Budget 2023: will the chancellor step in to fix the housing benefit gap that’s causing homelessness?

Published: by Charlie Berry

Rumours are starting to swirl about the potential contents of Chancellor Jeremy Hunt’s spring budget due next month. But for families facing homelessness right now, the biggest question is whether the government will finally act to end the three-year freeze on housing benefits which is driving homelessness for private renters.

As we highlighted in a previous blog post after the chancellor’s autumn statement, help with the cost of living has been focused almost entirely on cash to cover rising energy bills and food. But this does nothing to deal with rocketing rents.

The amount of housing benefit that renters can claim has been frozen at 2019 levels since March 2020 while rents have risen at their fastest-ever recorded rate. Two in five (40%) private renters claiming housing benefits have seen their rent rise during the last year, but with housing benefits frozen, they are stuck having to plug the gap between housing benefit and their rent from money which ought to be for heating and eating.

The government has so far refused to restore and relink the local housing allowance (LHA), which sets the amount of housing benefit people can claim, to reflect the real cost of renting. As a result, low-income families are caught in an awful trap. They simply cannot afford rent rises and are locked out of finding a new privately rented home, forcing them into homelessness.

As our recent alert briefing highlighted the situation has become dire. Local authorities are running out of emergency cash to help households and our advice services across England have seen a shocking 30% rise in clients who are in arrears with their housing costs over the last year.

The gap between rents and housing benefits is widening

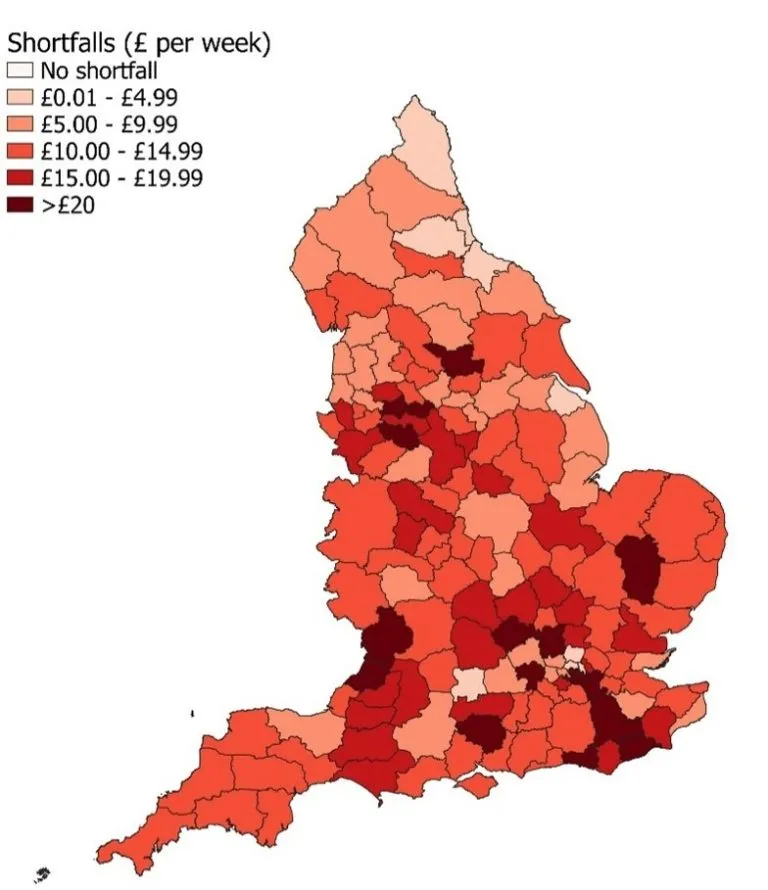

New figures released this month show that the gaps between LHA levels and modest rents have increased in many parts of the country. LHA is supposed to reflect what’s called the 30th percentile of local rents – that is to cover the cost of the cheapest 30% of homes in each part of the country.

However, private rental costs increased by 4.3% in England in the past year alone

Shortfalls are now widespread across the country as frozen LHA rates fail to keep up with rising rents.

New government data shows that there is not a single area across the country without a shortfall between LHA and the cost of a modest family rental property.

The situation is even bleaker than last year, when 91% of the country saw shortfalls, compared to 100% today.

Shortfalls between local housing allowance rates and 30th percentile rents for two-bedroom homes, 2023-23

Map data source: Shelter analysis of Valuation Office Agency, Local Housing Allowance (LHA) rates applicable from April 2023 to March 2024. February 2023

The same is true of one-bed properties: there’s nowhere in England that doesn’t have a shortfall between LHA and the cost of renting a one-bed property.

This poses a barrier to people moving on from rough sleeping, who are most likely to move into one-bed rentals. People are immediately having to contend with managing the shortfall, which can quickly snowball and cause financial problems. This makes it harder to rebuild your life and keep a roof over your head.

Research by Shelter shows that 54% of private renters claiming housing benefits are affected by shortfalls between their rent and housing benefits. On average, private renters are making up a shortfall- that’s over £150 a month!

Shortfalls push people into homelessness

Private renters are disproportionately affected by the cost of living crisis. Renters live at the mercy of their landlords’ rent prices, and almost a third (32%) are spending at least half of their monthly household income on their rent each month.

Frozen LHA rates and the consequent shortfalls put people at risk of falling into rent arrears or eviction, which can ultimately lead to homelessness. To avoid this, families might be forced to cut back on essentials. After all, a low-income household with children would have to cut its monthly food shop budget by half every month to cover a housing benefit shortfall.[1] This means adults and children going hungry just to pay the bills.

It couldn’t be clearer – the housing benefit freeze must end

Around 9,000 Shelter supporters emailed the prime minister over the winter demanding action. The message couldn’t be clearer: the government must restore housing benefit and connect it to the real cost of renting, so that it covers at least the cheapest third of local homes. Now it’s up to the chancellor to play his part.

We’ve joined with Save the Children, 38 Degrees, Turn2Us, and other supporters calling on the government to make sure this budget protects people during the cost of living crisis, including fixing the housing benefit gap. To add your voice, sign our open letter

Spend on food and non-alcoholic drinks for the lowest income quintile is £53.70 per week for a household with children. Family spending workbook 4: Tables A56 and A57. 2021. Family spending workbook 4: expenditure by household characteristic