Where’s all the money gone?

Published: by Toby Lloyd

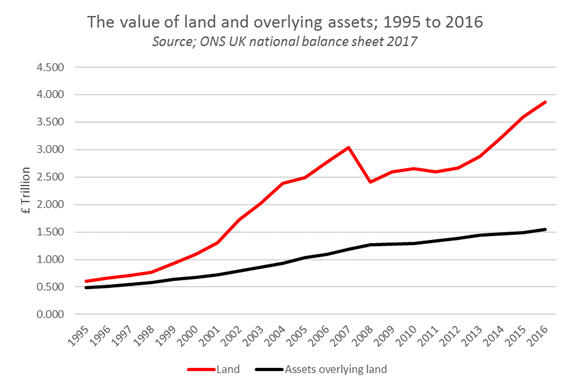

The net worth of the UK has more than tripled since 1995. But I’m betting you don’t feel three times richer than you were 20 years ago, or that the country as a whole is rolling in cash. So where’s it all gone? New data from the Office for National Statistics (ONS) shows that most of it has gone to one place: land.

This new data shows just how stark the problem is:

- land values rose by £280 billion in 2016 alone, to top £5 trillion

- since 1995, the value of land held by households has risen by 544%, while the combined value of assets overlying land (i.e. buildings) has risen by only 219%

- this means that in 1995, on average, the price paid for a home was almost evenly split between the value of the land and the building. By 2016, the cost of the land had risen to over 70% of the home price.

The critical point is that quite a few new properties have been built over those 20-odd years, and existing ones have been improved, so you’d expect the value of the housing stock to go up. But no new land has been created: that increase is simply channelling more of our national wealth into the hands of those that own land.

This is shocking, but not surprising: we’ve been banging on about the central economic importance of land for ages. To recap, the way the land market works – or rather, doesn’t work – drives sky-high house prices, the persistent undersupply of new homes, the shortage of affordable housing, the rise of ‘generation rent’, and ultimately growing homelessness. We could solve these issues with the right policies and enough investment in the right places.

This is shocking, but not surprising: we’ve been banging on about the central economic importance of land for ages. To recap, the way the land market works – or rather, doesn’t work – drives sky-high house prices, the persistent undersupply of new homes, the shortage of affordable housing, the rise of ‘generation rent’, and ultimately growing homelessness. We could solve these issues with the right policies and enough investment in the right places.

The problem is that the land market can easily suck up that money, boosting asset prices without actually solving the housing crisis. And it gets worse…

High land prices don’t just represent a waste of money, by channelling our national wealth into the hands of a few property owners: high land prices actively make all our housing problems worse, by making it increasingly difficult, risky and expensive to build more homes at affordable prices. That’s why any genuine attempt to fix our broken housing market has to start with a serious package of land market reform.

Land market reform

There has been some real progress in getting land onto the agenda in recent years – and indeed in recent days:

- the Budget last month announced a new geospatial data commission, and an important inquiry to identify why planning permissions don’t get built out faster (clue: it’s the land market)

- the Tony Blair Institute for Global Change published a useful contribution to the debate yesterday, calling for a Land Value Tax and a Sovereign Property Fund, among other sensible reforms

- Just today, former planning minister Nick Boles cited the German model of public land assembly as part of his radical housing agenda.

But there’s still a long way to go to get the land question into the centre of policy debates. As a campaigner it can be hard to get the centrality of the land issue across. Almost everyone is worried about our housing crisis, but not many people are really interested in land market reform. That’s partly because land is, quite literally, an underlying issue, so it’s just not that visible. But it’s also because there isn’t enough clear, transparent and readily available data on the land market – something we’ve been campaigning to change.

So it’s extremely welcome that the ONS has started separating land out from other assets in the national accounts. For the first time, we have an authoritative source on how much of our national wealth is tied up in the land market. Hopefully this will help overcome the last barriers to serious reform of the way we manage our most precious national resource.

- To read more on how land market reform can underpin better housebuilding, see our New Civic Housebuilding microsite