From the Frontline: the ongoing impact of welfare reform

Published: by Tom Weekes

The consequences of the broken housing safety net are laid bare in our new report, From the Frontline. This shines a light on the thousands of people we help every year who are being pushed to the point of crisis due to the continued impact of welfare reform and the introduction of Universal Credit (UC).

The freeze to Local Housing Allowance (LHA), which is housing benefit for those renting privately, is forcing people to make the impossible choice between paying their rent or skipping meals; keeping a roof over their family’s heads or buying clothes for themselves or their children. Every week, we see families threatened with homelessness because of the shortfall between their rent and their housing benefit.

This report follows two damning publications highlighting the housing emergency. The National Housing Federation found that in England, 130,000 families are now squeezing themselves into one bed flats, with as many as 627,000 children having to share a room with their parents. Meanwhile, the Children’s Commissioner’s Bleak Houses report estimates that there are now over 210,000 homeless children.

From the Frontline directly links the issues highlighted in these reports to the impact of welfare reform, particularly the role of UC and the freeze to LHA. The government must respond and respond quickly. Everyone in our country will only have access to a secure and affordable home once it commits to building three million social rent homes and restoring LHA rates to a level that meets basic local rents.

The ongoing impact of welfare reform

Our new analysis found that 65% of non-working private renters in receipt of LHA have a shortfall between their rent and their housing support.

In 2016/17, over 170,000 households were living with monthly shortfalls above £100, while close to 60,000 faced shortfalls of between £50 and £99.99. These amounts are impossible to budget around in the long term.

Managing day to day

These shortfalls are forcing households to live in constant fear of not being able to keep a roof over their heads.

Speaking about how being on UC made them feel, one of our service users said: ‘It’s humiliating asking for money all the time. Has UC helped manage the finances? No! Bailiffs are here, expenditure is high and rising, but the benefit isn’t enough at all.’

These kinds of experiences aren’t just limited to those we help, and are depressingly common across all private renters in receipt of housing benefit. In the last year:

- one in three (31%) have cut back on food for either themselves or their partner

- two in five (37%) have been forced to borrow money to pay for their rent

- two in five (37%) have cut back on clothing for themselves or their partner

There is also clear evidence that claimants are being forced to use their subsistence benefits to pay for their housing costs. Our survey shows that one in four private renters receiving housing benefit (26%) have done this.

Homelessness

These shortfalls can only be managed for so long, so it’s no surprise that in 2018, the National Audit Office made the link between LHA rates and homelessness, saying: ‘Changes to LHA are likely to have contributed to the affordability of tenancies for those on benefits and are an element of the increase in homelessness.’

This is seen in practice by the rise in the ending of an assured shorthold tenancy (AST) as a cause of homelessness. The ending of an AST became the most common trigger for homelessness in 2012/13 and increased by 66% since 2011/12, when the first changes to LHA were introduced.

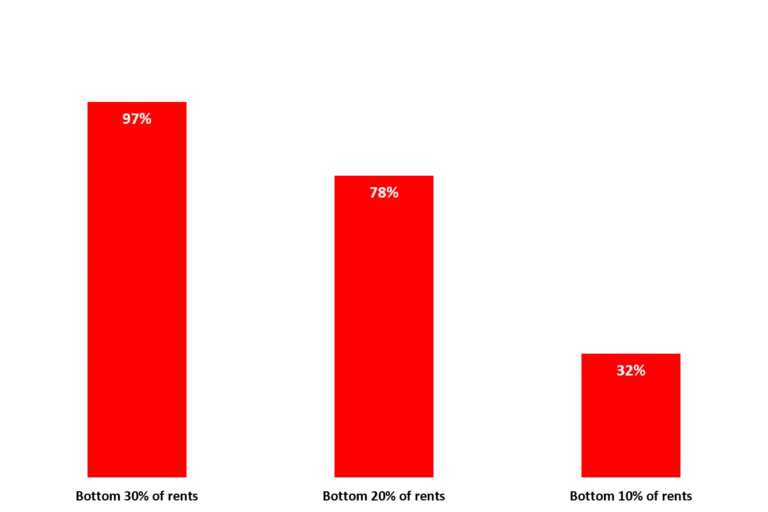

Homelessness occurs not simply when a family loses a settled home, but when they are then unable to afford another suitable home. The chart below illustrates the challenges in finding a home that’s affordable on housing benefit. In one in three (32%) areas in the country the LHA doesn’t even cover 10% of properties.

Percentage of areas in England where the LHA rate for a two-bedroom property does not cover the lowest proportions of the local rental market:

Overcrowding

Our analysis highlights that private renters are having to squeeze themselves into unsuitable accommodation in order to find a home affordable for them on their LHA. The number of overcrowded private rented households who are in receipt of LHA increased by 61% between 2010/11 and 2016/17 (from 75,000 to 120,300).

Shelter has long noted the physical and mental health impacts of overcrowding on families and particularly on children, and we believe that the devastating impact living in overcrowded housing has on a child’s development and wellbeing cannot be overstated.

Families should not have to live in inappropriate, overcrowded conditions, which put both parents and children at risk of physical and mental health conditions. They should not have to sacrifice their wellbeing by cutting out meals, borrowing money or sacrificing all social activities in order to keep a roof over their heads.

The government must make a significant investment in social housing so that people can have a secure and safe place to live, and they must immediately raise the LHA rates back up to the 30th percentile.

Shelter are supporting Crisis’s campaign calling the government to put investment back into LHA rates. Sign up to their #CoverTheCost campaign.