Will your children be able to afford their own home?

Published: by Pete Jefferys

The debate on house prices is shifting. Where once you would only see glowing newspaper coverage of rising prices, there is now a note of caution. Even papers long associated with championing house price inflation are including the alternative perspective.

This is probably because public opinion is shifting fast, with two in three voters now opposed to rising prices. Even the majority of over 60s, Express readers, home owners and non-Londoners would prefer stable or falling prices. I think this is because people know that even if they are ok, their children or grandchildren will be stuck. It’s not inter-generational war, but inter-generational worry that has led to an attitude shift about house prices.

New analysis we’ve released today shows just how difficult it is for young families on normal incomes to get a toe on the housing ladder.

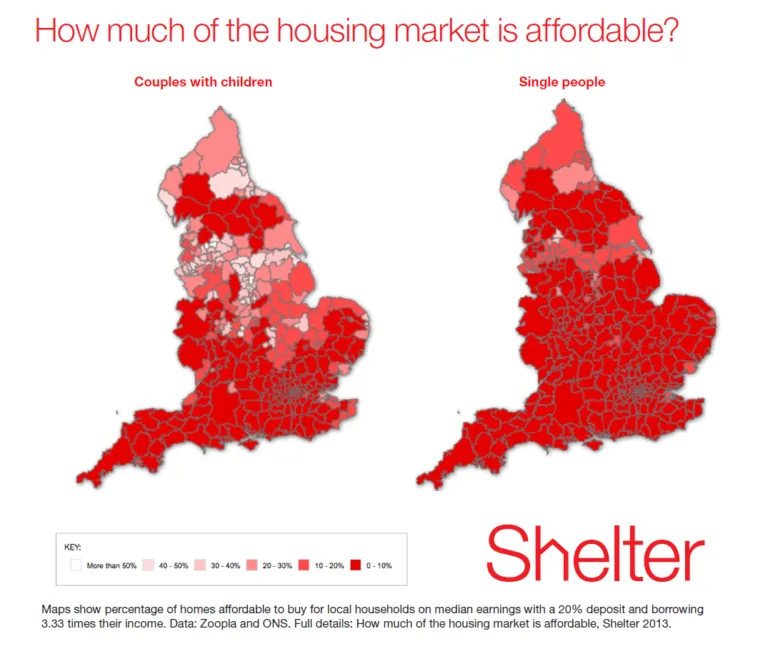

We ran a comprehensive data search on all the properties on property website Zoopla on one day in August 2013 to see how many homes were affordable to different types of family. We assumed potential buyers had a 20% deposit, average local incomes and that a bank was willing to lend them the average (3.33) first time buyer multiple of income in the market currently. Even with these fairly generous assumptions, the results show a market that’s not working for families on normal incomes.

For families with two incomes (one full time and one part time) choice is limited to say the least. Our analysis allows us to reveal the exact number of properties on the market that were affordable to typical two-earner couples with children.

- In Harlow, Essex. It was 26 homes (population 82,000)

- In Cambridge, it was 0 homes (population 124,000)

- In Newham, East London it was 7 homes (population 296,000)

- In Exeter, it was 6 homes (population 118,000)

What’s really striking is that house prices have moved away from average earners to such an extent that only a handful of properties are available, even to those lucky enough to have a 20% deposit.

There are very few homes on the market affordable for a person or family with a single average income, even if they have significant financial help with a deposit. Where once families on one income could expect to become home owners in their lifetime, the chance is now severely restricted unless you are in a couple and both earning.

So what’s the answer?

We think that the debate on house prices has to move away from the assumption that the only way is up. An era of house price stability would allow families on normal incomes to catch up and according to our polling, would be popular too.

We need to move away from tax-payer backed mortgage schemes which are more likely to push up prices than get homes built, according to the IMF and many others.

Instead we need to focus our efforts on the housing shortage: we are currently only building half as many homes as we need each year.

Building enough homes requires action on several fronts:

- Investment, public and private, in new social rented homes and a better form of shared ownership.

- Reform of the land market, so that it works for families who need homes and smaller builders, not speculators. Intervention to build new towns with land sold at reasonable prices would bring down the cost for home buyers and, if combined with supporting new builders into the market, could raise the quality of new homes too.

- Greater diversity of house builders to drive up standards and increase supply – the house builder market has become more concentrated since the banking crisis.

All these changes are achievable given adequate political will.

If we allow the status quo to continue – relying on state backed mortgages to prop up prices – then more and more families will have their hopes of home ownership frustrated and public opinion on rising house prices will harden further.