Debate around buy-to-let tax changes points to general need for extra safeguards for tenants

Published: by John Bibby

The new government looks set to press ahead with controversial changes to the tax regime for small landlords that were set in motion last year. Warnings that this will have disastrous consequences for renters appear overblown, given that our research shows a minority of landlords will be affected.

But it is fair to say that some landlords will likely be forced to sell or put rents up, and safeguards should be put in place to protect tenants affected by this reform or other market changes.

The tax changes at a glance

The changes apply to the tax relief that landlords are currently able to claim on mortgage interest payments that they make on their rented properties. Landlords are currently able to deduct the full cost of mortgage interest payments from rental income before paying income tax. But Section 24 of last year’s Finance (No. 2) Act will change this gradually over the period from April next year to 2020.

The changes are fairly complex, but in effect they will mean that

- For income tax purposes, all rental income will be considered as personal income, without deducting mortgage interest costs first

- The amount of income tax relief that higher rate tax paying landlords receive on their mortgage will be effectively reduced from 40% to 20%, and for top rate payers from 45% to 20%

Existing landlords with a mortgage who are on the higher or top rate of income tax will see an increase in their tax bill. Landlords who are currently on the basic rate will be affected in one of two ways:

- If their gross annual rental income plus other income is below the higher rate income tax band (£45,000 from next year) then their tax liability will remain unchanged. The government estimate this will apply to 82% of landlords

- But some landlords who currently pay the lower rate may be pushed up into the higher rate band. This will apply to those whose gross rental income plus other income is above £45,000, not just those whose net rental income (once finance costs have been deducted) are above that level

You can find some worked examples that HMRC have put together illustrating these here.

This could have significant consequences for some landlords. For example, if you are a landlord with a relatively large number of low yield properties, getting in a lot in rental income but also paying out a lot in mortgage costs, then you could face a large tax liability and little to pay it with. Some scenarios could even see landlords pushed into a position where they pay more out in mortgage and tax than they get in income.

The impact on landlord finances in the real world

However, existing research suggests that the majority of landlords are unlikely find the tax changes difficult to pay.

Every two years, Shelter commissions the polling company YouGov to survey both landlords and tenants. They are the biggest surveys of their kind in the country and an absolute goldmine of information for anyone with an interest in private renting policy.

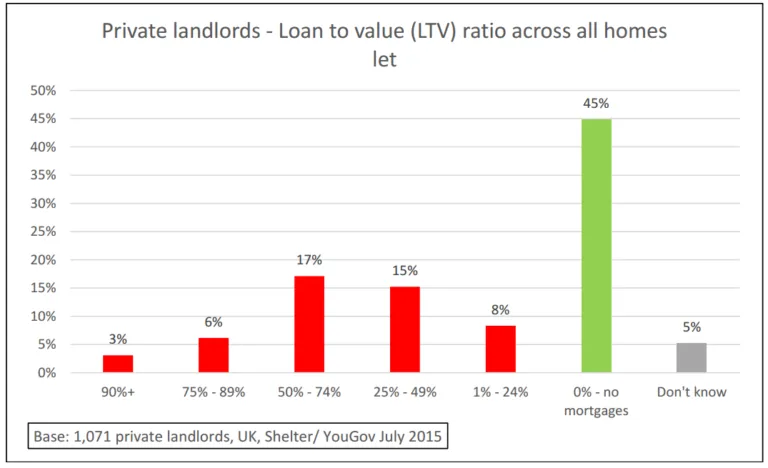

Our last landlord survey, conducted in July last year, found that 45% of landlords have no mortgage at all on their property or properties. These landlords will be entirely unaffected by the mortgage rate relief changes.

A further 24% have mortgages with a combined loan-to-value ratio of less than 50%.

While some of these landlords may have a higher tax bill under the new rules, the effect is likely to be small, because their repayments are likely to be relatively low and rental income relatively high.

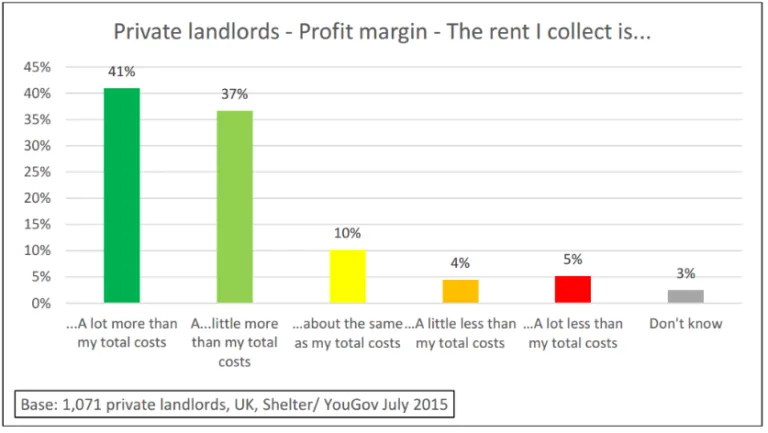

This is also backed-up by the numbers of landlords who say they are currently making a profit on their property portfolio. 78% of landlords surveyed said that the rent they collect is currently more than their total property costs – 41% said a lot more.

Furthermore, some of the 20% who are not making more in income than their costs will have capital repayment mortgages or be investing in the property with a view to doing it up and selling for a higher price.

Others will be base rate payers whose rental income is still insufficient to bump them up into the higher rate band and will also be unaffected – or only go into the higher rate a little and affected a little. Research by Natcen on landlord income and wealth in 2013 showed that working landlords’ median gross annual earnings from employment were £28,800. It also showed that 76% of landlords receive less than £900 in rental income a month.

So any claim that a majority of landlords will be forced to increase rents or sell looks overblown.

But – and it’s a big ‘but’ – this still leaves a significant and troubling minority who may be affected in a big way. The concern that some of these landlords will be forced to increase rents or – if they can’t – to sell at least some of their properties appears legitimate.

The need for extra safeguards for tenants

Is this a reason not to implement the tax changes?

We didn’t campaign for them, but we did support their introduction on the basis that they might help to dampen the risk of a bubble building up in buy-to-let and because the money could, if the government choses, be used to undo the damaging freeze on Local Housing Allowance rates. We stand by those principles.

However, we do think that government should be looking closely at any unintended consequences of the policy for the tenants of the minority of landlords with marginal business models.

And for us, this also illustrates a bigger point.

The reduction in mortgage rate relief is not the only change that will affect landlord finances and incentives in the coming years. In fact, an increase in interest rates or – given that the majority of landlords say they are in it for capital gains – a drop in house prices are both likely to have a much broader and deeper impact.

Both are likely to happen at some point. When they do, the growing number of people and families who rely on the private rented sector will need safeguards to help them – at best – stay in their homes or – at worst – find a new one and avoid homelessness. For example, the government could be thinking now about whether there is a role for local authorities or larger landlords to step in and buy rental properties with sitting tenants where a smaller landlord is considering selling their property.

For the moment it appears that the changes to mortgage rate relief will be introduced. The new government now has the opportunity to think about how to protect tenants from the inevitable changes that will affect landlord business plans.