Last week saw the release of the quarterly stats on planning applications in England. The data is our opportunity to get a preview of how many homes are likely to be built in the near future and helps us to assess whether planning slows down the delivery of the new residential properties we need.

Source; DCLG Table P120: District planning authorities

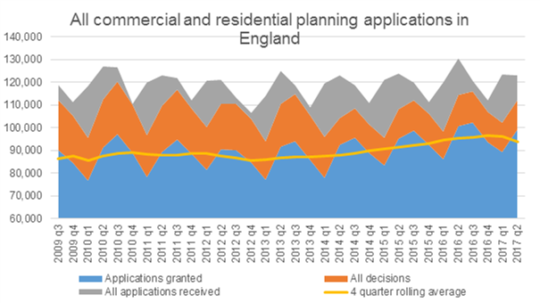

Planning applications take time and the chart of headline activity for residential and commercial, above, shows how the process works. Building is very seasonal work, developers tend to put in their applications in around June to September. This allows them to start work as the weather begins to improve. Across the entire time period presented above, 87% of all applications made were agreed.

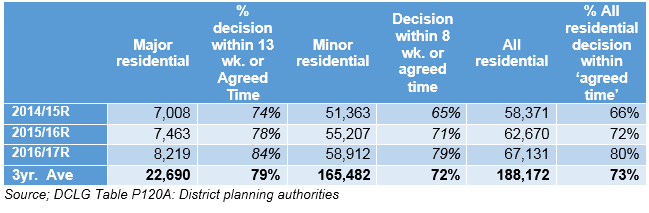

The first thing to point out is that while I’ve presented all planning applications above, most of these are commercial applications. In 2016-17, for example, there were 67,000 residential applications – 8,000 major (over 200 homes of four hectares) and 58,000 minor – compared with 373,000 commercial. But residential doesn’t seem to suffer from being lost among the piles of commercial work.

Source; DCLG Table P120: District planning authorities

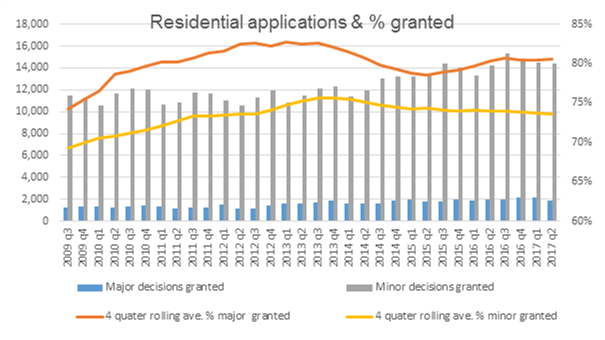

For residential applications specifically, applications have steadily increased over the past eight years, resulting in almost double the number of major development applications and an increase of around a quarter for minor development applications. Despite this increase in work for planning departments, you can see the chances of success have generally improved over time. Success rates have also been fairly stable, particularly over the past three years; for major developments it’s 80% for minor it’s 74%.

Developers are also very likely to get a decision within the timeframe they expected. For major developments that’s usually set at 13 weeks and for minor developments it’s eight weeks.

So, in practice (and based on the past three financial years) a residential developer has a three in four chance of getting their planning accepted, and a three in four chance of receiving a decision within the expected/ agreed time frame.

If you were a gambler, surely these would be good odds? Put a major residential application in and you’ve got a three in five chance of getting the thumbs up, and within the timeframe you expected.

As an aside, it’s also worth mentioning that most residential properties are built by the top five developers in the UK, so the planning process must be pretty familiar to them and they should know what to expect and what could cause a problem for their applications.

So, what’s stopping developers building the homes we need? Planning appears to be both predictable and fairly prompt. Could it be that, as we estimated earlier this year, only two in three planned units were actually built despite receiving planning permission? Because house prices are rising so quickly, holding back on building means developers can make a greater profit by simply doing nothing. For the top five house builders, this amounted to an increase of 388% since 2012.

There will always be voices that say building more homes is all about reducing the complexity of planning but the data doesn’t really support this, moreover, the speculative market looks to be going slower to maximise profits rather than meet demand.

At Shelter we believe that a move away from the speculative model of development would be a start. New Civic Housebuilding aims to achieve quite the opposite: the level of profit in a development will be determined by how much value is left once the public interest has been served. By prioritising quality and looking to the long term New Civic Housebuilding will generate long term value for everyone involved, landowners, homebuilders and the communities these new developments will create.