Come May 2020 what will Theresa May’s government look back on with pride and what will it look back on with regret? Depending on the choices made at this early stage housing has the potential to fall squarely into either the ‘pride’ or ‘regret’ column. At Shelter, in our 50th year, we want housing to become a source of pride for our country, not a chronic weakness.

Today we’ve published a new paper looking at how the government can meet its welcome commitment to build one million homes this Parliament. It will be hard, but it’s not impossible. More than anything else it requires taking on the broken, overly-concentrated housebuilding market which we’ve accepted for too long without real reform, especially since the 2008 recession.

If we’re going to build one million homes this Parliament, then many of those will need to be built outside of the business model of the major developers. This should be led by new small firms, Build to Rent companies, housing associations, self-builders, public bodies and new public-private organisations such as development corporations and local housing companies.

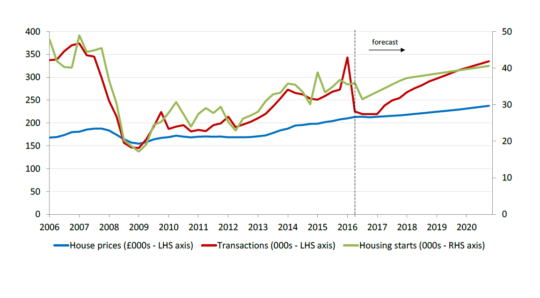

The need for a new approach is underlined by new projections we publish today from Capital Economics. These suggest that house building will slump by 8% this year, in the wake of economic uncertainty following the EU vote. This is not because Capital Economics expect the economic fallout to be terrible (they don’t), but because the major house-builders have a model which is vulnerable to slight changes in buyer sentiment. They will slow their production if prices don’t match what they expected when they bought their sites.

The big developers compete to buy land, with whichever firm that offers the worst deal for consumers (in terms of size, quality and affordability of homes) able to pay the most for a site. That model is unlike almost any other consumer market where firms compete to drive up quality and drive down prices for buyers. New homes just get smaller and more expensive.

The major developers are in no rush to expand their building levels above their historic level of around 150,000 homes per year as ‘over-building’ could risk their margins. Currently, there’s no-one ready to fill the gap to get us to the 1m homes target.

Graph: historic data and Capital Economics’ forecasts

The blame doesn’t just lie with a broken building model though. Policymakers have failed to respond to market cycles for too long as well. Our paper sets out in detail how two successive governments failed to take advantage of the slump in land values after 2008. This fall in values could have been used to break up the big house-builder monopolies within the land market and bring in new players. Instead, huge fiscal support was provided to the major developers – we estimate £32bn in the 2010-15 Parliament alone – propping them up and further concentrating the market into a few hands.

Government policy should focus on getting land, finance and planning certainty to new alternative homebuilders – rather than launching ever more subsidies at the big developers, propping up a broken system.

In particular we recommend:

- A Help to Build package for small and medium sized developers focused on access to development finance and public land.

- The government directly commissioning housebuilding by SME firms, both for sale onto housing associations but also for direct sale into the market.

- Promoting land market transparency, to make it easier for smaller house-building firms to find and access suitable plots

- Giving local communities the powers to force land-owners to use their sites for new homes where there is an identified local need and to drive down the land price to allow better quality, more affordable homes.

Along with these market reforms must come sustained investment in affordable homes and infrastructure. We therefore agree with Stephen Crabb and Sajid Javid that a ‘Growing Britain Fund’ should be created to use the government’s historically low borrowing costs to invest in homes and infrastructure. For some short-term government debt, yields have even been negative, which means the market is willing to pay the government to hold its money. Imagine if a bank offered to pay a business to invest in improved machinery that it needs – it wouldn’t hesitate and neither should the government at this time.

With the right package of policies it will absolutely be possible to build one million new homes this Parliament and make a sizeable dent in our housing shortage. If the government manages it, then we’ll join them in 2020 in being proud of that vital part of their record.

The million homes promised will only be provided as you say by SMEs. There are now only 2500 of these whereas in 1988 there were 12000. VAT on repairs and maintenance killed off many and Right to Buy destroyed the rest. The big builders are free to ensure that supply never meets demand and this suits the banks nursing an unpaid mortgage debt o about £1,3 trillion. Rent control once provided by the Rent Acts is also needed to provide secure homes currently only available to the most affluent. History also tells us that in the 1960s about 400,000 not 150,000 houses were built annually and about half of these were provided by SMEs. You must be right that before the promised million homes can be built by 2020, the monopoly enjoyed by the big builders must be broken.