Land banking: what’s the story? (part 1)

Published: by Pete Jefferys

At Shelter we argue consistently that the best long term solution to England’s housing crisis is to increase housebuilding: especially homes which are affordable for low earners to rent or buy. So when it seems that developers are sitting on land – often with planning permission – and not building homes, this frustrates us as much as anyone.

The Local Government Association (LGA) has repeatedly drawn attention to the large and growing stock of unbuilt plots with planning permission (nearly 500,000 on their latest estimate) and the new Communities Secretary has also called out housebuilders for their large land banks. However the industry has responded angrily, saying: “…housebuilders do not landbank. In the current market where demand is high, there is absolutely no reason to do so”.

It is true that ‘land banking’ is a not as simple as just greedy or lazy developers sitting on land. But it’s also true that we shouldn’t let them off the hook entirely. The question of land banking goes right to the heart of why we don’t build enough homes, let alone enough good quality, attractive homes that are affordable to local people.

What is a land bank?

At its most simple, land banks are portfolios of land which could be used for housing and are owned or controlled by a single organisation. That organisation might be a housebuilder, or it might be another type of company which has an interest in holding onto development land.

- Non-developers’ land holdings

A 2012 study by the consultants Molior found that in London 45% of sites with planning permission for new homes were owned by a company which did not build homes. A couple of years later that proportion had dropped to a quarter, but there is clearly still a significant amount of ‘land banking’ by non-housebuilders. This is a concern because these firms may be profiting from land trading at the expense of affordable housing or infrastructure obligations.

As for the housebuilders themselves, they typically have two types of land bank:

- Current land bank

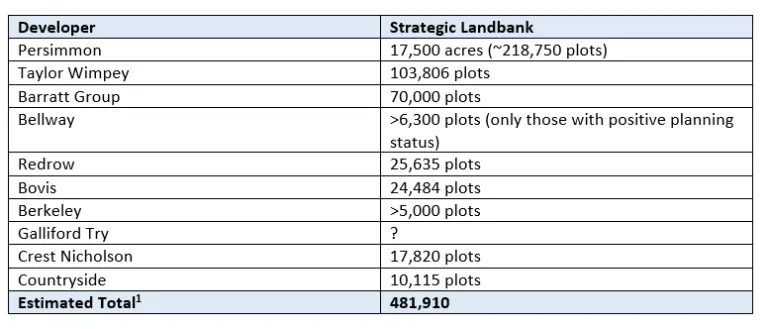

This is land which has planning permission for housing or is close to getting it. This is what developers themselves are referring to when discussing their land banks: it is the medium term pipeline of sites that they intend to develop. You can see how much land the ten biggest (listed) speculative developers say that they have in their current land banks below – it is typically between 4 and 10 years’ worth of supply.

Table: Current Land Banks[1]

Like any business, developers need to have a steady and predictable supply of raw materials to feed into their business. Land is the most critical raw ingredient for house building and so it does make sense for developers to have a forward pipeline of sites with planning permission ready to go.

But we could still question the amount of ‘current land’ that is required to be held in a land bank. Do developers really need to be holding land with planning permission which is 5 or more years away from being built on? It is very unlikely that they have contracts that far in advance for their other materials or for their contractors.

As the table above shows, the Top 10 listed developers – who are responsible for around half of all housebuilding in England – have more than 400,000 plots in their current land banks. This represents more than six years’ worth of housebuilding at their current build rate.

That’s a lot of unbuilt homes. But even this is not the full picture.

- Strategic land banks

‘Current land’ is not the full extent of speculative housebuilders land banks. The big housebuilders also control vast additional amounts of land in what they call ‘strategic land banks’. Some of this land will be owned by them, but much of it will be held with private ‘Option Agreements’ between the landowner and the developer. In effect these are exclusivity deals which mean that the developer has a legally binding ‘option’ to buy the land within a certain timeframe, or if a certain event occurs – such as planning permission being achieved. The landowner typically receives a non-refundable one off sum to secure the deal.

Why do developers have strategic land banks? First, it is because the earlier in the process of development you control a piece of land, the more you can potentially make from its development. As mentioned earlier, there are lots of land trading companies who exist simply to get planning permissions on land and sell it on for a profit. If a developer can control land right through the process then they can capture more of the ‘uplift’ in its value that a site accumulates as it passes through the planning system.

Second, strategic land banks offer developers more control. Exclusivity deals like Option Agreements make it harder for other players to come into the market by buying land. The reporting on these Option Agreements is murky, as there is no requirement for developers or landowners to register them publically (something we want to see changed). But you can get some sense of the scale of strategic land banks from the financial reporting of some of the main developers.

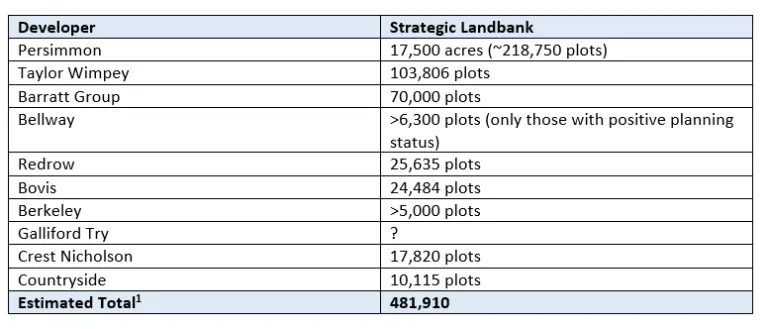

Table: estimated strategic land banks[2]

These estimates are almost certainly on the low side, because some of the developers don’t report on their strategic land banks or only report those plots with a ‘positive planning potential’ in the short term. However even this shows an additional half-million plots controlled by the top 10 builders, which is another 6 or 7 years’ worth of housebuilding. In 2008 the OFT found that the ‘vast majority’ (82 per cent) of land held by builders was strategic land, and these strategic land banks were an average of 14.3 years long.

Conclusion: symptom not a cause

The big speculative developers clearly own and control huge areas of land. We estimate that the Top 10 housebuilders alone own or control at least 12 years’ worth of housebuilding plots in their current and strategic land banks. Not all of these are immediately buildable, as they won’t have planning permission – but many will be.

To an extent this is reasonable. They are businesses which exist to increase the value of land by gaining planning permission and selling houses. It is questionable though whether housebuilders should be holding so much land out of the development system for so long when there is such an acute shortage. We also need more scrutiny of the intermediary companies who don’t build homes but hold land in their own land banks.

Ultimately though these land banks are a symptom not a cause of our dysfunctional housebuilding system. We will look at why that is the case in Part 2 of this blog.

If any speculative developer would like to provide us with more up to date figures, we’ll happily update the table.

[1] Most recent financial reporting as of December 2016

[2] Most recent financial reporting as of December 2016. Estimates from acres to homes based on a density of 12.5 per acre – which was the average in the DCLG Land Use Change Statistics for new build homes 2014/15.

Table updated January 2017 for Barratt Group who got in touch to confirm their strategic land bank at 70,000 plots, much less than the estimate of 140,000 we made based on the acreage.