Poverty and property: the trilemma of destitution, welfare or market intervention.

Published: by Toby Lloyd

The role of the state in helping people with their housing costs is right at the centre of the ongoing arguments around the future size and scope of government welfare spending – and in fact it always has been. All that’s changed has been the nature of that support. Right now, the debate is largely about welfare payments – in housing terms that primarily means housing benefit. It’s not hard to see why, as the total housing benefit bill has risen steadily to top £24 billion, despite recent cuts in the amount that households can claim, as both rents and the numbers needing help have risen. Now housing benefit is in line for further cuts – including a proposed four year freeze in the help private renters can get.

A lot of political ammunition was spent during the general election campaign on arguments about where and when £12 billion of benefit cuts would fall – but all political parties signed up to significant reductions in overall public spending. Working-age welfare is routinely in the cross-hairs – partly because it has a relatively small political constituency (compared to say, pensions or health), and partly because of a related suspicion that too much welfare goes to those who do not deserve it. But if public – and hence political – support for welfare is on a downward trajectory, it raises questions about how much poverty we are prepared to tolerate, and whether welfare benefits are the best means of tackling it.

This debate is neither new, nor surprising. Reducing and responding to poverty is one of the most complex problems modern societies face. While the nature of poverty evolves within changing economic and political currents, it also seems to exist in a symbiotic relationship with the very systems set up to reduce it. Taxes, employment law, benefits, and other aspects of the welfare state are all used to target poverty – and as a result, all of them shape the contemporary form that poverty takes, to the extent that many people identify the mitigations as creators and preservers of poverty themselves.

Again, this is not new: arguments about disincentives to work, benefit traps, the impact on wage levels, labour mobility and above all, the sheer cost of poverty alleviation have raged since at least Elizabethan times.

These debates, like the poor themselves, may always have been part of society, but it’s not been a smooth ride. Periodically, the debate heats up and our system goes through a spasm of crisis and change – not necessarily in that order.

With the creation of Universal Credit at the same time as major cuts to the level of benefit paid to some people, we’re clearly going through one of these periods of change right now. Depending on your view point, you may identify the current changes as a vital reform to a system grown bloated and dysfunctional, an ideological assault on the welfare state itself, or an unpleasant but necessary part of economic austerity.

Of course, none of these views are mutually exclusive – and all three probably have a good dollop of truth in them, because tackling poverty has always been a trilemma. As I see it, it is impossible to simultaneously avoid widespread destitution; an ever rising welfare bill; and major intervention in key markets. It should be possible to avoid two of these at once – but not all three.

At any given point in history, society is effectively making a choice to embrace, or at least tolerate, one of these three. It may not be explicit, but by prioritising the avoidance of one or two of these outcomes, we are implicitly agreeing to put up with the third as the lesser of three evils.

The first big change in society’s response to the trilemma was the enclosure movement. The pre-enclosure, largely feudal, economy was a non-market system in which inheritance and military power determined who owned what. Society was effectively choosing the third option and preventing a free market in land and labour from operating. Enclosure, which turned common land into private property, represented a critical turn towards a market economy – which led to economic growth, but also intense poverty as millions found themselves deprived of subsistence. In response, the Speenhamland system of ‘outdoor relief’ was introduced in the late 18th century. Local municipalities raised levies to feed the poor and mitigate the worst of rural poverty. This represented an (inadequate and patchy) acceptance of the need for welfare, rather than tolerating poverty or intervening in the emerging property and capital markets to enable the poor to feed themselves.

But as the costs of alleviating poverty grew, so did moral objections about the impact on the poor’s motivation to work and employers’ incentives to pay decent wages. Under the New Poor Law of 1834 Speenhamland was abolished and the workhouse was born: for the rest of the 19th century, millions endured abject poverty of the type made famous by Dickens. Victorian society chose to tolerate destitution, avoiding both intervention in property and capital markets and major state spending on financial transfers to the poor.

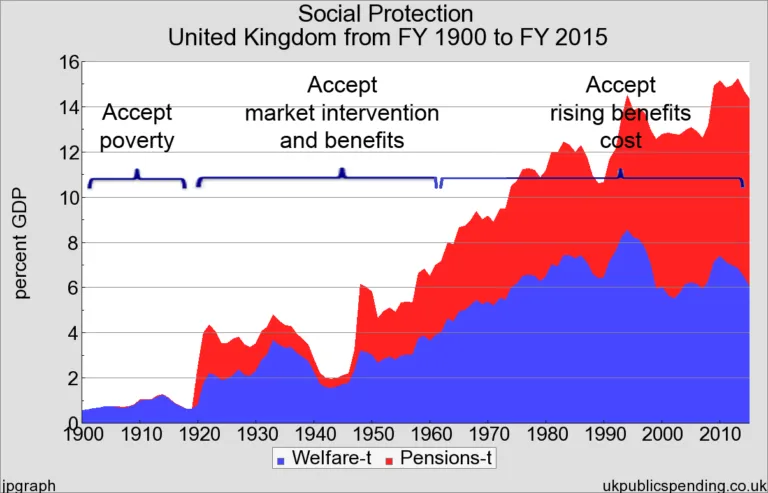

The wheel turned again in the 1900s, as greater efforts were made to alleviate and prevent poverty – partly in response to the parlous physical condition of army recruits for the Boer War. This trend increased during the ‘short twentieth century’ from the First World War to the 80s: the implicit choice became one of market intervention first, and benefits payments second. The birth of council housing, landlord and tenant regulation, and the creation of the national planning system are all evidence of the willingness to intervene in markets to prevent and reduce poverty. Welfare spending rose dramatically compared to the pre-first world war era – and increased again in the 60s – but then remained fairly stable. By the mid 70s it still didn’t take much more of a percentage of GDP than in the early 1920s.

From the late 1970s onwards the choice shifted again – this time away from intervention and back towards the acceptance of a high welfare bill. Characterising Thatcherism as willing to accept large welfare payments may seem odd to anyone who remembers the anti-welfare rhetoric of the time. But in relation to housing at least it was very explicit. The private rented sector was deregulated, council housing sold off and property ownership advantaged in the tax system – while the state stopped building homes. In other words, market intervention was dropped and the focus shifted to using welfare help people house themselves in the market. Ministers argued explicitly that any increase in poverty occasioned by a move towards freer markets would be offset by spending more on housing benefit, which would be there ‘to take the strain’.

Since then, and under successive governments, public investment in affordable housing has collapsed and housing benefit has indeed taken the strain. The bill has risen to top £23bn a year and is projected to grow yet further. Inevitably, this has put the spotlight back on the benefit bill, and prompted repeated assaults on the real and perceived failings of the welfare system.

But no matter how hot the current debate gets, the basic trilemma remains. If we are not prepared to spend as much as we do on benefits, we have to accept EITHER more poverty OR greater intervention in markets. In housing terms, if we do not want to see families destitute on our streets, but don’t want to pay more and more housing benefit to landlords to house them, we have to do something else.

Few would argue publically for a return to Victorian levels of urban poverty. Even putting morality and social justice aside, the consequences for public health and social order do not bear thinking about. Politicians also have a fully enfranchised electorate and a vocal media to contend with nowadays, which would make widespread abject poverty harder to sustain politically.

So the broader debate is really about what that something else should be – how we can intervene in markets in a smart way to both reduce poverty and welfare bills. The government has recently shown signs that it is beginning to recognise the need for intervention: the surprise announcement in the Summer Budget that social rents would be lowered by 1% a year for four years, and moves to level the playing field between Buy to Let investors and first time buyers can both be seen in this light.

In my view, the best target for greater intervention now is the dysfunctional land market, which lies at the heart of our failing housing system.

Land is the essential natural resource needed to build a home. However unlike other raw materials, it also has numerous other functions. Most importantly, land is where the majority of all wealth in Britain is stored (remember most of the value of a home is in where it is) and how it is passed down the generations through property inheritance. Land value is also the collateral against which our entire financial system is leveraged via mortgage finance.

As we’ve argued with KPMG, smarter public intervention in the land market to get more land developed, while constraining price growth, could start to tackle these problems at source. And it could get more, better and cheaper homes built.

It wouldn’t be cost free: every time society reaches for a new response to the trilemma there are losers, and some land owners would make less than they might currently expect to. But if we are not prepared to pay the political price of that intervention, we will have to accept an ever rising welfare bill, and/or a return to widespread, abject poverty.