Mortgaged ownership slides further as generation rent grows up

Published: by Sara Mahmoud

English Housing Survey results released yesterday show the lowest levels of households buying with a mortgage recorded since 1981. Whilst much has been made of frustrated 25-34-year-old buyers, the alarming growth in 35-44 year old renters suggests that generation rent may be growing up but not moving up. For these households, bold action to fix our broken housebuilding system can’t come soon enough.

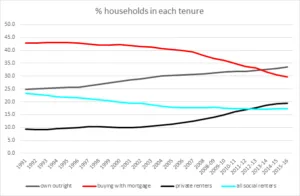

Home ownership overall hasn’t changed significantly since last year but this masks changes in who owns and how. Outright ownership overtook all other tenures in 2013-14 and now accounts for over a third of households. This is largely explained by older people paying off their mortgages, with 62% of these households headed by someone retired.

Source: English Housing Survey, 2015-16

By contrast, the proportion of households who own with a mortgage dropped by around 1 percentage point and is now below 30% for the first time since 1981.

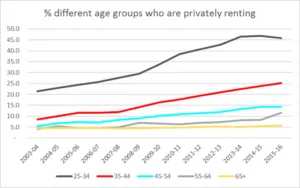

While much has been rightly made of priced out younger households, digging in to these numbers reveals some unfortunate ‘firsts’ for other age groups. For the first time in over a decade 10% of households aged 55 to 64 are now privately renting, potentially driven by people having no other housing options when relationships break down or partners are lost later in middle age.

Source: English Housing Survey, 2015-16

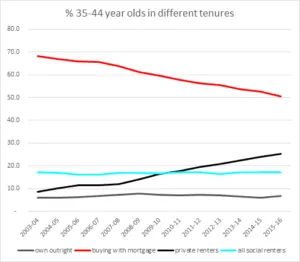

More strikingly, over a quarter of households headed by someone 35-44 rent privately, topping a million for the first time since 2003, when only 9% of these households were in the sector. The proportion owning with a mortgage mirrored this, dipping below half for the first time since 2003.

Source: English Housing Survey, 2015-16

This is a stark reminder that today’s priced out late 20-something is tomorrow’s frustrated renting 40-something. If current trends continue, it does not seem unlikely that private renting will overtake home ownership for those in their late 30s by 2021. Facing high rents and unstable tenancies even further in to life may have an impact on raising children, financial stability, saving for retirement and ultimately, expectations about what being an adult in Britain means.

The problem can often feel intractable, for politicians and the public alike, not least because it is often framed as a battle between priced-out youngsters and ageing, housing-rich ‘NIMBYs’. The English Housing Survey shows, however, that well over a third (36%) of first time buyers used either inheritance or help from family and friends as a deposit. This suggests older households are all too aware of the difficulties younger people face in finding a home and – when they have the wealth to do so – are trying to help their younger relatives out.

This is an unreliable tactic though and offers nothing for ordinary families who don’t have affluent relatives. If we truly want to reverse the decline in home ownership, we must fix our broken housebuilding system, empowering people of all ages to come together to build the beautiful, sustainable and affordable homes that their communities need.