There are other options to balance the books besides cutting our safety net

Published: by Adam van Lohuizen

Today the Chancellor is set to unveil up to £12 billion of the cuts in welfare that he the first committed to a year and a half ago. We won’t know for sure what the cuts will look like until they’re announced this afternoon. What we do know is that if housing benefit is badly hit, as has been suggested, it will have dramatic consequences for millions of households across the country.

But cutting our safety net isn’t the only way to balance the books, which is the Chancellor’s ultimate objective. He could also do it by raising taxes – or removing overly generous or inefficient tax breaks that particular groups currently receive.

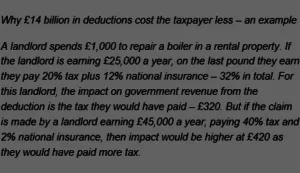

One place to look for significant savings is landlord tax breaks. In 2012-13 landlords claimed tax deductions against their income of over £14 billion. It’s impossible to say for certain how much these actually cost the taxpayer: the Government doesn’t even know itself, because the deductions reduce the taxable income of the person making the claim, not the tax that person has to pay.

Our best guess puts the cost to government of these deductions at around £5 billion back in 2012‑13. Two years later, we now expect that to have increased to £5.75 billion a year.

But not all of these tax deductions for landlords are necessarily bad. In fact some are appropriate and even necessary. They can provide incentives for landlords to improve their properties which is to the benefit of their tenants. But others risk being overly generous as it’s not clear what we gain for allowing landlords to opt out of paying this tax.

The tax deductions probably encourage buy-to-let investment, but the difficulty is it’s not clear more investment of this sort feeds through into us building more homes – as the Barker Review highlighted a decade ago. If huge amounts of mortgage lending going into housing equalled a similar uplift in building, our lending boom would have solved the housing supply problem by now.

There is therefore significant scope for the government to review these tax deductions, and possibly others, to find savings and balance the Budget instead of cutting support from people struggling to keep up with sky-high housing costs. And we know that the Chancellor has been prepared in the past to make significant reforms to taxes. This is one of many choices the Chancellor faces today, and I hope his focus is on solving our housing crisis instead of removing the support we give to people suffering from its consequences.