Is the Stamp Duty cut worth it?

Published: by Alex McCallum

In amongst the jokes and the political padding, Wednesday’s Autumn Budget aimed to deliver policy ideas to address the housing crisis. The top billing for housing this time certainly underlined the fact that this government wanted to show it’s a priority.

There were some positive announcements too. Some good news on Universal Credit payments, and an increase in the Targeted Assistance Funding for areas where Housing Benefits fail to cover the shortfalls in private rents (all at a cumulative cost of £2.73 billion over five and a half years).

Phillip Hammond also announced £44 billion commitment to housing related projects – with details to follow – an increase in the target for house builders and the big give-away; a Stamp Duty cut for first time buyers.

Headline grabbing

The Stamp Duty cut was clearly an attempt at grabbing headlines without too much pain to the Treasury.

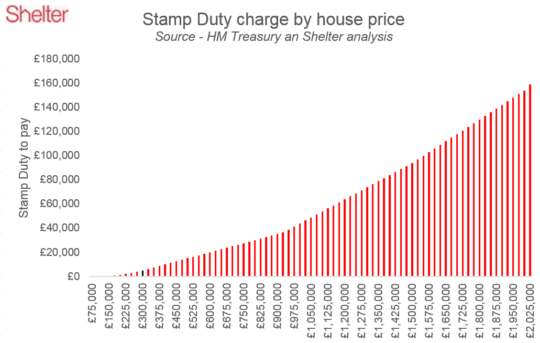

The latest data from HM Land Registry suggests that the average price paid by a first time buyer in England is £191,000. Under the old Stamp Duty regime £1,320 in tax would have been due. First time buyers who could stretch to a £300,000 home (the upper limit for this cut) would have paid £5,000.

Now, I don’t deny both figures are a lot of money, but given that the loan to income ratio (the amount people borrow compared with their income) is around 4:1, this means a household on £75,000 a year could get a mortgage of up to £300,000 and would have to pay an additional £5,000 to the Treasury (as well as the deposit and moving fees of course). That’s an effective tax rate of 1.67% on the transaction, which doesn’t seem all that disproportionate.

The Office for Budgetary Responsibility (OBR) has also looked at the budget numbers and it predicts that, as a result of the Stamp Duty give away, prices will increase by 0.3% more than expected.

What does this mean? Next year, if prices grow as the OBR predict, first time buyers will pay, on average, £199,000 for their home because of the cut, rather than £198,000. So, some of that ‘saving’ on stamp duty will just end up going to the vendor.

Cost and benefit

Perhaps the cut will be seen in a positive light because, cognitively, it’s more appealing to spend money on an asset than handing it over to the tax man. No one likes paying taxes; however, the budget is about making the best use of limited resources, not just an opportunity to make headlines.

The cost of any policy change in the budget is published straight away. It says the change to Stamp Duty will cost £3.19 billion over the next five and a half years; that’s £580 million a year.

The OBR have estimated that this cut will genuinely help around 3,500 first time buyers get a home.

Why is this number so small? Well, mainly because many first time buyers already buy homes under £125,000, the minim price where Stamp Duty is payable, and for those that do pay Stamp Duty – because they can afford a higher mortgage – can possibly more easily afford the tax, so it wouldn’t stop them from actually buying in the first place.

But the important point to make here is; what else could government have done with this money to help with the housing crisis?

Based on the government’s own estimate of the social housing grant (£80k per home) the money lost from stamp duty could have built 40,000 social rented homes. Or, if they spent it simply on building the homes themselves (at a cost of £170,000 per unit) they could have delivered 18,800.

Helping the wrong people

So, the consensus is that the money will move from the Treasury into the pockets of existing home owners, and first time buyers won’t benefit in the long run. Meanwhile, there are still 1.2 million people on the housing waiting list.

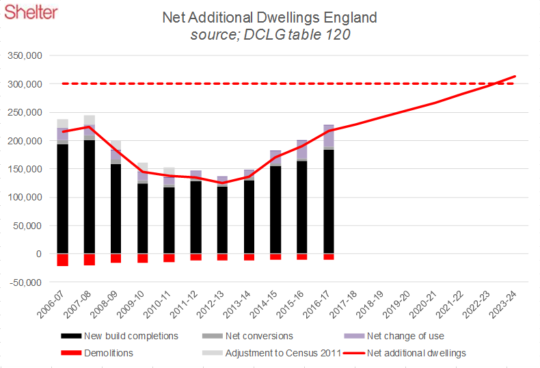

Given the new target of 300,000 set on the supply of housing, a lot more will need to be done to turn good intentions into successful outcomes.

That’s why we will continue to call on the government to focus on delivering far more genuinely affordable homes and address some of the causes of high house prices, such as the high cost of land.

- Read more about our vision for building new homes with our New Civic Housebuilding model