Watch out for the Lump of Subsidy Fallacy

Published: by Toby Lloyd

Governments repeatedly come up with new types of ‘affordable’ housing that don’t actually make homes genuinely affordable, because they hope this will help more people by making subsidies go further. But this is a mistake, because house building finances are more complicated than doing the weekly grocery shop.

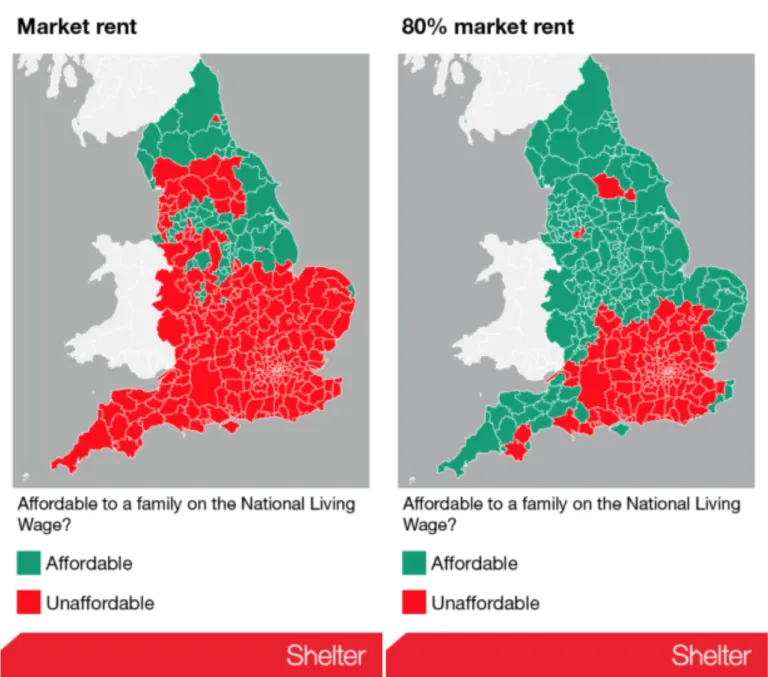

Our new research published today (and covered in The Sun) shows just how few people on ordinary incomes can afford the private rent on an ordinary home. We all know that homes to buy and private rents are pretty pricey – but it’s perhaps more surprising that the picture doesn’t improve a huge amount for homes let at 80% of the market rent. And of course, because they’re pegged to a rising market, even that 20% discount will be lost pretty soon.

Yet this is precisely what is rumoured to be the new government’s planned solution to the housing affordability crisis. If true, it would be a terrible wasted opportunity – but it wouldn’t be the first time. The last government introduced ‘affordable rent’ at up to 80% of market rents, only to drop the policy when it became obvious it wasn’t working. They then proposed Starter Homes that are supposed to be sold for, yes, 80% of the market price – although these will be unaffordable to just about everybody.

So why do governments keep coming back to a solution that clearly doesn’t work for the people they want to help? I think part of the answer lies in the Lump of Subsidy fallacy, a misconception that pervades policy making at all levels.

Economics and public finances are complicated and poorly understood by most people. So those that deal in them struggle to communicate with the public effectively. Small wonder that politicians and commentators alike love an everyday analogy to make difficult concepts more tractable, and sell their ideas to a confused sceptical public. Say that you’ve found the magic money tree. Worried that at relative increase in the ONS measure of public sector net debt may not grab the headlines? Say that the nation has maxed out its credit card. Struggling to explain the policy of sovereign money creation? Claim you’ve found the ‘magic money tree.’ Dislike the new social sector size criteria for housing benefit? Label it the bedroom tax. Pointy-headed experts and your political opponents may protest, but these are messages that make sense and ring true to lots of people.

Everyday analogies work. The problems start when the analogies start to distort our understanding of the issues they are meant to explicate. We can all fall into this trap accidentally: unlike most of us, David Cameron surely understands the difference between the debt and the deficit – but he still managed to muddle them up in public statements. A lot of these distortions come from extending our everyday experience of the economy as individuals and households to the level of entire countries. The difference isn’t just one of scale: to take just one example, an individual’s working lifetime is limited, whereas a nation can reasonably expect to still be working and earning in 100 years’ time. So individuals have much tighter limits on what they can borrow sensibly than nations do. It’s not that the analogy is meaningless: there ARE limits to sensible national borrowing. They’re just qualitatively different from those individuals face.

The ‘lump of labour’ fallacy is classic of the genre, which has been much discussed recently in relation to immigration and employment. It seems intuitively obvious that, if there are x-number of jobs going in my local newsagent’s window and more people arrive in my town looking for work, unemployment will go up. But this assumes that the amount of jobs is fixed independently of the number of people in an economy, which it clearly isn’t: an uninhabited island will have zero jobs, but one with a population of people to feed, clothe and house can expect to require quite a lot of work to be done. Which is not to say that the number of jobs will automatically rise to fit the population – that would be just as simplistic and just as wrong. It just means that we have to recognise the limits of everyday analogies: the entire national economy is more complex, more dynamic than any one household.

There is a similar problem that often crops up in relation to affordable housing: the lump of subsidy fallacy. If you’re a Minister or civil servant in a government department and the Treasury gives you x-millions of pounds to spend, you’ll want to spend it wisely and get as much bang for your buck as possible. Nowadays, ‘bang’ tends to mean the number of homes you can build – as everyone rightly accepts that we have a severe housing shortage. So the simple analogy is this: when I go shopping with my weekly budget, I can buy more tins of beans if I buy in bulk from Lidl than if I buy organic from Waitrose. So by analogy, we want to spend as little on subsidy per home as possible, so that we can buy more of them. Makes sense, right?

Well no. Sadly affordable housing finance is bit more complicated than this. Firstly there’s the question of where the homes are built. Spending all of the budget in hyper-pricey Kensington won’t build us many homes, so we should look to invest more efficiently elsewhere. But it will always be cheaper to build in relatively remote, unattractive locations where there’s much less competition for land. If we follow the lump of subsidy logic too far, we would build all our housing as far away as possible from cities, transport, jobs and the people who might want to live in them, as that will build us more homes with our limited budget. In reality of course we have to make a more balanced judgement about the relative value for money of investing in different locations that are neither the most expensive nor the very cheapest. The same false economies applies to making homes smaller, or cutting back on the quality. We’d just end up building rabbit hutches we’d have to pay more to knock down before long.

The lump of subsidy fallacy springs from the assumption that government buys homes at a fixed price, like we do when we go grocery shopping. In fact, house building is a productive, dynamic system – not a supermarket. And grant subsidy is only one small part of the mixed financing model that builds affordable homes. The bulk of affordable housing finance comes from borrowing by the housing provider (secured on the future rental income that the home will generate) and planning subsidy (the proportion of affordable housing that developers are required to build as part of private housing schemes).[1] Both of these elements are strongly influenced by government policy. So there’s not much point in shaving a bit off your grant cost per home if at the same time you’re slashing the amount of planning subsidy and cutting the income of housing providers – the number of affordable homes built is still going to go down.

The interaction of these different elements also reveals another flaw in the lump of subsidy fallacy. The assumption is that the more affordable to the tenant or buyer you want the home to be, the more subsidy you have to put in. So if you want to build as many as possible for a fixed budget, put in as little subsidy as you can get away with per home, right? Wrong: to get a home built with less grant, you have to increase the both the amount of borrowing, and the rent charged, which in turn inflates the housing benefit bill. A superficial efficiency gain on one year’s capital budget looks a lot less clever when the benefit budget has to grow year after year, for ever.

At its simplest though, the lump of subsidy fallacy is an example of ‘hitting the target but missing the point’ (or Goodhart’s Law for the wonks). The entire point of affordable housing subsidy is to provide homes that would not otherwise be built, for people who could not otherwise house themselves adequately in the market. There is little point in subsidising homes that only the wealthy can afford – and no point at all if it comes at the expense of homes for the millions of hard working, just coping families that the government wants to help. When the commentariat discuss the inevitable trade-offs and tough choices in the Chancellor’s Autumn Statement, look out for the lump of subsidy fallacy creeping in to the arguments: don’t let it go unchallenged.

[1] Even this version of the traditional mixed funding model is an over-simplification, but I do still want people to actually read this….