Are private rents in England going up or down?

Published: by John Bibby

Some newspapers have got very excited recently about reports that private rents in England are dropping.

With many private renters struggling to make ends meet, anything that makes renting more affordable would be exceptionally welcome. But does this mean England’s affordability crisis is over? Unfortunately not.

Are private rents actually falling?

It depends who you believe…

- Down: In April, estate agent group Countrywide reported that rents across Great Britain had fallen in the year to March 2017 by 0.3%

- Mixed: And earlier this month, tenant referencing company Homelet reported that London rents had fallen by 1.2% in the year to April, while UK rent inflation was 0.4%, the lowest since 2010.

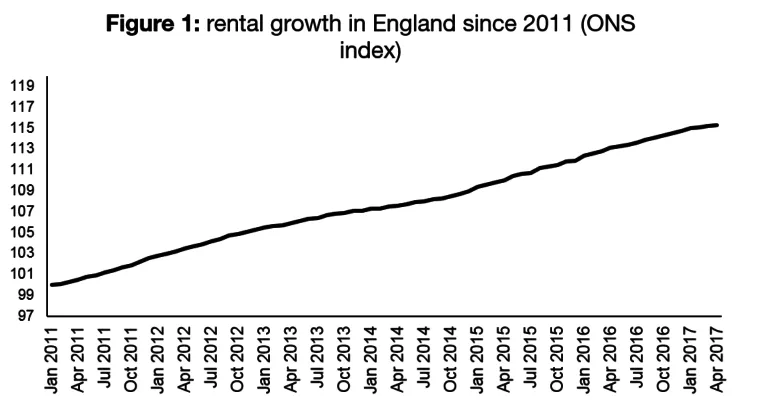

- Up: But the official statistics from the Office for National Statistics (ONS) say the cost of renting a private home in England actually increased by 2% over the year to April.

Who’s got it right?

Countrywide and Homelet have a partial view, because their indices are based only on data from their customers. As you’d expect, the ONS bases its index on a representative sample.

The Countrywide/Homelet pair also only measure changes in rents for new tenancies, ie. whether it would cost more or less to start a new tenancy today than a year ago.

The problem with this is that most renters aren’t starting new tenancies today. They’re locked into contracts with a set rent for six or twelve months.

If market rents fall for a short period most existing tenants can’t take advantage – and if market rents rise they are protected, for the moment.

The ONS index measures how much it actually costs to be in a private rented tenancy. They include the cost of existing tenancies, not just new tenancies. As such, their index moves more slowly, but more accurately reflects whether most renters are paying more or less rent than they were a year ago.

The truth then is likely to be that some parts of the market have cooled in recent months, but most renters aren’t seeing those benefits.

What can we do about unaffordable re****nts?

It’s important to remember that even if rental growth is slowing now, it has been rising faster than incomes for years. Even if market rents dip, the majority of those who are struggling to pay the rent will continue to struggle.

And when you consider growing inflation, stagnating wages and cuts to housing benefit, then it’s clear we’re far from out of the woods.

To get to grips with the crisis, we need to:

-

Build more homes with rents based on what people can actually afford. Recent government affordable housing policy has been largely based on discounted market housing. ‘Affordable Rent’ homes, for example, are let at up to 80% market rent. Shared ownership homes are sold at 25%-75% the market sale value. The problem is that as rents and prices have climbed then these options have become less affordable, particularly for those on low incomes. We want the next government to build a new generation of homes with rents that aren’t based on market rents at all, but with living rents based on what low income households can actually afford.

-

Make sure housing benefit is sufficient to help people who can’t afford their rent. Almost a third of private tenants receive some form of welfare assistance to pay their rent. Many of these renters are in low paid jobs and just can’t afford eye-wateringly high market rents. The trouble is that over recent years Local Housing Allowance rates have not kept up with rising private rents and are now frozen until 2020. We predict this will mean that the large gap between the help low income households get to pay the rent and the actual level of their rent will get even bigger. This will mean more people cutting back on other essentials like utilities, clothing and food. To tackle this the next government must bring the amount of help that low income tenants can get with their rent into line with actual rent levels.

-

Introduce stable tenancies that would protect renters from big rent hikes. Rents don’t move up uniformly across the country. Renters in some areas have seen their rent spiral up quickly and force them out of their home. Landlords in buoyant markets can take advantage of rising rents by evicting existing tenants and re-letting on higher rents. We are campaigning for the introduction of Stable Rental Contracts, which would prevent no-fault evictions and limit the amount that rents could rise within the period of a five year tenancy.