Rental fraud – a quarter of a million fall victim in the last five years

Published: by John Bibby

What is rental fraud?

Rental fraud usually follows a similar pattern: someone posing as a landlord or letting agent shows a prospective tenant around a property. When the person looking at the property says they like it, the purported landlord/agent asks them to pay an immediate up-front holding deposit (a sum that is often taken to reserve a property in advance of referencing, signing contracts, etc.) often in cash.

The prospective tenant pays the sum (which can be several hundred pounds or more), but the landlord/agent then disappears with the cash. It transpires they had no right to let out the property in the first place – maybe they were just renting it through Airbnb, like the scammer who made £8,500 off a weekend stay in this London flat.

Normally there is no way of tracking the scammer down, leaving the victim permanently out of pocket. So it’s a serious problem for those who fall victim. And it also appears that the number of victims is large and growing.

How much of a problem is rental fraud in the UK?

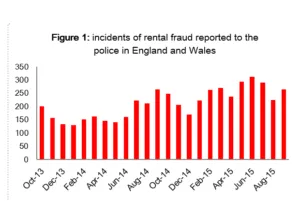

The special anti-fraud police unit, Action Fraud, which collates the national fraud statistics, has warned previously that there has been a steady increase in the number of rental fraud cases being reported. Their figures show that reported instances of the crime rose by almost half between 2014 and 2015.

But our research makes it clear that most instances of rental fraud go unreported to the police. Victims may be too embarrassed or just don’t think they stand to get the money back.

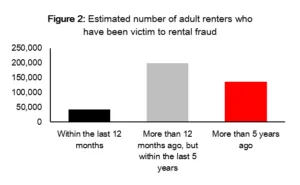

Our research gives a more complete picture of the scale of the problem. Research conducted by YouGov for us last year found that 2.8% of private renting adults say they have been victim to this type of fraud in the last five years. We estimate this to be the equivalent of almost a quarter of a million people. A previous study suggested that the figure could be anywhere as high as one in ten renters.

What’s the solution to rental fraud?

The most obvious solution to rental fraud would be to wrap a ban on holding deposits up into the ban on letting fees. With the knowledge that it was against the law to charge any up-front sums at all, prospective tenants would be much less likely to hand their money over to fraudsters.

But there are problems with banning holding deposits outright. The government has identified the risk that without having to make any down payment on a property, prospective tenants may commit to a number of properties at once, only to pull out and leave the landlord out of pocket with no tenant. Instead, they have floated the idea of a cap on holding deposits.

We agree that, while there can be serious problems with holding deposits (including but not limited to fraud), landlords need confidence that tenants who have committed to a property will follow through.

What could the government do to reduce the risk of rental fraud?

The consultation on the letting fees ban is packed with excellent news for private renters. The new proposal to place a limit on the maximum size of damage deposits should at least limit the upfront cost of finding a deposit. And the ban on fees itself will prevent tenants being stung for massive charges every time they move home.

But the specific exemption from the ban for holding deposits means prospective tenants will continue to face the real risk of rental fraud. A range of measures could help to protect prospective tenants when they do pay a holding deposit:

-

A cap on deposits – this proposal, floated in the consultation, is welcome. While it won’t entirely remove the risk of rental fraud, by setting a maximum amount that can be charged it should help to minimise scam victims’ losses. Plus, if anyone purporting to be a landlord or agent asks for more, tenants will know something is fishy

-

Reliable information on landlords – at the moment, there’s limited readily available information to prove that the person you’re thinking of renting from actually owns the place. Online services have been set up to bring together the existing available data sources. For example, RentProfile, which has been supported by the government and given funding, was set up by the victim of a scam to help protect tenants. It includes both a free service where landlords are able to verify themselves voluntarily and a paid service through which they check other data sources and contact the prospective landlord to verify their ID directly. By giving prospective tenants an option to get more peace of mind today, this is undoubtedly a positive development. Though we also think government action is needed to get full and free coverage of reliable landlord information. We’ve long been arguing that England needs a light-touch landlord register that they would be required to join, which would guarantee universal coverage and free access. It would allow prospective tenants to look up properties, check they’re rented and that the person purporting to be a landlord is who they say they are.

-

A move away from cash payments – rent a car today and you will often not be charged a deposit up-front. Instead, the car hire firm will ask you to authorise a payment on a debit or credit card which they only charge if you damage the car (or don’t bring it back). While small landlords – who would appear on a national register – don’t have the infrastructure required to take card payments, there is no reason why agents already using card payments couldn’t take deposits in the same way. The move away from cash would reduce the risk of fraud – and delayed authorisation would also reduce the burden on tenants of finding money up-front. At the very least, even with cash, where agents have an office it’s imperative that it should be handed over there, not at the property, and that prospective tenants are given proper receipts

The government is making some great steps forward with its ban on fees, which will help to bring to an end what is practically daylight robbery. These further practical measures would help to prevent actual daylight robbery.