Priced out and p*ssed off: Britain’s forgotten middle

Published: by Charlotte Gerada

Britain’s forgotten middle. The 1.3 million-strong private renters who continually struggle to pay their rent and have little hope of ever buying their own home. These ‘hard-pressed private renters’ increasingly turn up at Shelter’s doors, looking for support with their housing and paying their rent. They’re the families we’re suggesting a new generation of living rent homes should be built for – with rents pegged to lower rates of pay in any given area that enable hard-pressed renters to reach security, afford their rent and build up savings. Click here to find out more about these renters.

Shelter isn’t the only ones who’ve picked up on this growing group. The Conservative party launched their manifesto for this June’s general election. Theresa May directed much of the launch speech at ‘hard-working families’ and those struggling to get by. This is reflected in pledges on housing policy, which include encouraging landlords to offer longer tenancies as standard and building a million homes by 2020, including new social housing.

But Theresa May’s focus on these grafting families is not new. Since being PM she has constantly referred to ‘Just About Managing’ families (JAMs) and how she’ll aim to help this section of the population earn more, get on the housing ladder and secure more stability. Support couldn’t come sooner for these families; rising rents, stagnating pay and sharp rises in house prices mean they often can’t keep up with rent and saving for a home seems like a distant dream.

This blog explores who these renters are, why they perpetually struggle and how they overlap with Theresa May’s JAMs.

Who are hard-pressed renters?

Shelter analysed YouGov Profiles of JAM low income renters, with sample sizes of 450 to 2,000 to find out more about hard-pressed renters.

These renters are typically in work and have a household income of £17,000-£22,000 per year.

They over-index in C2/D/E category jobs – the type of work that keeps the country going. From bus drivers, to teaching assistants, to retail workers; these renters are finding it challenge to keep up with their rent, couldn’t afford home ownership and wouldn’t be in priority need for social housing. Meaning they’d be trapped perpetually in private rented accommodation.

Data from the Family Resources Survey shows they’re mainly young families.

How do hard-pressed renters vote?

In general, unlike other renters like students, hard-pressed renters are a politically salient group as they vote just as often as the general public and they’re more likely to live in a marginal constituency; 23% live in marginal compared to 19% of the whole population. These are suburban towns and rural areas like Halifax, Plymouth, Great Grimsby, Burnley and Hastings.

Hard-pressed renters are more likely to perceive no difference between political parties, generally feel disengaged with politics but are more likely than other private renters to vote Conservative. They’re more likely to have voted Leave in the EU referendum. This might explain why Theresa May has focused on JAMs during her leadership.

What media do they prefer?

In general, hard-pressed renters compared to the rest of the British public have low engagement with media and over-index on reading print, non-broadsheet media. Typically, these renters read The Sun and The Star.

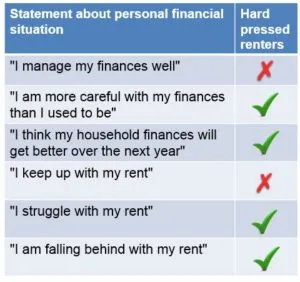

How do hard-pressed renters manage financially?

The interacting factors of rising rents, stagnating pay and increasing living costs means household budgets are more squeezed. Compared to the rest of the general public, they don’t tend to feel they can manage their money well and they’ve had to become more careful recently. They over-index with struggling to pay their rent every month, although they’re optimistic about their futures.

How do hard-pressed renters pay their rent?

Hard-pressed renters struggle to pay their rent month-to-month. They have to sacrifice their savings and often borrow money in order to cover their monthly costs.

Hard-pressed renters are only a pay check away from getting into arrears and are unable to save even just £10 a month.

How are their savings affected?

Among hard-pressed private renters, saving cash at the end of the month’s a challenge. Savings that were used to cover their rent were most commonly being set aside for a ‘rainy day’. Holiday savings and savings for a home deposit were the next most common.

Over a fifth of these renters were using their savings to pay off existing debts, illustrating how this section of the population are trapped, struggling to make ends meet.

How do hard-pressed renters pay their rent?

Shocking new figures from Shelter and YouGov show people are being driven into debt to keep on top of their rent, with over half a million low-earning renters borrowing from credit cards, overdrafts or friends and family in the last year alone.

And huge numbers of low-earning private renters are only just managing to keep a roof over their heads, with a staggering 70% either struggling with or falling behind on rent.

With private rents eating up so much of their income, 800,000 hard-pressed private renters are not even able to save £10 a month according to a Shelter analysis of government statistics.

How much stability do hard-pressed renters have?

Hard-pressed renters stay in their homes between 2-5 years, but they worry about not being able to stay in their home as long as they want to. At the back of their minds, they worry about their children having to move schools due to a forced move.

These renters see longer tenancies as an appealing way to improve renting stability.

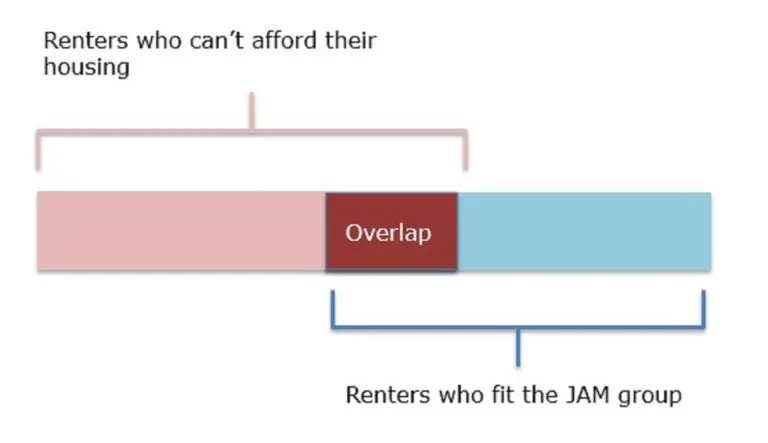

How do hard-pressed renters overlap with JAM families?

Hard-pressed private renters represent around 15% of the Prime Minister’s ‘Just About Managing’ target group (all households in income deciles 2-5), and tend to be at the sharper end of this group of voters.

Of all PRS households that fall into the ‘JAM’ definition, 70% are hard pressed private renters struggling to pay the rent.