How much longer can lenders get away with DSS discrimination?

Published: by Rhea Newman

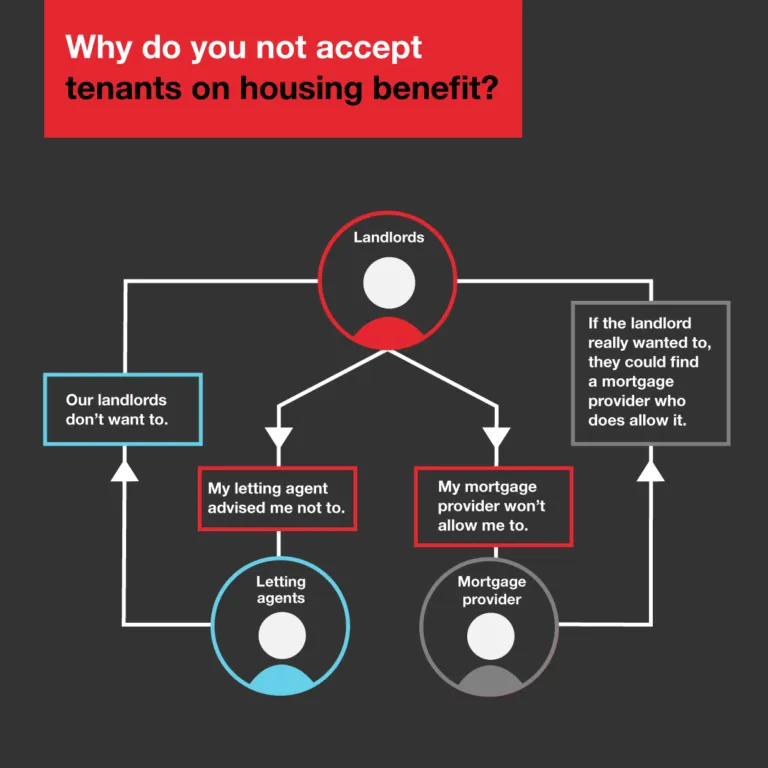

When challenged over why they discriminate against renters on benefits, landlords and letting agents often point the finger at the banks – blaming the fact that buy-to-let lenders do not allow landlords to let to tenants on housing benefit. We hear this defence regularly in response to our campaign, so in this blog we’re going to look at the extent to which lenders really are driving discrimination against renters on housing benefit. And why the recent controversy with NatWest should make the mortgage industry step up to end their discriminatory practices once and for all.

The scale of the problem

There’s no doubt that buy-to-let lenders are one of the drivers behind discrimination against renters on housing benefit. In our most recent survey, 13% of landlords said they are reluctant or prefer not to let to tenants on benefits because their mortgage lender or insurer does not allow it.[1]

But when trying to determine the extent to which lender policies drive DSS discrimination, it’s important to remember that not all landlords have mortgages – in a Council for Mortgage Lender Survey of landlords in 2016, 49% of respondents owned all their property outright.

For those landlords who do have mortgages, the likelihood that their buy-to-let lender will restrict them from letting to people on housing benefit is up for debate. Research by the Residential Landlords Association (RLA) in 2017 suggested that two-thirds of the largest lenders, representing approximately 90% of the buy-to-let market, bar landlords from letting to tenants who claim housing benefit. However, UK Finance more recently told us that at least two-thirds of the market (according to market share) do allow landlords to let to people in receipt of housing benefit – and some lenders have suggested this figure could be as high as 85%.

These figures seem hard to reconcile, although in the 18 months since the RLA carried out this research, it’s likely that some lenders will have changed their policies. Some of the biggest players in the market, such as BM Solutions and Nationwide, changed their policies back in 2013 – and we understand that more recently other lenders have seen the error of their ways and quietly followed suit.

Regardless of the exact number, there’s no doubt that some lenders still operate restrictions. So perhaps a more pertinent question is how can the mortgage industry justify the fact that any lender still operates these discriminatory policies?

Lender explanations of ‘No DSS’

The most common excuse from representatives of the mortgage industry is that landlords who want to let to people on housing benefit can easily find a lender who will allow them to. This explanation might hold for landlords who are already letting to a tenant on benefits, or landlords who have made a conscious decision that they want to let to people in receipt of benefits. But we’re not convinced that the majority of landlords will be choosing their mortgage based on whether the lender will allow them to let to tenants claiming housing benefit.

The other explanation we’ve heard from the mortgage industry is that some lenders have felt little imperative to change their policy because their customers (i.e. landlords) are not putting them under any pressure to change their policy. This perhaps isn’t surprising when you consider six out of 10 landlords are reluctant or prefer not to let to people on benefits.[2] But it becomes somewhat chicken and egg when landlords say the reason they are reluctant is because their lender won’t let them do it in the first place… #theblamegame.

You might have thought the fact that ‘No DSS’ terms could be in breach of the Equality Act would give the mortgage industry an imperative to change their policies. But if that’s not enough, perhaps seeing how their policies are directly putting people at risk of homelessness might force lenders to finally take action.

Lenders must learn from NatWest’s mistakes

NatWest recently brought the spotlight onto the mortgage industry by telling landlord Helena McAleer that she would either need to evict her tenant who claims benefits, or pay an expensive mortgage repayment charge. It’s shocking that a bank would be prepared to put someone at risk of homelessness, despite being told of their vulnerability and how good a tenant they are. In this case, the tenant was fortunate to have a good landlord who was prepared to stand up to NatWest. But how many other landlords would go to such lengths to defend their tenant?

NatWest is reviewing their policies and we’re calling on NatWest to remove any restrictions. However, it’s not just NatWest which needs to learn the lessons from this case. How can any lender continue to defend policies that are not only discriminatory – but also directly put people at risk of homelessness?

The pressure on lenders is mounting. Helena McAleer is petitioning the government to urge them to take action against the banks. The RLA has written to the Treasury, calling on it and others (such as the Financial Conduct Authority) to step in to end this discrimination. Voices within the industry, such as Mortgages for Business, are calling on lenders to do the right thing. And now the Work and Pensions Committee has said the government should look at regulating lenders if they don’t voluntarily change their policies.

We hope that lenders will listen to these calls and remove any remaining restrictions preventing landlords from letting to people in receipt of housing benefit. And once lenders have removed their restrictions they must communicate with their landlords so there can no longer be any confusion about where lenders stand on this issue.

[1] YouGov, survey of 1137 private landlords, online, August 2017

NB: We’re not talking about insurers in this blog but we will be talking more about insurance providers in the weeks to come.

[2] YouGov, survey of 1137 private landlords, online, August 2017