The government is consulting on introducing longer tenancies for private renters. Great news! But despite an announcement that the Secretary of State backs changing the law, there’s still a question about whether the government will follow through. New tax incentives and ‘better education’ are still officially under consideration alongside legal change.

It’s clear to us that anything less than legal change to give all private tenants more security by default isn’t meaningful change at all.

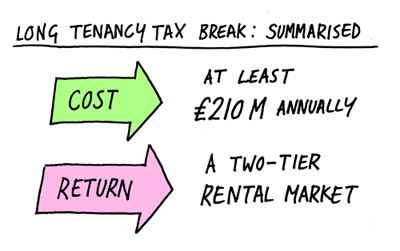

In this post, we’ll look in more detail at why trying to do it through tax incentives won’t work. We’ll see how they could mean the government shelling out £200 million a year to landlords – or more. And in exchange, all we’d get would be a two-tier system, where those who need security most continue to lose out.

Hey, big spender

With no specific proposal on the table, it’s impossible to say exactly how much Treasury would be forking out to persuade landlords to offer longer tenancies. But it is possible to get a sense of the likely overall scale of the cost.

The best place to start is the amount that the government saved by scrapping a comparable tax break called Wear and Tear Allowance, axed in the summer 2015 budget.

In theory, Wear and Tear Allowance was supposed to be spent on replacing worn-out furniture, fixtures, fittings, etc. In practice, it was a flat 10% tax free allowance on net rental income for landlords who let out furnished properties, even if they hadn’t spent a penny.

It’s a useful comparator with a possible new longer tenancies tax break for a couple of reasons. First, the size of the tax break was in the right ballpark; significant without being lavish. As a simplified example, getting 10% tax free would knock just short of £200 a year off what a basic rate paying landlord, with a single unmortgaged property at average rent, would owe to HMRC.[1]

Second, the number of landlords eligible to claim Wear and Tear Allowance was pretty much the same as the number who say they’d use a longer tenancy in exchange for a tax break. According to a landlord trade body, 47% of landlords were eligible to claim Wear and Tear. According to research for us, 46% of landlords said they’d be willing to let on a three-year tenancy if they were given a tax incentive.

So, how much did it cost?

In total, the government saved £840 million over four years by scrapping Wear and Tear, or an average of £205 million a year. That’s five times as much as gets spent on enforcing housing standards every year across the whole country.

By implication, it would cost a similar amount to introduce a similar tax break for longer tenancies.

But wait! It could cost even more…

When Treasury calculated how much it would save by scrapping Wear and Tear, they deducted the cost of replacing it with a new, less generous tax break. So, the cost of introducing a whole new 10% tax free allowance would likely be greater.

Furthermore, while it’s ‘in the right ballpark,’ it’s possible that landlords are going to try and argue for more than 10% to offer longer tenancies. For example, one of the landlord trade bodies has said incentives would need to be proportionate to ‘thousands of pounds’ over the course of a tenancy.

Either way, it’s clear that on this conservative estimate a tax break would mean government spending big.

A two-tier system

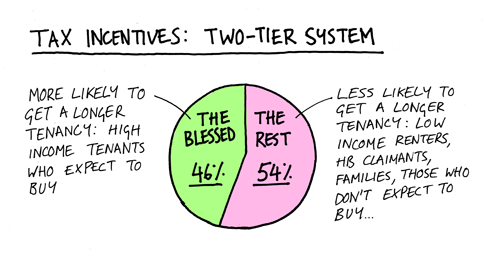

Spending big on tax incentives might be worthwhile, if it delivered a good outcome. But in reality, the best it could manage is to create a two-tier system, cleaving tenants into the blessed and the rest. What’s more, the people who need longer tenancies most would be least likely to get them.

To illustrate the point, let’s assume the tax break was ‘successful’ on its own terms, and the 46% of landlords who say they’d offer longer tenancies in exchange for the bung followed through. This would leave just over half the renting market still operating on short-term, insecure contracts. The market would be split roughly down the middle.

Who would end up getting a longer tenancy and who would miss out?

There’s every reason to believe that the existing discrimination that we see today would be replicated in the new two-tier market. For example, tenants on housing benefit already face discrimination when they look for a new private rented home. Even if they’re able to find a landlord who’ll rent to them at all, they still tend to find it tougher to get a twelve-month contract, and may only be offered a six month or rolling month-to-month.

Likewise, our research shows that renters on low incomes, those who expect to be renting for the rest of their life and renters with kids, all find it more difficult to find an affordable private rented home than the average tenant.

These are exactly the renters who would benefit most from having more secure, longer tenancies. And they’re exactly the ones who would find it harder to get them in a two-tier system.

Only legal change is meaningful change

There are many other problems with tax incentives. Under our self-assessment tax system, without rigorous checks to make sure landlords are actually using longer tenancies, it would be a tax scammers charter. Government would also be forced to fork out to the small number of landlords who are offering three-year tenancies already.

But the fact that they would see Treasury paying hand over fist for a two-tier system should be enough to convince that they’re a poor option on its own. When legal change, which would deliver benefits to all private renters with no direct cost to Treasury, it’s pretty clear which one most renters and tax payers would prefer.

[1] Average national rent of £829 a month taken from VOA’s 2017/18 rental market summary. Tax saving calculated using the RLA’s tax calculator