Renting in England: Paying more for less

Published: by Tom Weekes

Do you ever get the feeling that you’re being ripped off? The answer is probably yes; everybody occasionally thinks they’ve overpaid or haven’t been getting their money’s worth. Hopefully, that’s a rare feeling for you. But if you’re a private renter, then there’s a good chance it’s all too familiar.

New analysis from Shelter shows that renters have every reason to feel this way. The average private renter is now paying over £1,600 more per year on housing than a homeowner with a mortgage.

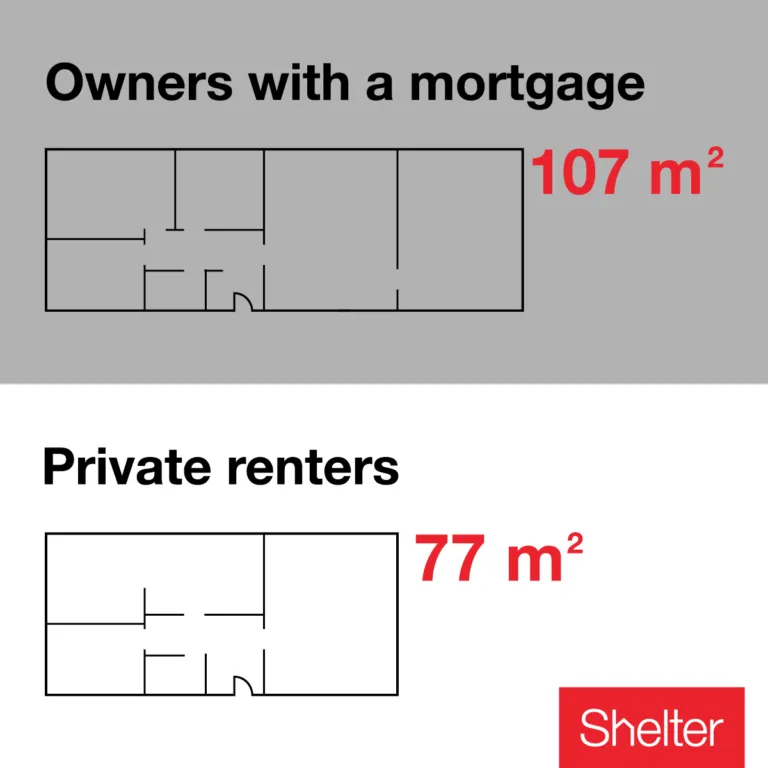

Yet despite shelling out more, the reality is renters are getting less. Private rental properties are on average 28% smaller than owned properties, with private renters’ money buying them just 77m 2, while owners get a luxurious 107m 2. That difference is roughly equivalent to the size of a master bedroom and a kitchen.

In some ways, though, it is probably just as well that renters don’t have that extra bedroom, because for renters, space simply costs more.

The cost of space

Having shown that renters simply pay more than homeowners – a situation that’s gotten worse over the past decade – we need to move on to thinking about space.

The table below shows the change in the average monthly housing cost per metre squared between 2006/07 and 2016/17. The headline: in just a ten year period the cost of space for private renters has soared by 45% – far more than the increase for mortgaged homeowners[1].

| Housing costs per metre squared | ||

| England: Average monthly cost | ||

| Year | Mortgaged owners | Private renters |

| 2006/7 | £5.69 | £7.46 |

| 2007/8 | £6.28 | £7.64 |

| 2008/9 | £6.19 | £8.62 |

| 2009/10 | £6.02 | £8.82 |

| 2010/11 | £6.05 | £9.21 |

| 2011/12 | £5.95 | £9.59 |

| 2012/13 | £6.20 | £9.58 |

| 2013/14 | £6.12 | £9.83 |

| 2014/15 | £6.46 | £10.05 |

| 2015/16 | £6.45 | £10.45 |

| 2016/17 | £6.43 | £10.78 |

| Ten-year change | 13% | 45% |

The important thing isn’t the change over time. It’s the state of play today, because that’s what matters to the millions of families now living in the private rented sector. Today, the average renter would pay £10.78 per square metre each month, while a mortgaged owner only pays £6.43 for exactly the same amount of space. No wonder private rented households are three times more likely to be classed as overcrowded than owned accommodation.

This is contributing to private renters now paying twice as much of their household income on housing costs than owner occupiers. Private renters spend over 40% of their income on housing costs, compared to just 19% for owners[2].

What does this mean?

Essentially, these numbers tell us something pretty simple: renters are right to think they’re getting a raw deal.

And that’s only half the story of the great rental rip-off. Not only do renters get gouged from space costing more to rent than buy – the quality of that space is simply not as good. For example:

- 27% of homes in the private rented sector are classed as ‘non-decent’ compared to 20% that are owner occupied

- Privately rented homes are three times as likely to have problems with damp than owner occupied properties.

Then you’ve got the fact that renting is insecure, with the end of a tenancy now the leading cause of homelessness in England.

So that’s renting. Pay more, get less (in pretty much every sense).

It doesn’t need to be like this though.

What can be done

Improvements in private renting need action from the government – which won’t happen until we show the government that renters want this and that there is a benefit to offering it to them.

Already Shelter has shown that renters have a growing importance politically – with more of them voting and seeing housing as the key issue they need the government to fix.

The results of this may be coming through as well. For example, via the government’s consultation on longer tenancies for private renters, which would start to address some of the instability Shelter has long highlighted.

Far more is needed, though, before renting is truly fit for purpose and renters no longer feel like they’re being ripped off with their housing costs. That means:

- Ensuring that the Tenants Fees Ban currently going through Parliament stamps out all unfair costs once and for all

- Making sure renters get the stability they need through longer tenancies, and address affordability by linking rent rises to inflation

- Delivering a new generation of social homes that are genuinely affordable to those on low-incomes, ending our reliance on the private rented sector.

[1] The cost of space was taken by comparing the average monthly housing cost against the average usable space (metres squared). These figures do not normally include repairs and insurance.

Sources: Calculation by Shelter using EHS tables FA3601, FA2501 and DA1101 and predecessor versions. Calendar and financial years fitted on best match basis (i.e. 2015/16 for cost matched to 2015 for space).

[2] English Housing Survey 2016/17 Headline Report – Household tables – Annex Table 1.13