Shelter’s general election call: help for the growing army of hard pressed private renters

Published: by Steve Akehurst

Today Shelter has launched our campaign calling on the new government to deliver 500,000 homes in the next Parliament at ‘living rents’, a concept that has growing cross-party and cross-sector support.

There is coverage in The Sun and The Guardian, among others. Our short briefing is here, which we will be following up with a fuller investigation and report later in the year.

Why are we calling for this?

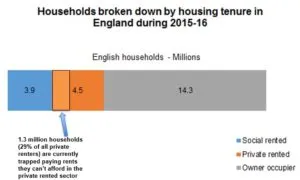

In part we’re trying to raise the alarm about a growing army of low income households in the private rented sector who are increasingly struggling to get by – what we call ‘hard pressed private renters’. Our detailed research out today has found that there are now 1.3 million private renting households struggling to make ends meet after paying the rent to their landlord* – that’s 10% of the population, or 30% of all private renting households.

This group has largely slipped under the radar of politicians of all parties: traditionally government assistance has focused on those in greatest need, while more recently parties have competed to help better off young professionals priced out of the housing market. In that time things have got silently worse for this group of low income private renters.

Indeed it is this group of people – in work but on low incomes – that is now increasingly turning up in Shelter services struggling with debt, sometimes only a missed paycheque or two away from losing their home. We find 1 in 3 of these hard pressed private renters have had to borrow money to pay the rent in the last 12 months.

Who are these forgotten hard pressed renters? Why do they matter?

Typically, they earn around £17,000 – working class or lower middle class households, in work but often among the growing army of part-time or self-employed workers. They are shop workers, cleaners, teaching assistants, administrative workers.

Importantly, this group make up a big chunk – about 15% – of the Theresa May’s broad ‘Just About Managing’ class of voters that she has identified as her priority for help (this has been roughly defined as those between income deciles 2-5). They are among the hardest pressed of the Prime Minister’s target group, just about keeping their heads above water.

Crucially, unlike many groups of private renters (such as students), this group of hard pressed renters vote in general elections just as much as the general public, and their party affiliations are a lot more fluid and up for grabs.

We’ll publish more insight on this group on the blog next week.

Why do they need help?

In short, at the moment this group is falling through the gaps of our housing market and government interventions. They are the forgotten middle – not well off enough to be able to afford home ownership, or government schemes like Shared Ownership or Help to Buy, but typically not in high enough levels of need to get social housing (or not wanting it), which for a variety of reasons tends to be targeted at those at the sharpest end.

As a result, they are trapped in expensive and unstable private renting, paying an increasing proportion of their salary in rent and often having to uproot and move home every 12 months.

The government’s ‘Affordable Rent’ (rent at 80% of market) homes also don’t fill the gap, as the rents are typically too high: a two-bedroom property at Affordable Rent levels is unaffordable to families in 2/3rds of the country.

What are living rent homes?

We’ve called for the next government to commit to delivering 500,000 living rent affordable homes in the next Parliament – 100,000 a year.

The driving principle behind this is the idea that nobody who gets up and goes to work in the morning should be unable to pay the rent at the end of the month.

To ensure this, at the heart of the living rent concept is that rents would be linked to what people can afford to pay, not to a broken private market. Like with the Living Wage, this is designed to ensure that tenants can afford to live a decent life rather than just scrape by. We’d envision that living rent homes for this group would be set at about 1/3 of their typical take home income.

These would be delivered by Housing Associations, councils or developer contributions, with rents set low enough for people to afford – targeted solely at those in work but on low incomes, with 10 year tenancies, and an option to buy the home after 5 years.

This would give people breathing space today, but also hope for tomorrow – the low rents allowing them to build up savings for the future.

As a concept, it has been knocking around for a while and enjoys growing support: JRF and Savills have done some important groundwork on it, it’s been endorsed by influential centre-right campaign organisation Renewal, while Sadiq Khan is funding a version of it at the GLA.

How is this different to social housing?

It differs from social housing in a few fundamental ways. Firstly, the allocations would be targeted only at those in work on lower incomes, while social housing tends to go to those at the sharpest end. Secondly, it would have long term tenancies but not indefinite (as traditional social housing did), to provide more flexibility. Thirdly, the rents would likely be more flexible area-by-area as it’s more clearly linked to local incomes.

How could it be funded?

We will publish a full report on the idea in September, but this could be funded in one of three ways: re-arranging and increasing grant allocated through the existing Affordable Homes Programme; via existing developer contributions through Section 106, or through our New Civic Housebuilding model which would see local authorities or development corporations buy up land cheaply in order to more easily finance the delivery of more affordable homes.

We’ll look to launch a fuller campaign around this idea later in the year, but we hope the research today will spark some discussion around what the next government’s housing focus should be.

—

*We’ve defined this as households that fall below the minimum income threshold after they’ve paid the rent.