First Homes: the new government policy which could make the housing emergency worse

Published: by Tarun Bhakta

Right now, the government is consulting on its flagship ‘First Homes’ policy. And it poses a huge threat to the supply of social housing. Here’s why what the government is proposing is no solution to the housing emergency.

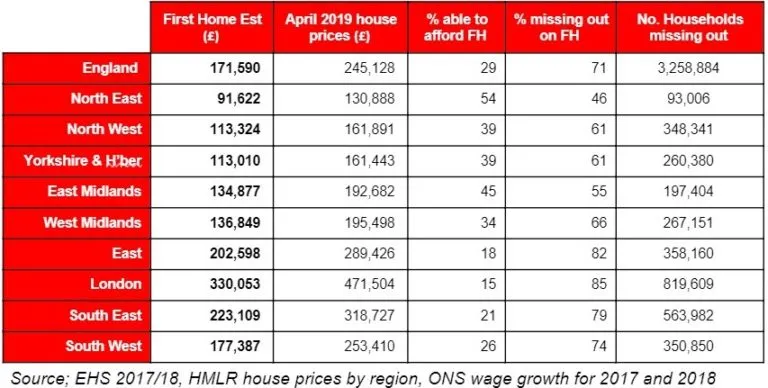

Last month, the government announced its new ‘First Homes’ policy in another bid to boost homeownership levels. These new homes will be offered to first-time buyers at a 30% discount on the market price, with the intention that the discount will remain for future buyers. As we’ve already shown, these homes will be unaffordable to the average earner in 96% of the country.

But the consultation on First Homes asks all the wrong questions. All the options given for building these homes would spell disaster for social housing.

What is the government asking?

The government wants to use the planning system to get First Homes built. As we’ve said previously, the planning system is vital in tackling the housing emergency. It’s a way to guide development to ensure it works for local communities and crucially, to ensure that the market delivers homes that local people can afford. But First Homes won’t do either.

The consultation asks whether First Homes should be delivered as a fixed proportion of developers’ affordable housing contributions (section 106) or a fixed proportion of all homes built on suitable sites. In practice, the effects of each of these would be the same. Both would take the planning system out of the hands of local communities. Both would push truly affordable social homes to the side lines to make way for these unaffordable First Homes.

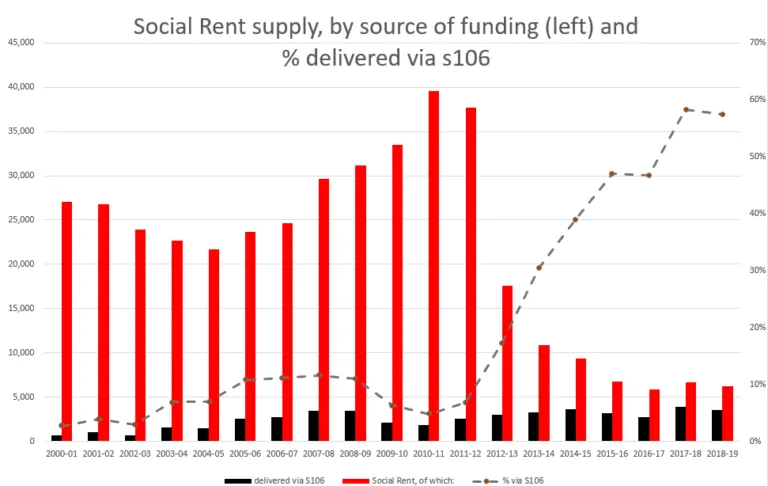

We rely on section 106 contributions for what little social housing is being delivered. Since direct government funding for social housing has all but dried up, section 106 now accounts for nearly 60% of the small number of social homes delivered.

The government intends to force councils to redirect this stream of supply away from social housing, prescribing that 40%, 60% or 80% of homes delivered in this way should be First Homes. All three options would cut social housing delivery down to levels even lower than last year’s paltry 6,287.

These aren’t questions we take pleasure in answering. So, we suggest some questions the government might have started with…

Will First Homes fix the housing emergency?

To buy a First Home, people will need a deposit. But high rents mean it’s impossible for most private renters to save for a deposit – 63% have no savings at all. And even if they get over this hurdle, not only will these homes be unaffordable for average earners, but our analysis shows that across the whole of England, only the richest 28% of private renting households earn enough money to be able to access a First Home. The vast majority of private renters – 3.3 million households – will miss out.

The consultation also asks about local connection tests, an income cap, and other eligibility criteria. It asks how these could be best devised to ensure First Homes go to local key workers, armed forces personnel, and other groups of first-time buyers – without asking first whether average local earners in those groups could have any chance of affording a First Home.

In fact, across the country, the average household income needed to access First Homes with a 30% discount would be £41,000. Most renters, including the average key worker, earn much less than this. And all First Homes will be new builds, which tend to be more expensive. So it’s likely that many of those lucky enough to access First Homes would be able to afford to buy a home on the second-hand market in the near future anyway.

Of course, some people will benefit from First Homes, but they will do nothing to tackle the housing emergency in front of us, and they should not be delivered instead of the social homes that will.

At the heart of this emergency is affordability. There are over 280,000 homeless people in this country and many more currently unable to find a safe, secure home they can afford. As our analysis shows, First Homes won’t do anything for these people. It will actually make it worse for them by eating into the provision of genuinely affordable social rent homes they so badly need.

Prescribing that 40%, 60%, or 80% of developer contributions should be First Homes risks slashing the number of social homes currently delivered, limiting local authorities’ abilities to meet the housing need in their area.

Should central government decide the tenure mix?

Local authorities are best placed to determine what and where need is in their area, so they can respond to it. A robust assessment of local housing need is vital in ensuring that the types and tenures of homes that our communities need are delivered. The government’s proposals undermine this logic, suggesting that a fixed share of homes delivered in all areas should be First Homes.

There may be some role for a product like First Homes in a properly functioning housing market. Demand for First Homes might be higher in some places than in others. Housing markets are different across the country and housing policy should reflect that. A blanket approach, dictated by central government, fails to acknowledge this. It risks taking from councils, the flexibility they need to meet housing need in their local area.

What should the government do?

The government clearly wants to ensure First Homes are delivered. But forcing councils to deliver them in place of other affordable tenures, before asking whether local people can afford them or not is putting the cart before the horse.

Councils need flexibility to deliver the right mix of affordable housing. And they need to be given the tools to deliver more of it.

We have long advocated for improvements to the planning system and reform of the Land Compensation Act – both of which would help to deliver more affordable homes of all types. We are also calling for an ambitious commitment from government to increase capital investment in social rent housing from its current low levels at the earliest opportunity.

In this future, low-cost home ownership products like First Homes might exist alongside, and in addition to, a thriving social housing sector. But right now, we are in a housing emergency. The hundreds of thousands at the sharp end of it – homeless and unable to find somewhere safe, secure and affordable to live – urgently need social housing. The government should deliver more of it, not less.

It’s vital that we stop First Homes becoming an attack on what little social housing is already being delivered. We only have until 3 April to show the government the damage this policy could unleash.

Add your name today to support our response to the First Homes consultation and tell the government to put social housing first.