First indication of Local Housing Allowance rates out last week

Published: by Steph Kleynhans

Last week, the Office for National Statistics (ONS) published some local rent data. This is relevant to people keeping an eye on what is going on with housing benefits, as it is rent data for the 12 months up to September that is usually used to set the Local Housing Allowance (LHA) rates, (the way in which housing benefit is calculated for those renting privately) for the following April.

However, this year is different because in the spending review last month, the government announced a cash freeze to the LHA rates. This blog will explain a bit more about what this cash freeze will mean for families now there has been some data released.

What happened in the spending review?

In the spending review on the 25 November, the government announced it will be freezing LHA in cash terms.

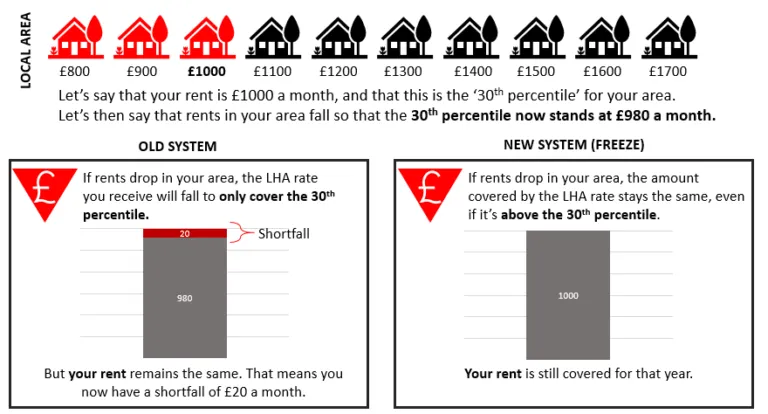

Freezing LHA rates usually means that if rents in an area go up, you can expect to see shortfalls between people’s rent and LHA start to open or widen. If rents go down in an area, the government usually lowers LHA too, because there was a provision in the regulations which stated that you can’t have an LHA rate that sits above the 30th percentile of rents in any area. This means that the LHA rates cover rents at the bottom 30% of each rental market area – or the 30th percentile.

Effectively the LHA rate always had a maximum cap at the 30th percentile.

However, in this year’s spending review the government took out this cap, so that if rents fell, the LHA rate would not drop below the 30th percentile. In theory, we know this could benefit some households.

How could this benefit households in areas where rents fall?

What data was released last week?

The ONS released some early rental data last Friday. When LHA is based on rents, it is uprated every April, based on rent data from the previous September. Therefore, this is the data that LHA would have been based on next year (if it wasn’t being frozen). The data is indicative, as it is for local authorities (not broad rental market areas) and they don’t give us the exact result for the 30th percentile. But it still gives us a good first sense of what the changes in the Spending Review might mean for people next year.

What does the data tell us about the possible impact of LHA changes?

We’ve done some analysis on the data the ONS have released for two-bedroom homes and found that one in eight areas (13%) have seen rent rises – so are perhaps likely to see shortfalls opening, or widening, between low rents and LHA.

However, now we have some data we can see who might lose out and who might benefit.

The data suggests that six in ten areas (59%) have seen rent decreases at the bottom part of the market – so people in these areas may benefit from the removal of the 30th percentile cap.

| Mean | Lower quartile | Median | Upper quartile | |

| Rents drop | 76% | 59% | 56% | 54% |

| rents stay same | 1% | 28% | 32% | 30% |

| rents up | 23% | 13% | 12% | 16% |

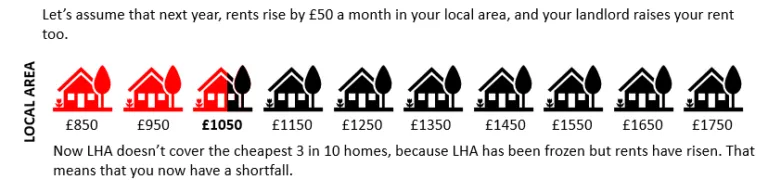

People in these areas will not lose out on money from their entitlement (as shown in the earlier illustration). It will also mean that, in the areas where rents have dropped, people may have more access to the market because they’ll have an LHA rate that could, in theory, afford 35% of homes as opposed to the 30%.

There are still grave concerns over the freeze announced in the Spending Review

Despite positivity for some, we know households in the one in eight areas where the rents have risen, are likely to see a larger shortfall next year:

There are also still several things we don’t know. For example, we don’t know how much of the market LHA now covers, what percentile of the market LHA sits at and also what this change actually looks like in Broad Rental Market Areas (BRMAs), which is how LHA areas are calculated. We currently just know what the change looks like within local authority areas.

We do know, though, that over 40% of private renters now claim LHA which means it is still likely that there will be lots of households facing shortfalls between their LHA and rent.

Looking at the long-term perspective as well, implementing an LHA freeze, is worrying and we have seen the damaging impact of an LHA freeze before. We are likely to face a situation over the years where LHA rates are eroded in the face of rising rental costs, as we did for the four-year benefit freeze (2016-2020). This is also the prediction that the OBR made at the spending review. Falling rents also suggest people are struggling more. While it is positive some people may receive more housing benefit, the idea that rents are falling is a bad sign of how people on low incomes are struggling.

Join our call to reverse the decision to freeze the LHA rates and keep rates at at least the 30th percentile everywhere in the country.