Challenging DSS discrimination at NatWest

Published: by Chris Thorne

For the last two months we’ve been leading the fight against ‘DSS discrimination’, where renters receiving housing benefit are unfairly banned from renting homes they could afford. This prejudice isn’t just wrong – we also think it’s unlawful.

The campaign kicked off with the results of our joint investigation with the National Housing Federation into housing benefit bans in the lettings industry. This suggested that several leading letting agents are turning people on benefits away.

We’ve written to the culprits, to ask them to change their behaviour, and thousands of Shelter supporters have contacted them too. We’re hopeful that these agents will act and lead the way in stamping out housing benefit discrimination across the sector.

But DSS discrimination isn’t a problem confined to letting agents. Some landlords want to rent to people receiving benefits but are unable to do so because of a clause in their buy-to-let mortgage. This problem is highlighted in our report and we’ve been calling on all lenders to remove these restrictions.

We recently heard from a landlord with a NatWest buy-to-let mortgage. NatWest told them that they either need to evict their current tenant or face an expensive charge – because their tenant is in receipt of benefits.

We believe that any policy that prevents someone receiving benefits from renting a home is totally unjustified. These clauses can push people closer to homelessness.

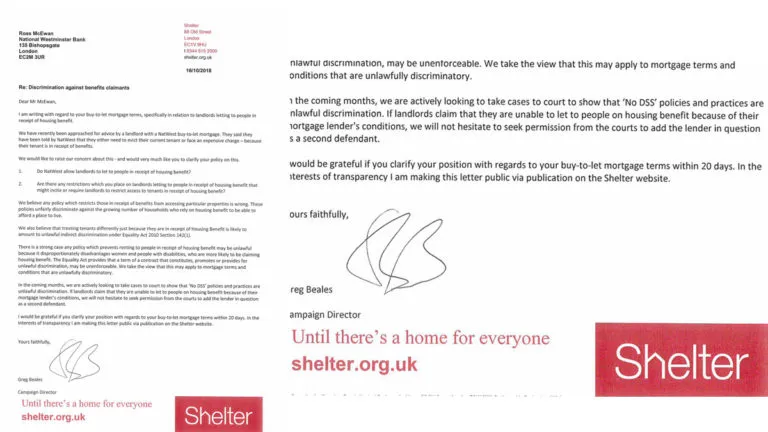

Greg Beales, Director of Campaigns, Policy and Communications at Shelter, has written to the NatWest CEO to raise our concerns and to ask for a full clarification on their buy-to-let mortgage terms. Here is the letter in full:

‘Dear Mr McEwan,

I am writing with regard to your buy-to-let mortgage terms, specifically in relation to landlords letting to people in receipt of housing benefit.

We have recently been approached for advice by a landlord with a NatWest buy-to-let mortgage. They said they have been told by NatWest that they either need to evict their current tenant or face an expensive charge – because their tenant is in receipt of benefits.

We would like to raise our concern about this – and would very much like you to clarify your policy on this

1. Do NatWest allow landlords to let to people in receipt of housing benefit?

2. Are there any restrictions which you place on landlords letting to people in receipt of housing benefit that might incite or require landlords to restrict access to tenants in receipt of housing benefit?

We believe any policy which restricts those in receipt of benefits from accessing particular properties is wrong. These policies unfairly discriminate against the growing number of households who rely on housing benefit to be able to afford a place to live.

We also believe that treating tenants differently just because they are in receipt of Housing Benefit is likely to amount to unlawful indirect discrimination under Equality Act 2010 Section 142(1).

There is a strong case any policy which prevents renting to people in receipt of housing benefit may be unlawful because it disproportionately disadvantages women and people with disabilities, who are more likely to be claiming housing benefit. The Equality Act provides that a term of a contract that constitutes, promotes or provides for unlawful discrimination, may be unenforceable. We take the view that this may apply to mortgage terms and conditions that are unlawfully discriminatory.

In the coming months, we are actively looking to take cases to court to show that ‘No DSS’ policies and practices are unlawful discrimination. If landlords claim that they are unable to let to people on housing benefit because of their mortgage lender’s conditions, we will not hesitate to seek permission from the courts to add the lender in question as a second defendant.

I would be grateful if you clarify your position with regards to your buy-to-let mortgage terms within 20 days. In the interests of transparency I am making this letter public via publication on the Shelter website.

Yours sincerely,

Greg Beales’

We look forward to hearing NatWest’s response, and we’ll be following up with other lenders about these practices soon. But in the meantime, we’d encourage landlords to shop around to choose a lender who doesn’t unfairly restrict who they can let to.