Late Admission Charge: How entering the housing market later costs you

Published: by Rachael Emmett

Our research out today highlights that home ownership is seen as the only real option for long-term stability, and yet our housing crisis is increasingly leaving all but the lucky few locked out of a home of their own for years on end. While our research last month showed how first-time buyers are becoming older and richer, our new findings interrogate the very real impact this has on people’s lives. We are seeing a new divide between those who – with a lot of help – get on the housing ladder early, and those who have to save.

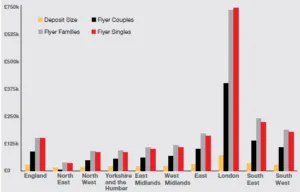

We created a financial model to show the differences over their lifetimes for people we call ‘Flyers’ – those who are helped onto the housing ladder by their families – and ‘Triers’, who have to struggle and save by themselves. The financial gap was staggering. We found that families with one child who buy in their mid-twenties will be £146,300 better off than families who have to save and buy later, and an incredible £561,200 better off than families stuck renting for the rest of their lives.

Lifetime financial benefits for Flyers compared to Triers who eventually buy, by region

But financial models only tell us half the story. Interviews with both Flyers and Triers showed even more financial gaps, but also the social and emotional impacts of long-term renting. Something we hadn’t really anticipated was the benefit of time that buying early gives people. Before they have children, Flyers have time to stabilise their careers, cement their relationships, adjust their spending and importantly, buy their second, ‘family’ home.

By contrast, people who found themselves renting in their late 30s and early 40s were left with impossible choices. Triers told us about leaving it ‘almost too late’ to have children because they wanted to buy a home first, or that they bit the bullet and had children anyway but then found themselves living in overcrowded accommodation. One woman told us about having to sleep with her husband on a pull-out sofa in the living room:

“Sometimes you just want to lie in bed and read your book in peace but you get a knock on the door from one of the children needing water from the [kitchen] sink”

Trier, currently renting, female, London, 48

We also found that the financial benefits for Flyers went beyond what our model predicted. Home owners were able to rent out rooms, access credit and add value to their homes. While on the face of it renting appears more flexible, in fact, home owners were the ones with all the choices open to them.

“If you’re a homeowner then more doors are open to you, all sorts of organisations, particularly financial organisations have a lower opinion of you if you’re a private renter.”

56yo male Trier, currently renting in Birmingham

Importantly, people explained that a home isn’t just an investment for the future, but somewhere to call and make your own. Without being able to make a home our own, renters can feel alienated from home-owning friends and are never quite settled.

“The personalisation of their home…then it is a home rather than just a house you’re living in. Your touch on that house makes it your home rather than just four walls that you go back to every night after work’

Trier, currently renting, female, Leeds, 40

Ever-increasing rents and house prices make saving hard for most, and any financial setback like redundancy can then make saving a deposit little more than a dream. For many, home ownership simply isn’t a choice they can make.

“I don’t feel like I’ve ever had a choice of what I really wanted, there’s always been a problem to solve.”

Trier, currently renting, male, Leeds, 36

The housing crisis leaves few of us untouched. It impacts who we live with, where we live, when we have children, and how we feel about our careers and relationships. Until we build the homes we need, few of us can make real choices about how we live. We need genuinely affordable homes, so we can all fly high in a home of our own.