Parental wealth the key to homeownership

Published: by Kate Webb

This week has brought fresh confirmation that people’s homeownership aspirations are increasingly dependent on their parent’s wealth.

New research by Legal and General found that the Bank of Mum and Dad is funding at least a quarter of all mortgages in the UK. Gifts from family are now so commonplace that parents are effectively the tenth largest mortgage lender. This follows previous research from Shelter that found parents are spending more than double what the government does on housing each year.

And today brings the alarming news that 100% mortgages are back – but only for those with affluent parents. Barclays will lend the full value of a home if parents are able to stump up 10% of it to stick in a linked bank account.

Innovation is of course the offspring of desperation and this new product from Barclays does enable parents who can’t quite afford to give away their hard-earned savings a means to help their children. Parents will get the money back after three years, as long as their children keep up with mortgage repayments – and as long as 100% mortgages aren’t the first of the four horseman that will finally pop the house price bubble.

Although homeownership is commonly seen as a key milestone of independent adulthood, the truth is it’s increasingly bound up with ongoing parental help. As house prices rose in the noughties, help from mum and dad switched from being a novelty to the norm. When homeownership was at its peak in 2003, fully 77% of first time buyers could claim they bought independently with no help from friends or family. Over the following decade that has fallen to two-thirds – meaning that 27% of recent first time buyers were reliant on a gift from friends and family, and 8% relied on an inheritance.

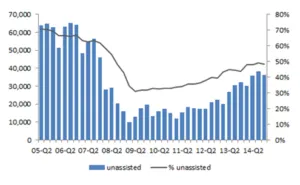

That figure is probably an under-estimate of the Bank of Mum and Dad’s true role: research from the Council of Mortgage Lenders based on households’ incomes and saving ability estimates that in 2014 only 48% of first time buyers could realistically be buying without help.

Number and proportion of assisted FTBs (source: CML)

Faced with asking prices that are simply not serviceable on typical incomes, it’s entirely understandable that families who can help their children are doing so. Baby boomer property wealth has often been crudely characterised as a generational struggle; but translated to the real world many of those baby boomers are happy and willing to help their children out with deposits. Those who benefit will rightly feel very appreciative.

But those without parental help are left facing an up-hill struggle. Our research tells us that parents who are able to help their child with a deposit are much more likely to be outright owners, reflecting both their age and their relative wealth. Other parents who have helped their kids may have overstretched themselves, or dipped into savings they needed to fund their own retirement.

First time buyer numbers are still below pre-crash trends, and those who do buy are now markedly more affluent than the average household. The English Housing Survey reports that nearly three-quarters of recent first time buyers have household incomes in the fourth or fifth quintile, up from just under two-thirds in 2002-03. In contrast, a third of buyers were on low to middle incomes in 2002-03, a proportion that has now slumped to less than a quarter. Those being squeezed out are most likely to be those on ordinary incomes without parental backing.

There’s now a deep irony at the heart of the housing market. The late 20th century saw a huge expansion in property wealth. Homeownership became democratised and achievable for those on average or even low incomes. But a failure to build enough homes and subsequent rising house prices quickly put an end to that. For all the recent anxiety about falling homeownership rates, and the plight of first time buyers, mortgaged homeownership actually peaked in the early nineties – before house prices went through the roof.

Many of the beneficiaries of this boom now hold huge amounts of equity, and many are in the financial position where they can help their adult offspring get on the ladder – and in doing so help keep house prices up. But this isn’t so much a leg up as an exclusive key – those without assistance are increasingly locked out. The twentieth century’s democratisation of housing wealth looks set to be reversed in the twenty first, as getting on the housing ladder becomes increasingly the preserve of those with inherited wealth.

(If you need a bit of light relief from the crushing reality of inequality, check out this video we made last year).