No excuse for no DSS

Published: by John Bibby

Our campaign against ‘no DSS’ has split the lettings industry. Some agents have engaged positively with it and are taking meaningful steps to drive out old discriminatory practices by making sure they take into account every tenants’ full financial circumstances.

But some have just tried to defend old practices.

Many defences of no DSS are transparent prejudice. But a couple of arguments for ruling out tenants on housing benefit sound more plausible, like:

- what if a landlord can’t afford to get paid in arrears, which is how housing benefit is paid?

and

- what about agents who exclusively market properties at the upper end, which tenants on housing benefit wouldn’t be able to afford?

In this post, we look at these more plausible-sounding defences of no DSS and find that – when it comes down to it – they’re just as bogus as the rest.

The landlord who needs rent upfront

Housing benefit and Universal Credit are paid in arrears (i.e. at the end of the month, rather than at the start).

Although the first payment for a new claim normally takes around five weeks, in some cases it can take even longer, meaning that some tenants could face a big delay before they can make their first rent payment.

Clearly, this doesn’t fit with the way most landlords want to get paid rent. Most want the full rent upfront.

For some landlords, though, such a delay could even push them into financial trouble, like mortgage arrears.

So, we’ve heard the argument that it should be acceptable for agents to exclude all prospective tenants on housing benefit from consideration as a matter of course if the landlord can’t afford to get paid in arrears.

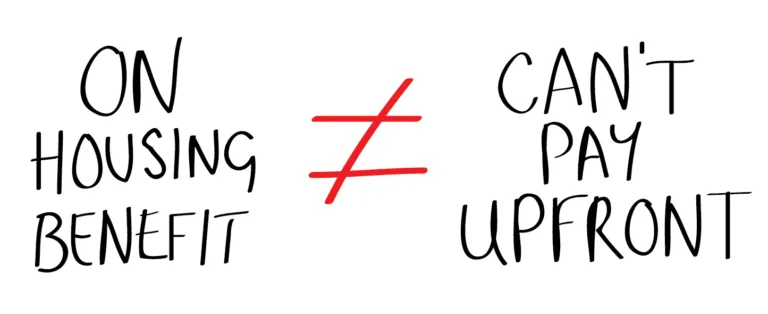

The problem is this: just because a tenant receives housing benefit, it doesn’t mean they will necessarily be unable to pay rent upfront.

For example, they might be able to

- apply for an advance payment to get paid their benefits early

- use existing savings (you can have anything up to £6000 savings before it begins to affect the amount of housing benefit you might be entitled to)

- borrow the money (e.g. from family or an overdraft)

Many tenants on housing benefit won’t be able to – or won’t want to – pay upfront. But agents can’t assume this applies to all tenants on housing benefit and should consider the individual circumstances of each applicant.

The agent of top end properties

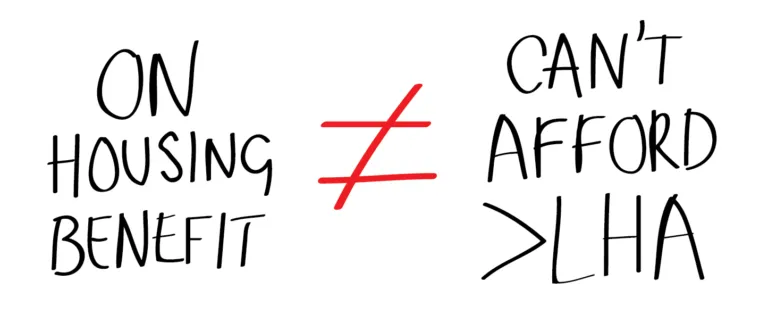

We’ve also been told that some agents should be able to rule out all tenants on housing benefit because their businesses cater only to the ‘top of the market’.

To kill this argument dead we’ll consider an extreme example: the agent of a Mayfair mansion where the rent is at least £10,000 a month, like one of these.

(Put aside the fact that the likelihood of a tenant on housing benefit actually calling one of these Mayfair agents is practically zero. It’s important to debunk an extreme case so that every more ordinary case where an agent tries ‘the top of the market’ excuse is debunked with it.)

Why would it be reasonable to expect the Mayfair agent to explore and consider the full financial circumstances of a prospective tenant on housing benefit?

Well, even though the tenant couldn’t possibly get enough in housing benefit or have enough in savings to afford the rent,[1] they might still have other ‘voluntary income’, which is disregarded when calculating benefits. The most obvious example of voluntary income is getting a bailout from family or parents.[2]

So, even in this extreme example, the agent wouldn’t be in a position to tell unequivocally that a prospective tenant couldn’t afford the rent just because they received housing benefit.

In practice, most agents inclined to try the ‘top of the market’ excuse would likely just be advertising properties with rents above Local Housing Allowance rates. The extreme case shows it’s always possible that tenants on housing benefit might be able to make up the difference from other sources.

No excuse for no DSS

It will always be acceptable to reject an applicant for a property if they can’t afford the rent.

But these example show it’s never acceptable for an agent to use receipt of housing benefit as a shorthand for what a tenant can afford and that there is no excuse for no DSS.

Letting agents and landlords should treat renters receiving benefits fairly, on a case by case basis. Otherwise they may be acting unlawfully. Sign our petition calling on leading letting agents to end discriminatory practices here

[1] The maximum allowance for savings is £16,000 before a claimant loses all entitlement to housing benefit

[2] Voluntary income is income that creates no ‘legally enforceable rights or obligations’ between the payer and the payee and where ‘the payer obtains nothing in return for the payment’. Commissioner Mesher’s decision in CH/3013/2003 — R(H) 5/05