to be based on the additional expectation that renters will move ‘within regions to areas where they can afford to buy’. This seems like an odd assumption; if everyone in a region moves to a cheaper area, it won’t stay cheaper for long!

To add even more confusion, the government provided a list of first-time buyer new build prices as a guide for what to expect for Starter Homes. This included £220,000 in the east of England, £352,000 in the South-East, £356,000 in London and £216,000 in the whole of England. These are quite clearly median prices and don’t fit with government estimates, provided in the same session, that Starter Home buyers will need annual incomes of £45,500 in the South East and £39,500 in the East.

Who can buy one?

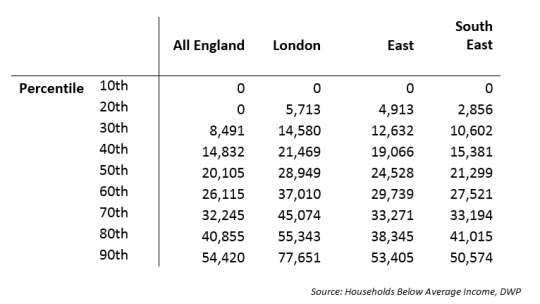

To gauge the percentage of households who can’t afford a Starter Home, we compare our estimate of the annual income needed to the distribution of incomes of real private renting households under 40 in a given region using survey data.

Our method suggests that a household will need to earn £62,000 a year to buy a typical Starter Home in London. This is comfortably above the 80th percentile of household net earned incomes, hence Starter Homes are out of reach of at least 80% of young private renting households.

We also looked at what affordability looks like in the parts of the country where we have some clues on the government’s estimates:

This shows that even if we apply different assumptions to Starter Home prices, the proportion of private renting households who can’t afford them is roughly similar. Yes, depressingly they’re so unaffordable that even assuming a lower price doesn’t help many more people!

Spot the difference

There are two other reasons for the differences in our figures. Firstly, we only consider households where the reference person is under 40 and it’s not clear if the government do so. Secondly, we look at income from work alone, minus taxes. The government may be using a measure of household income that not only doesn’t account for tax but also includes benefits – which lenders often won’t take into account.

Hopefully, the discrepancy will become clearer when the government publishes their working out. Until then, the uncertainty around how Starter homes are valued, what they look like, who will build them, who will lend on them and ultimately, who will benefit, will remain.