Geography makes the housing crisis more complex

Published: by Shelter

Unfortunately for those of us who try to come up with neat policy solutions to our housing problems, there isn’t just one housing market. That means policies need to reflect local variation.

Ever-increasing house prices are a result of a range of complex and interconnected issues: the amount of land brought forward for development; investment and speculation on land and housing; employment and wage levels; credit availability; interest rates and consumer confidence, to name but a few. Policies that recognise these complexities can be more targeted and better informed.

But there is another vital and often overlooked factor to throw into the mix – geography. Arguably, there is no such thing as the ‘English housing market’, rather it is made up of many local markets. Unfortunately national governments of all stripes, and despite the recent localism drive, have never recognised this sufficiently. This tends to lead to centrally-created policies that won’t deliver on housing where the demand is the highest.

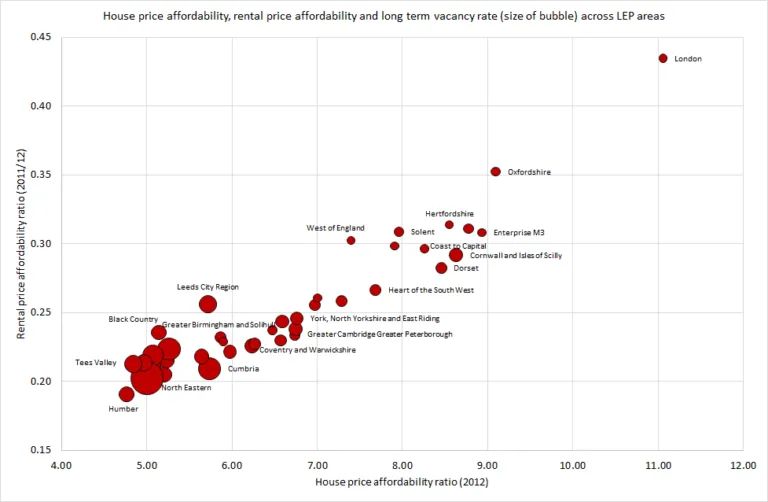

Local housing markets reflect the strength of the local economy in terms of jobs, investment, wages, desirability – i.e. demand side factors – and the local availability of land, finance, regulations – i.e. supply side factors. This is shown in the graph below, which compares the sub-regions covered by Local Enterprise Partnerships. It shows how much buying or renting an average dwelling costs compared to the average salary (with the size of bubble representing how many empty homes there are).

The huge variation this shows between different areas makes creating policy on a national level very difficult, as it will have different effects in different places, and may lead to unintended consequences. Policy designed to fit high cost London is unlikely to solve the problems in Cumbria, and vice versa.

This can be seen in various current housing policies such as Get Britain Building and Help to Buy I (the equity loan scheme).

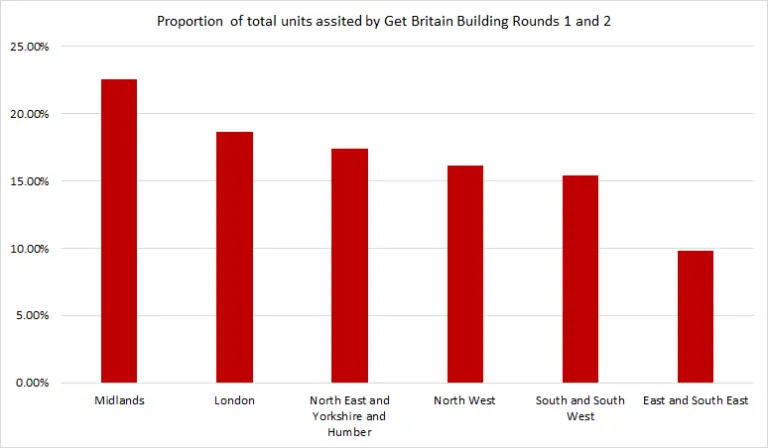

Get Britain Building is a fund created by the Government and administered by the Homes and Communities Agency to stimulate house building. With limited funds, different people will have different views on how or where to spend this money as there is no one single housing market. The graph below shows the proportion of units assisted by Get Britain Building by region as a proportion of the total. Development costs vary by region too, so while London has a smaller proportion of total units helped, it will have received a higher proportion of the cash than shown here. But is it really sensible for the scheme to support homes in the north than the high demand areas or the south?

Arguably the most important intervention so far is the Help to Buy (Equity loan scheme). This allows buyers to purchase a new built home (worth up to £600,000) with a five per cent deposit which the government tops up with a loan up to 20 per cent of the house value, reducing the mortgage to 75 per cent. Again, with limited funds the question is ‘where best to spend it?’ The most pressing need for more homes is in the South East and London, yet this scheme, which has at its core the link between credit and new homes, seems to work most effectively elsewhere, as the map below shows.

This raises the question of whether this policy is suitable for all areas, and whether it might be better and more efficient to create a different policy for London.

Fundamentally, Shelter wants to see more houses being built across the country to keep pace with growing demand. But we also know that different areas face different challenges. Following our recent Solutions to the housing shortage report we are creating a suite of policy options – for launch in Spring 2014 – for both national government and that local authorities and their partners could take up on an individual basis.

We can’t assume that blanket policies will work everywhere across the country, so we will ensure that specific interventions are right for getting homes built on a local level.