Increasing housing supply can improve living standards for the squeezed middle

Published: by Guest blog

Guest Blog – Thomas Aubrey, Centre for Progressive Policy

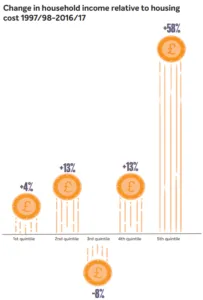

Housing costs over the last 20 years have been a real drain on household incomes. Indeed, this rise in prices for renters and owner occupiers has been responsible for more than a third of the rise in overall living costs. House prices have increased in the last two decades at a much faster rate than earnings, resulting in the median house price to earnings ratio roughly doubling. But these costs have impacted different income groups in very different ways.

New research of UK-wide household incomes and housing costs using the ‘households below average income’ dataset between 1997-98 and 2016-17 provides insight into how each quintile has fared over this period.

Median income households have uniquely seen their household income fall by 8% relative to housing costs. This is due to lower nominal wage growth, the limited availability of social housing with subsidised rent and higher private rental costs. Furthermore, for renters in this quintile wishing to make the switch to owning a house with a mortgage, higher housing costs to income have extended the period required to save for a deposit, putting homeownership out of reach for many.

The richest 20%, however, have seen their household income after housing costs grow more than 50% over the period. This is due to a combination of faster earnings growth and, above all, a decrease in the cost of housing through home ownership due to falling interest rates.

The poorest 20% of households have seen their housing costs rise at more than twice the rate of the richest. However, total household income has risen marginally faster than costs due to a significant increase in the number of people working, in addition to the introduction of the minimum and living wage. The growth in employment amongst this group has largely been down to the increase in female participation in the labour force, although the data indicates that these jobs mostly pay less than median wages.

Putting a lid on housing costs

Modelling undertaken for the 2004 Barker Review indicated that a 50% rise in private sector housing output and a doubling of social housing per annum would reduce trend real house price growth by 1%. To the extent that this model is still applicable today, delivering around 300,000 new build completions would reduce trend growth by around 1%.

The Centre for Progressive Policy (CPP) has estimated that a 1% lower trend rate of growth in house prices over this period would have resulted in 0.35% lower housing costs. This would have been transformative for the median quintile, with household income after housing costs rising by 4% instead of falling by 8%. Supply therefore can make a real difference to household welfare over time. The challenge for public policy is how the level of output might be increased.

Central to raising the growth in both social and private sector housing output is to increase the rate of infrastructure investment. However, infrastructure is expensive, challenging to implement due to its complexity, and is generally characterised by revenue streams lagging many years behind large-scale upfront expenditure.

The New Towns solved this conundrum, as they were able to use the uplift in land values to invest in the necessary infrastructure. This approach generated income streams from social housing as well as from selling off land with planning permission to housebuilders once the infrastructure had been put in.

The challenge for replicating the success of the New Towns today is that where private land needs to be acquired and assembled for a development, then the requirement to pay ‘hope value’ will reduce financial viability and increase uncertainty in land values, thereby increasing the risk of the project. For this reason, large-scale, ambitious projects do not often come forward at all. New housing must instead be built where it can be served by existing infrastructure, itself increasingly under strain. Hence, the inability to invest in new infrastructure necessarily limits the output of housing.

If the government wants to help the squeezed middle and improve living standards, then it needs to invest far more in infrastructure than it is currently doing. Should they decide to follow the recommendation of the House of Commons Select Committee on Land Value Capture, an additional £200bn over the next 20 years could become available. The proposed reform of the 1961 Land Compensation Act would enable more of the uplift in land values to flow to public authorities, enabling more private and social homes to be built driving down living costs.

Should the government fail to follow this path and drive up housing supply, millions of middle-income households will continue to experience a squeeze in living standards. Such an outcome clearly does not bode well for future electoral success.