Making Fair Rent Homes a reality

Published: by Adam van Lohuizen

The need for a new wave of Fair Rent Homes is clear. But how do we build them? And where is the money coming from?

The financing of new affordable homes has becoming increasingly complex. Prior to 2010, significant levels of grant and long-term bank loans could be combined to provide genuinely affordable, social rent homes. However, with the arrival of the Coalition government and a 60% cut in the grant available for affordable housing, housing providers had to change their financing models.

This has led housing associations in particular to increase their exposure to capital markets, issuing bonds and also embrace cross-subsidy: selling properties on the open market in order to use the profits to help finance social homes.

Financing Fair Rent Homes

Shelter looked at how to make development work for a product that could be let at a genuinely affordable rent for low paid households. There have been a number of reports which have travelled this ground before – here, here and here . Our modelling used existing approaches (namely discount cashflow modelling) and a wealth of available sources from government departments and elsewhere. We used these to construct a model of how rental revenues, operating costs, interest rates, build costs, land costs and cross-subsidy all interact (to name a few). A number of these values are highly varied across the country (read: land values), so we created sub-geography models in order to deal with some of this complexity.

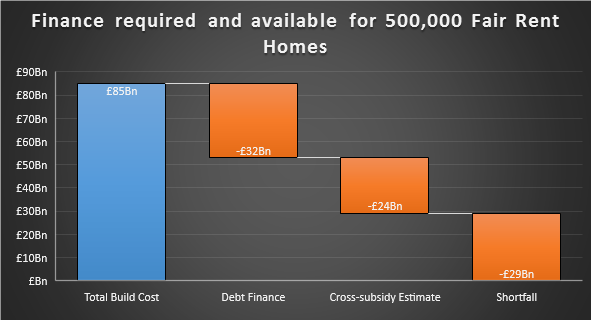

With rents set at one third of the 30th percentile of gross household income (without housing benefit –we are keen that households in Fair Rent Homes don’t primarily rely on housing benefit to pay for their housing costs), we estimate that £85 billion would be required to build 500,000 Fair Rent Homes.

Looking at need and affordability suggests that supply of Fair Rent homes should be skewed towards London and the south east. By factoring in the higher cost of land in these areas (and a degree of flexibility for unforeseen issues), and requiring these homes to be built above the minimum space standards, the average total cost of £170,000 per home is significantly above that of the current Affordable Homes Programme . In practice, costs may be reduced, but people need a fair deal on their Fair Rent Homes – they should not be done on the cheap.

We conservatively estimate that £32 billion could be secured by providers against their future net rental income, and we very conservatively estimate that £24 billion could be accessed from cross-subsidy, with just over a third of the total cost to be made up by other means.

Funding Fair Rent Homes

This assumes on average only 28% of the total build cost of a property is covered by cross-subsidy. The latest HCA Sector Risk Profile refers to 56% of the cost of new affordable homes from now until 2021 being expected to come from cross-subsidy. If we had used this higher figure, the estimate would have instead been for £48 billion to come from cross-subsidy, with only £5 billion (or £10,000 per home) to be made up from elsewhere.

However, we agree with the HCA and others that this is not an infinite resource. House prices do not always go up. It is very possible that profits in market sale will experience a Wily Coyote moment over the next ten years. Families will need Fair Rent Homes more than ever if that happens – so it is important we don’t rely on current high expectations of cross-subsidy bearing fruit.

That means that some grant funding is necessary to fill the gap. At £2.9 billion a year to provide half a million homes over the next decade, this is an opportunity for the government to directly boost housing supply and show it is on the side of ordinary working families.