Soaring rents and frozen housing benefit leaves renters facing housing cost crisis

Published: by Charlie Berry

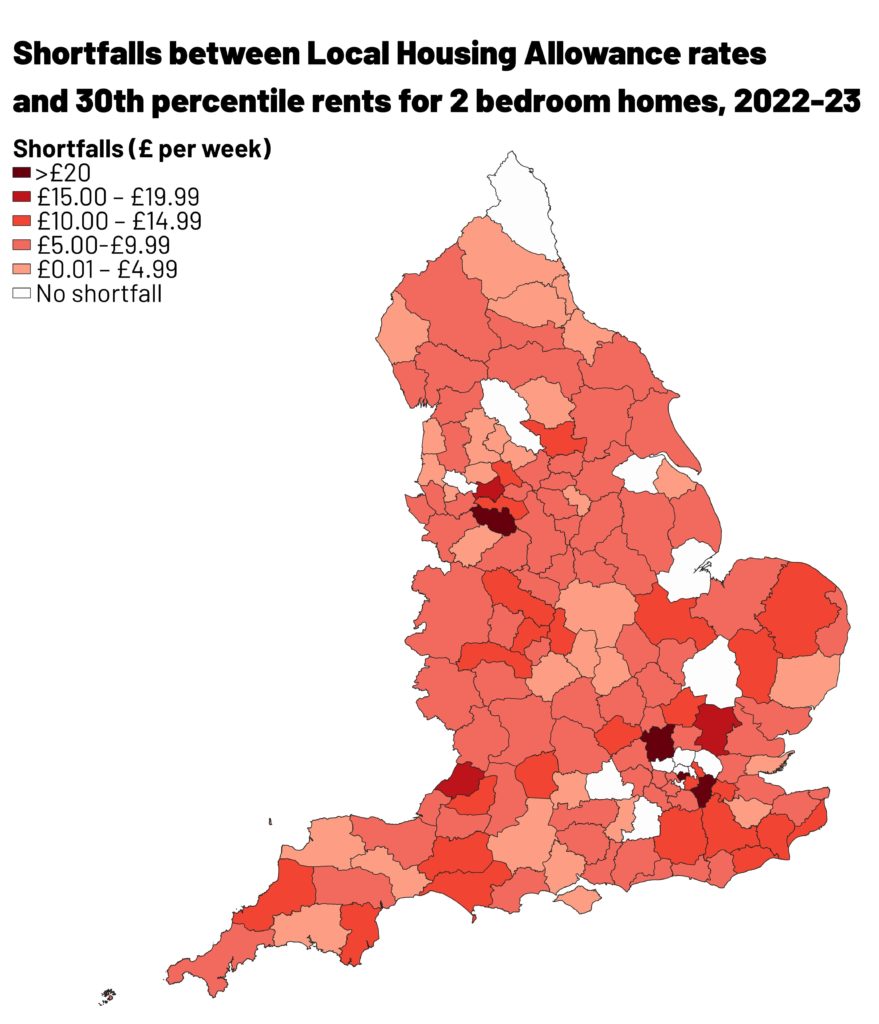

Newly released government data shows that the cost of a modest family rental is now out of reach for people claiming housing allowance in 91% of local areas in England.

Almost two million private renters rely on housing benefit

Around 1.9 million private renters in England now rely on housing benefits – either the housing element of Universal Credit or ‘legacy’ Housing Benefit – to pay their rent. Many of these renters are in employment but need housing benefits to bridge the gap between low-paid jobs and high rents.

The amount they can receive is determined by Local Housing Allowance (LHA), which is set by the government, and is supposed to reflect the cost of renting in each area of England, but this is no longer the case.

The government understands the importance of LHA in preventing homelessness. At the start of the pandemic, it restored LHA after years of limitations and freezes so that it covered the cheapest 30% of homes in each local area.

However, LHA has now frozen again (at March 2020 levels) while rents around the country have risen rapidly. This means that for a family renting a modest two or three-bedroom home at the 30th percent of local rents, the amount of housing benefit they receive is inadequate in 91% of areas in England.

For renters, the cost of the living crisis is being driven by a failing housing policy. Having to make up ever-increasing shortfalls in housing benefits means that a growing number of families are now having to make the difficult choice between rent and food: eviction or eating.

As the cost of living rises, growing housing benefit shortfalls risk pushing people into homelessness as they struggle to avoid rent arrears and eviction.

Families would have to miss weekly shop to make up shortfalls

On average, households renting a two-bedroom home at this rate will have a shortfall of £10.53 a week – more than £45 a month – between their housing benefit and their rent.

To avoid falling into rent arrears and eviction, families now face hard choices over how to make up this shortfall. For a household without children on a low income, making up the shortfall would mean the equivalent of skipping a weekly food shop a month and still having to make savings elsewhere. *

Data source: Shelter analysis of Valuation Office Agency, Local Housing Allowance (LHA) rates applicable from April 2021 to March 2022. January 2022

This map shows that shortfalls are widespread across the country. It shows that many regions have seen significant rent increases since the LHA rates were set at the start of the pandemic in 2020.

In the past year, rents have increased by more than 3% in the East Midlands, South West and East of England so people in areas like Peterborough, North Cornwall, and Bury St Edmunds face shortfalls of over £10 per week between their housing benefit and the cost of a modest home.

The table below shows that for three-bedroom homes, the shortfalls are particularly severe in towns and rural areas in London’s commuter belt, where rents have risen as people have moved out of the city during the pandemic.

| Rank | 1 bedroom | 1 bedroom | 3 bedrooms | 3 bedrooms |

| Broad Rental Market Area | Shortfall (£ per week) | Broad Rental Market Area | Shortfall (£ per week) | |

| 1 | Central London | £71.12 | Central London | £306.09 |

| 2 | Bristol | £18.41 | Aylesbury | £24.17 |

| 3 | Birmingham | £17.26 | Outer South East London | £23.01 |

| 4 | Milton Keynes | £17.26 | Bristol | £23.01 |

| 5 | Southern Greater Manchester | £13.81 | South West Herts | £21.86 |

| 6 | Barrow-in-Furness | £13.57 | Outer South West London | £20.71 |

| 7 | Wakefield | £12.66 | Harlow & Stortford | £17.26 |

| 8 | Outer South East London | £12.66 | Inner South East London | £17.26 |

| 9 | East Cheshire | £12.66 | Cambridge | £17.26 |

| 10 | Canterbury | £12.66 | High Weald | £16.11 |

In places like Aylesbury in Buckinghamshire or South West Hertfordshire, a family relying on housing benefits faces shortfalls of over £20 a week (£87 a month) between the cost of a modest rented three-bedroom home and LHA. This would be the equivalent of a low-income family with children skipping one weekly food shop and one week’s transport costs every month.*

This isn’t just a problem in the South-East. People living in major cities including Manchester, Bristol and, Birmingham face shortfalls that have increased as housing benefit has failed to keep up the pace with rising rents.

In Bristol, the cost of a one-bedroom home at the 30th percentile is 7% higher this year than last year, but with housing benefits now frozen, there is now a shortfall of £18.41 a week between what a person can claim and the cost of a modest home.

People urgently need support to avoid a wave of homelessness

The main cause of homelessness is an inability to afford housing. Housing benefit is an essential safety net to prevent homelessness. We know the government wants to prevent families from becoming homeless this year, so the answer is simple: they must urgently re-link housing benefits to the real cost of renting in 2022.

If we are to avoid a growing wave of homelessness this year, we must urgently restore LHA to at least the bottom 30% of local rents. Given the cost of the living crisis, this is now an essential stopgap, until there’s enough investment in a new generation of permanent and decent social homes that ordinary families can afford without having to claim housing benefits.

*Comparison of shortfalls to household spending is against the weekly amounts spent on food and non-alcoholic drinks reported by households in the lowest income quintile according to the Family Resources Survey. These are £34.50 per week for a household without children and £50.10 for a household with children. ONS, Family Resources Survey 2019/20, Workbook 4: Expenditure by household characteristics, Tables A56 and A57.